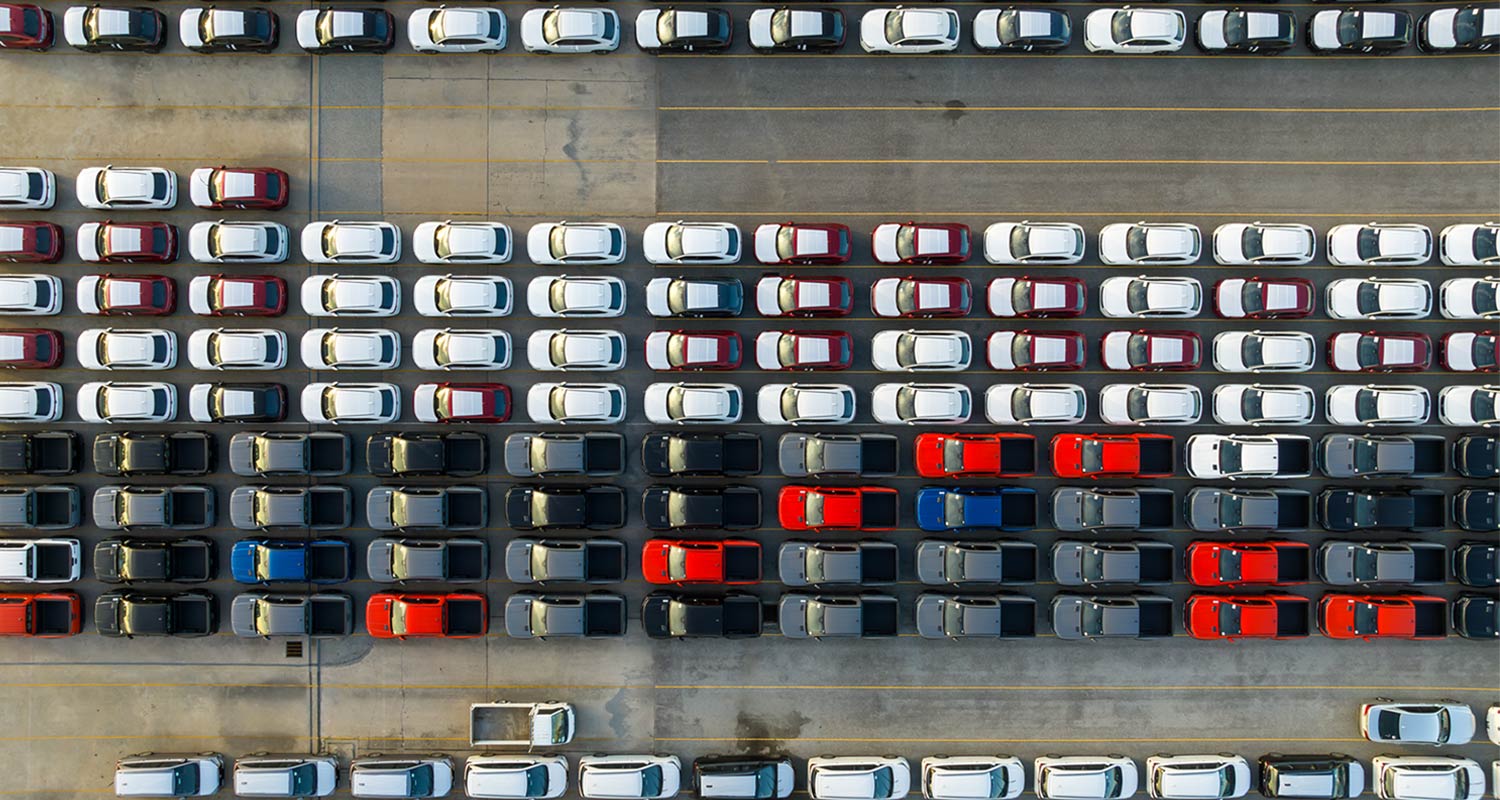

The EU voted on Friday to impose tariffs as high as 45% on electric vehicles from China in a move set to increase trade tensions with Beijing, according to people familiar with the process.

The EU voted on Friday to impose tariffs as high as 45% on electric vehicles from China in a move set to increase trade tensions with Beijing, according to people familiar with the process.

The European Commission, the bloc’s executive arm, can now proceed with implementing the duties, which would last for five years, said the people, who spoke on the condition of anonymity. Ten member states voted in favour of the measure, while Germany and four others voted against and 12 abstained.

The decision by the EU comes after an investigation found that China unfairly subsidised its industry. Beijing denies that claim and has threatened its own tariffs on European dairy, brandy, pork and motoring sectors.

The bloc is actively trying to reduce its dependencies on China, with former European Central Bank president Mario Draghi warning last month that “China’s state-sponsored competition” was a threat to the EU that could leave it vulnerable to coercion. The EU, which did €739-billion in trade with China last year, was split on whether to move forward with the duties.

The EU and China will continue negotiations to find an alternative to the tariffs. The two sides are exploring whether an agreement can be reached on a mechanism to control prices and volumes of exports in place of the duties.

The European Commission, the bloc’s executive arm, has repeatedly said that any alternative to tariffs has to have strict requirements, including alignment with World Trade Organisation rules, address the impact of China’s subsidies and be something the EU can monitor for compliance.

The new tariff rates will be as high as 35% for EV manufacturers exporting from China. The new duties would be on top of the existing 10% rate.

Squeeze

Chinese EV makers will have to decide whether to absorb the tariffs or raise prices, at a time when slowing demand at home is squeezing their profit margins. The prospect of duties has prompted some Chinese car makers to consider investing in factories in Europe, which might help them dodge tariffs.

The additional tariffs already have slowed Chinese car makers’ momentum in Europe, with their sales plunging 48% in August to an 18-month low. The region is a desirable destination for the nation’s manufacturers because EVs sell in relatively high numbers and at much more robust prices than other export markets.

Read: South Africa’s first electric minibus taxi to hit the road

The share of electric cars sold in the EU that were made in China climbed from around 3% to more than 20% in the past three years. Chinese brands accounted for around 8% of that market share, as international companies that export from China including Tesla taking up the rest.

Still, Europe’s tariff hike will have a “minor impact” on Chinese manufacturers because the region accounts for only a fraction of their total sales, according to Daiwa Securities analyst Kevin Lau. Europe contributed between 1-3% of overall sales for BYD, Zhejiang Geely Holding Group and SAIC Motor in the first four months of this year, he estimated.

Still, Europe’s tariff hike will have a “minor impact” on Chinese manufacturers because the region accounts for only a fraction of their total sales, according to Daiwa Securities analyst Kevin Lau. Europe contributed between 1-3% of overