There has been a lot of hype around individual coins, but are you exposing yourself to the best sectors in the cryptocurrency market?

There has been a lot of hype around individual coins, but are you exposing yourself to the best sectors in the cryptocurrency market?

Forget solana, cardano, polkadot and all the rest for a minute and take a step back. Many experienced investors use what they like to call a “top-down approach” to analysis.

A top-down approach is exactly what it sounds like: We simply take an asset class in its entirety and work our way down it to get, finally, to the individual stock (or, in this case, coin) we wish to invest in.

So, where to start?

For the world of crypto, we would start by defining the top-down structure and keep things simple. It would look something like this:

So, we start at the overarching blockchain consensus mechanism that is used — in this case, proof-of-work (PoW) and proof-of-stake (PoS).

So, we start at the overarching blockchain consensus mechanism that is used — in this case, proof-of-work (PoW) and proof-of-stake (PoS).

PoW is basically a mechanism in which work needs to be done in the form of computational power used to solve cryptographic algorithms which validate the block of transactions. This action is known to many as “mining”.

PoS is a little different in that no “mining” is done, so to speak. Transaction validation is done by the coin holders themselves. The idea behind a PoS protocol is that participation is determined by ownership of the coin supply that you are staking on the network. Users who want the opportunity to be selected to add blocks to a PoS blockchain are required to stake a certain amount of the blockchain’s cryptocurrency in a special contract. The amount of coins staked determines their chances to be selected as the next block producer. Yet, if users behave maliciously, they may lose their stake as punishment.

This is a similar concept to having equity in a company you work for. Suddenly, you have a vested interest in the company, and you really care about how the company performs from one quarter to the next. You have a stake in the company’s success, and now you’re a “stakeholder”.

Simple right?

Because PoW is mainly dominated by bitcoin (although ethereum is technically PoW, but will be becoming PoS soon), we are going to skip the step of deciding which blockchain we want and rather focus on the sectors we want to be involved in. From this, we will be able to point out the performing coins and therefore be able to decide which coins we want to be involved in.

Now we know there are countless new sectors popping up left, right and centre, but for the sake of sanity we are going to focus on the four main sectors in the crypto space: payments, smart contracts, decentralised finance (DeFi) and exchanges.

Sector performance

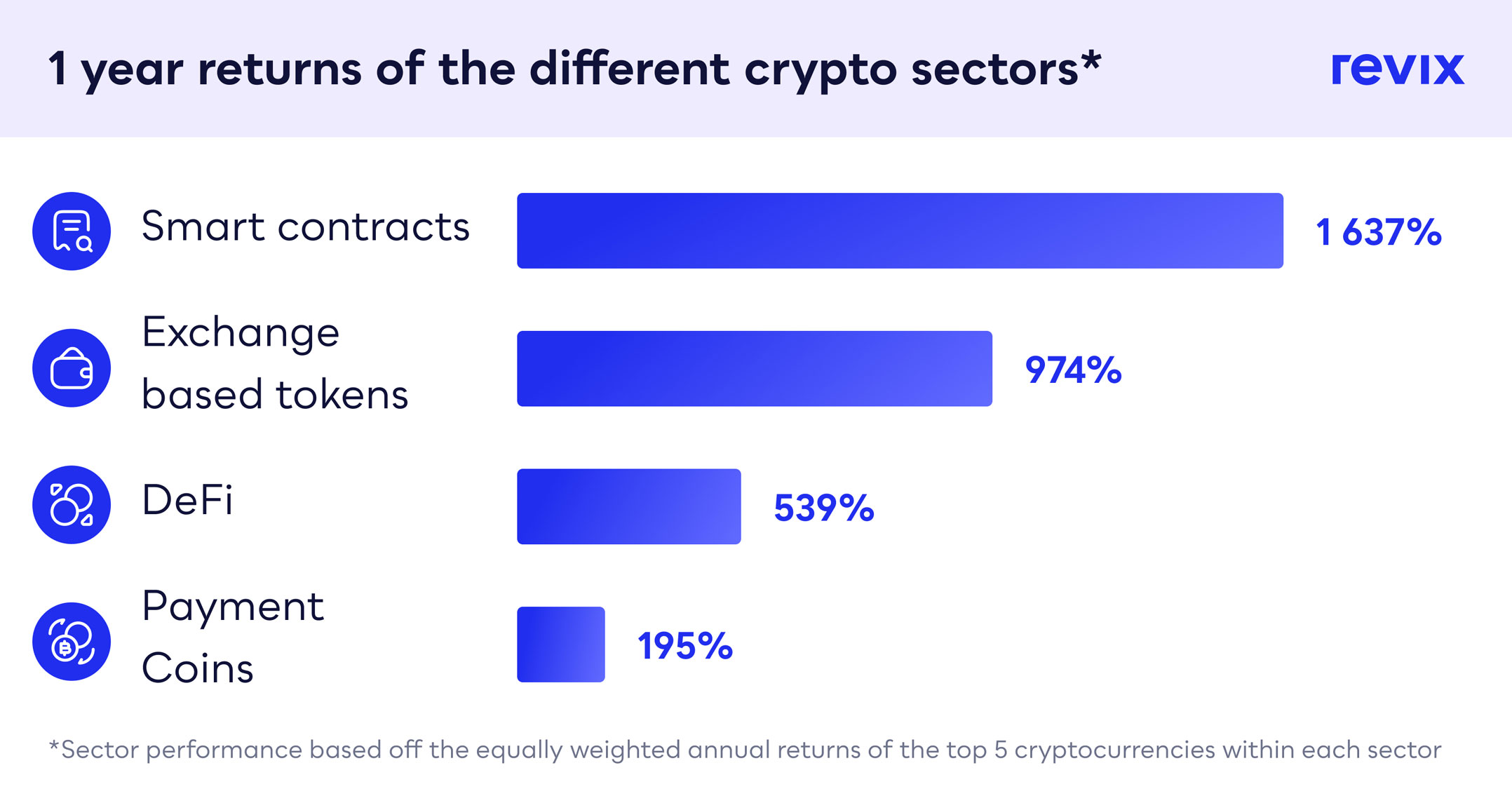

In the last year, the smart contracts sector has been on fire, bolstering returns of 1 637%. This shouldn’t come as much of a surprise considering smart contracts are the backbone to some hot topics that have captured the attention of the market this year. Here we’re talking about DeFi, NFTs (non-fungible tokens) and decentralised exchanges, all of which ride on the coattails of smart contracts.

In the last year, the smart contracts sector has been on fire, bolstering returns of 1 637%. This shouldn’t come as much of a surprise considering smart contracts are the backbone to some hot topics that have captured the attention of the market this year. Here we’re talking about DeFi, NFTs (non-fungible tokens) and decentralised exchanges, all of which ride on the coattails of smart contracts.

Yet, maybe to the surprise of some, exchange tokens have come in second, beating DeFi and payments with a return of 974%.

Now that we know what sectors have performed, let’s break down these sectors and see which coins have captured these returns.

Payment coins

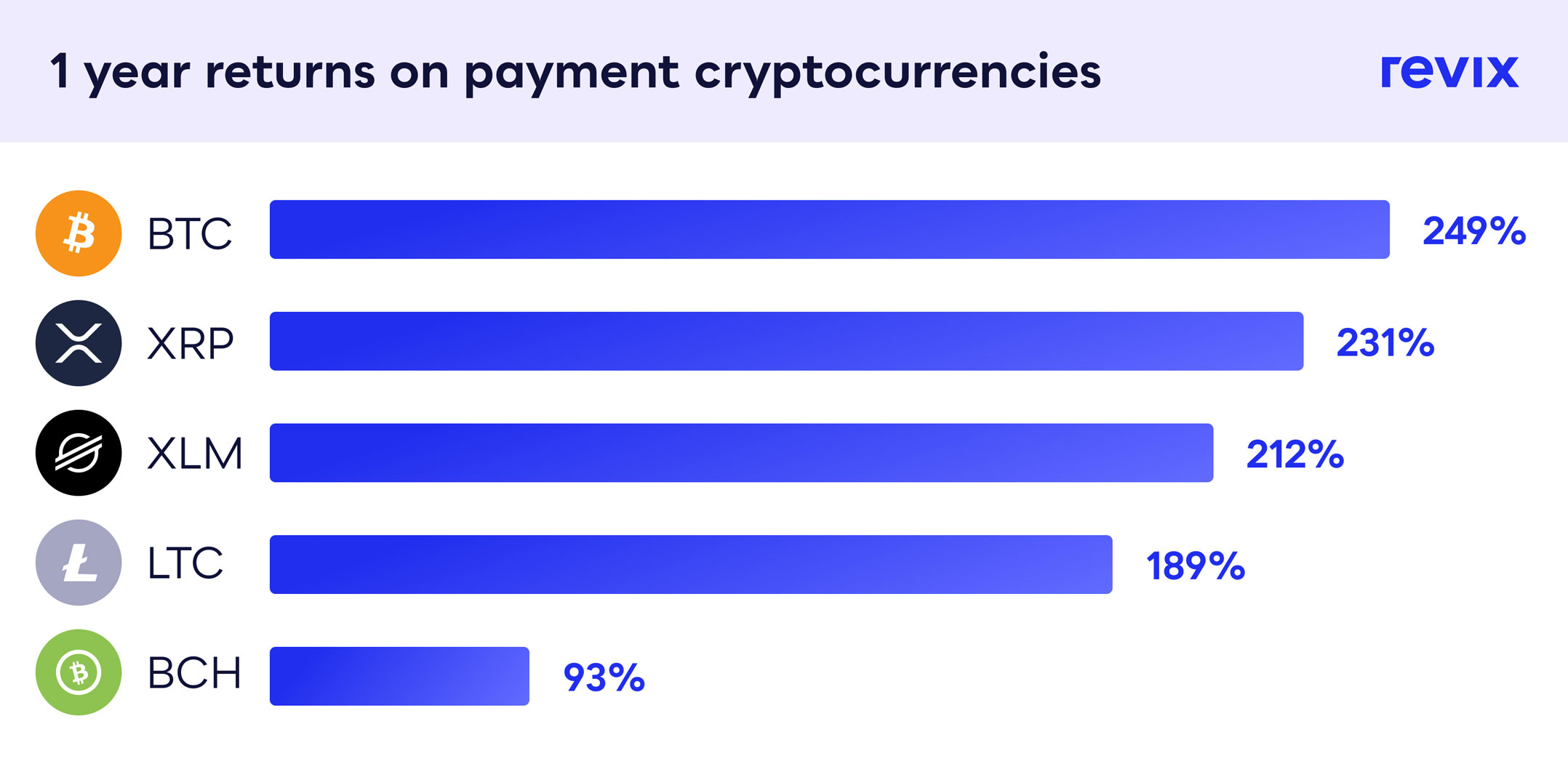

Payment coins are cryptocurrencies that are looking to revolutionise money and how value is transferred using their own blockchain and coin as means of payment.

We can see that the payment race has been nothing short of a tight one, and it’s only fitting that the granddaddy still holds the top spot despite all the competitors. Bitcoin posted a return that would make traditional finance investors feel like they are Gordan Geko, while simultaneously making crypto investors feel like they are holding AAA-rated bonds… Nothing.

We can see that the payment race has been nothing short of a tight one, and it’s only fitting that the granddaddy still holds the top spot despite all the competitors. Bitcoin posted a return that would make traditional finance investors feel like they are Gordan Geko, while simultaneously making crypto investors feel like they are holding AAA-rated bonds… Nothing.

Nonetheless, a 249% return is nothing to be upset about, and if you are interested in the payments sector, it seems bitcoin is still your guy.

Smart contract platforms

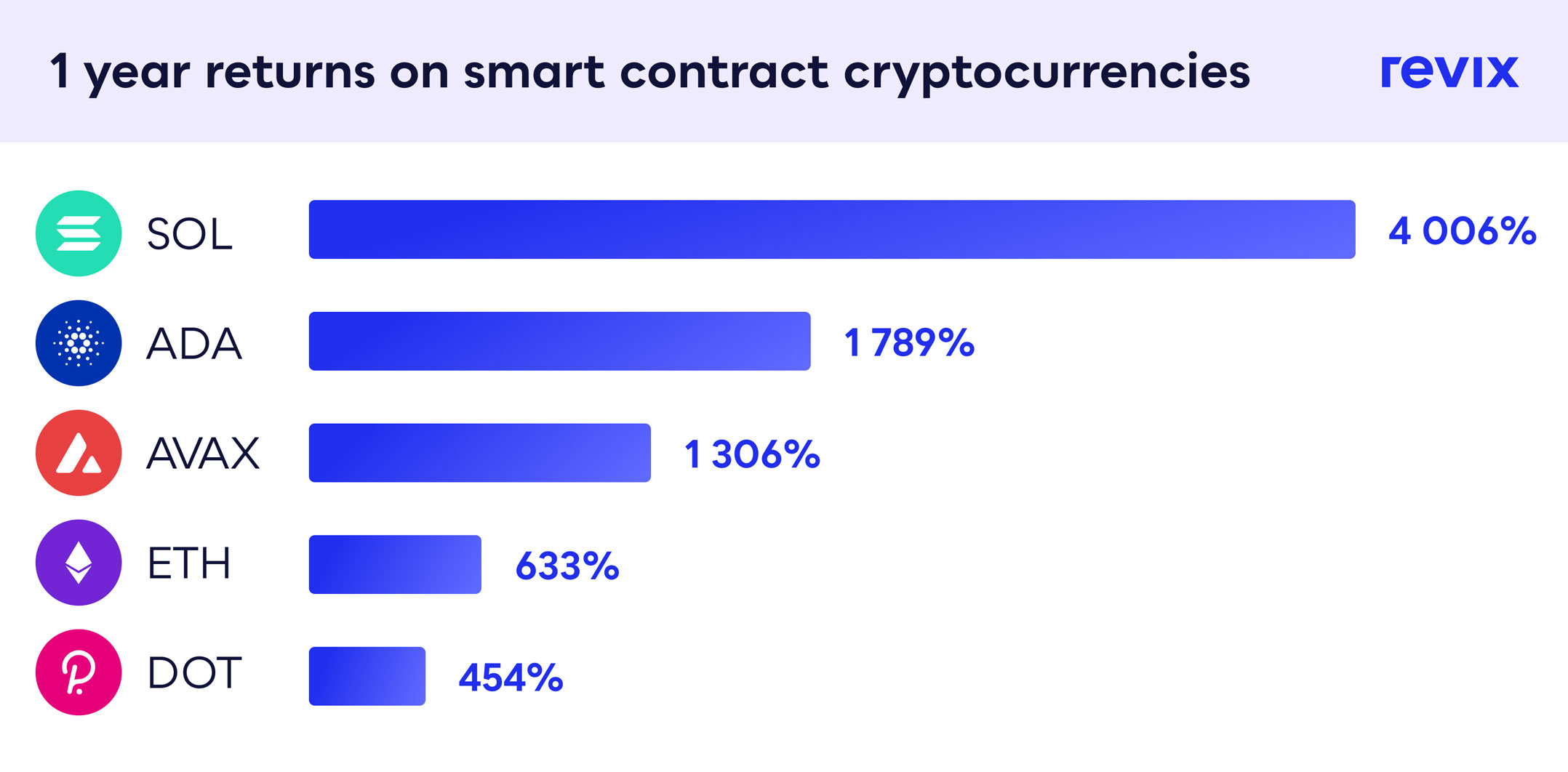

A smart contract refers to a computer program that lives on the blockchain. These programs automatically run when predetermined conditions are met. With the help of smart contracts, the blockchain network becomes a programmable platform that can host other applications — like how apps work on your phone’s operating system. Smart contracts have become a game changer in the cryptocurrency market and for new categories built on top of it, such as DeFi.

Now this is a sector that simply crushed it over the last year. It seems the market has finally realised the true value of smart contracts as they start to build out the new financial world order. This year’s smart contract king goes to solana (SOL). Simply put, solana looked like a man amongst boys as it left its competitors in the dust to produce a staggering 4 006% return. Not even the cardano (ADA) army could catch them.

Now this is a sector that simply crushed it over the last year. It seems the market has finally realised the true value of smart contracts as they start to build out the new financial world order. This year’s smart contract king goes to solana (SOL). Simply put, solana looked like a man amongst boys as it left its competitors in the dust to produce a staggering 4 006% return. Not even the cardano (ADA) army could catch them.

It’s clear this sector held multiple winners, with even fifth place (polkadot) beating bitcoin. If you were looking to get exposure to smart contracts, all the above would work for you.

DeFi

DeFi is a subsector of the cryptocurrency industry challenging traditional financial institutions, including banks, insurance companies and stockbrokers, where entrepreneurs build semi-automated trading and lending systems on top of blockchain networks.

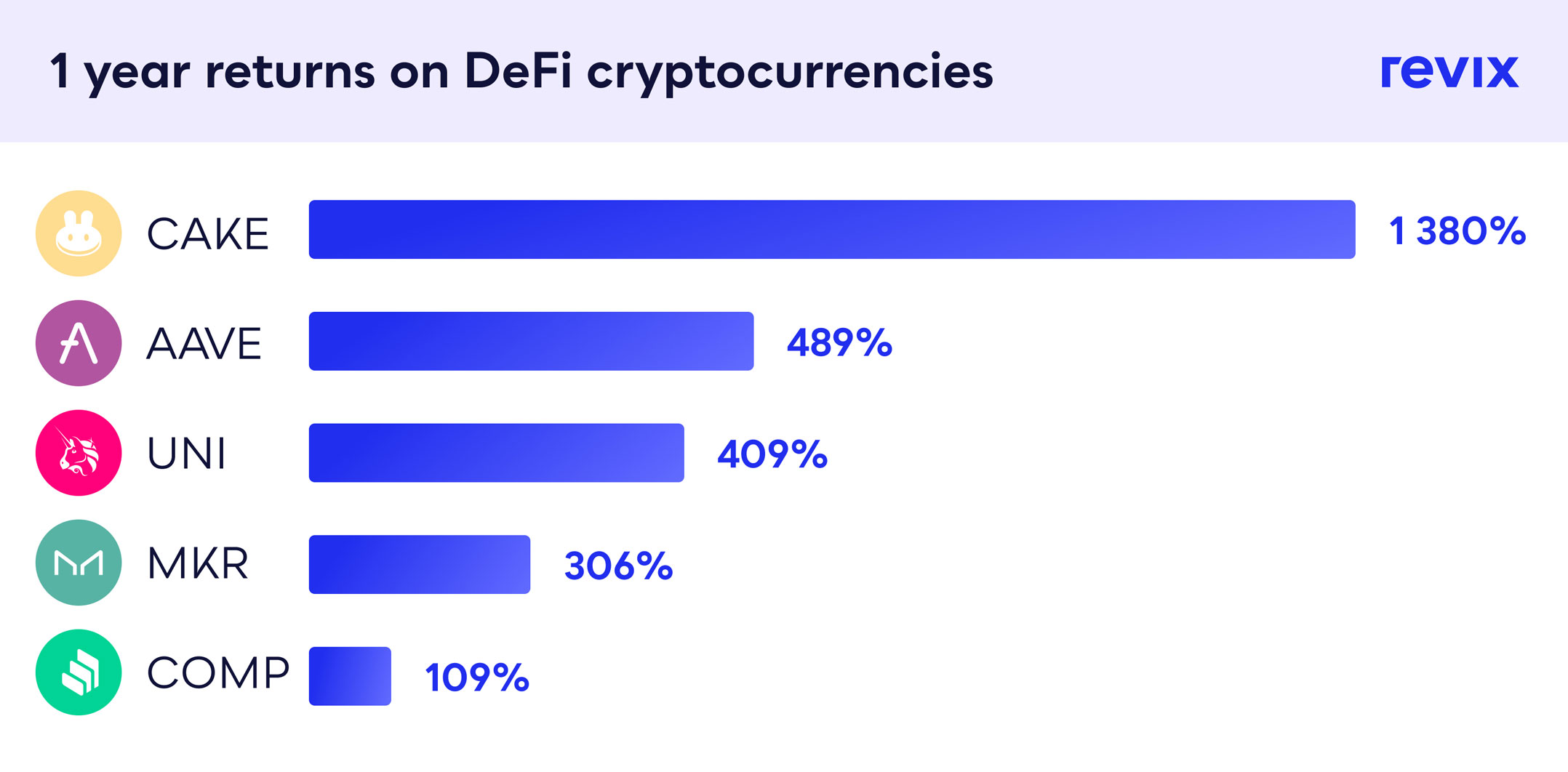

Whoever said, “You can’t have your cake and eat it”, clearly never owned PancakeSwap (Cake). The Binance-based decentralised exchange left its competitors in the dust accumulating a 1 380% return over the year.

Whoever said, “You can’t have your cake and eat it”, clearly never owned PancakeSwap (Cake). The Binance-based decentralised exchange left its competitors in the dust accumulating a 1 380% return over the year.

While DeFi is a revolutionary sector, it is still finding its feet as it tippy-toes through regulation, and maybe this is the reason it hasn’t quite rivalled smart contracts.

If you were looking to gain exposure to this area, PancakeSwap is the clear winner. But if you’re feeling like the centralisation of Binance isn’t your cup of tea, try sipping on some AAVE, Uniswap or Maker. These ethereum-based decentralised exchanges are the main players when it comes to total value locked on their platforms. Maybe once ethereum solves its fee issue, these coins will catch up to Cake.

Exchange tokens

Exchange tokens are digital assets native to a specific exchange. These tokens can be used for multiple reasons, such as to incentivise trading by lowering transaction fees if these tokens are held or to increase an exchange’s liquidity.

Exchanges are split into centralised and decentralised exchanges, namely:

Exchanges are split into centralised and decentralised exchanges, namely:

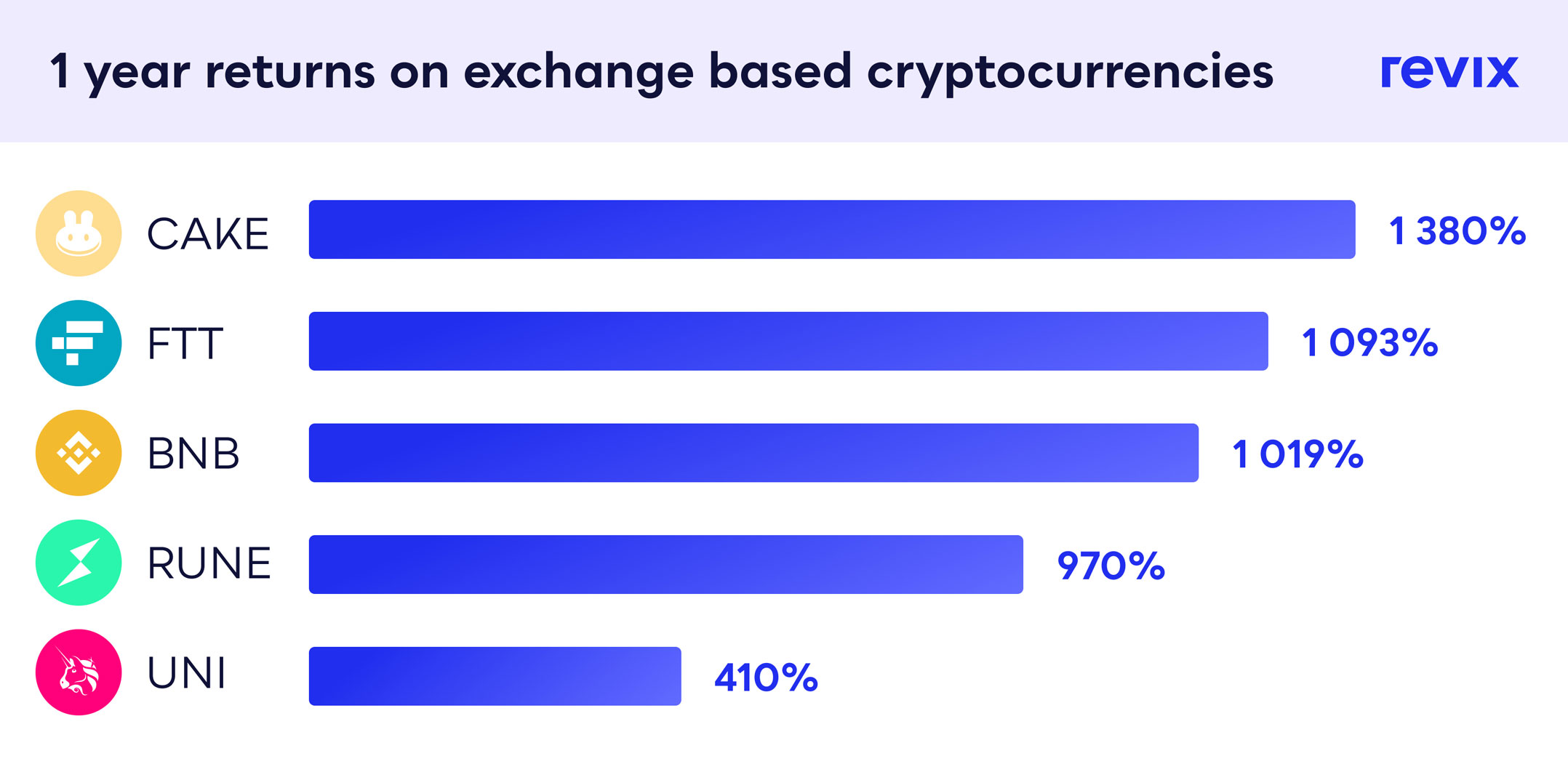

- Centralised: FTX (FTT) and Binance (BNB)

- Decentralised: PancakeSwap (Cake), ThorChain (Rune) and UniSwap (UNI)

While Cake took the top spot — it was the centralised exchanges that were both hot on its tail. Therefore, from a centralised vs decentralised standpoint, you would have to say centralised has outperformed its counterpart.

Let’s get real here, though — any of the above coins would’ve been a winner. You just had to know that exchanges was a sector that you wanted to be exposed to.

The beauty of crypto is that it is open to everyone — there are no restrictions on people, and therefore gaining exposure to all of the assets spoken about here is relatively simple.

Where can I get exposure?

Cape Town-based crypto investment platform Revix, which is backed by JSE-listed Sabvest, offers access to polkadot, uniswap, solana, cardano, ether and more.

On the Revix platform, you can also buy bitcoin and ready-made “crypto bundles”. The crypto bundles allow you to effortlessly own an equally weighted basket of the world’s largest and, by default, most successful cryptocurrencies without having to build and manage a crypto portfolio yourself. Revix currently offers three bundles, namely the Top 10 Bundle, Payment Bundle and Smart Contract Bundle.

The Top 10 Bundle is like the JSE Top40 or S&P 500 for crypto and provides equally weighted exposure to the top 10 cryptocurrencies making up more than 85% of the crypto market.

The Payment Bundle provides equally weighted exposure to the top five payment focused cryptocurrencies looking to make payments cheaper, faster and more global.

The Smart Contract Bundle provides equally weighted exposure to the top five smart contract-focused cryptocurrencies like ethereum, EOS or tron that allow developers to build applications on top of their blockchains, similar to how Apple builds apps on top of iOS.

You can get started with as little as R300. Sign-up is quick and effortless, and you can withdraw your funds at any time.

Head over to www.revix.com to learn more.

About Revix

Revix brings simplicity, trust and great customer service when investing in cryptocurrencies. Its easy-to-use online platform allows anyone to securely own the world’s top cryptocurrencies in just a few clicks. Revix guides new clients through the sign-up process to their first deposit and first investment. Once set up, most customers manage their own portfolio but can access support from the Revix team at any time.

Remember, cryptocurrencies are high-risk investments. You should not invest more than you can afford to lose, and before investing please take into consideration your level of experience and investment objectives, and seek independent financial advice if necessary.

This article is intended for informational purposes only. The views expressed are opinions, not facts, and should not be construed as investment advice or recommendations. This article is not an offer, nor the solicitation of an offer, to buy or sell any cryptocurrency.

To learn more, visit www.revix.com.

- This promoted content was paid for by the party concerned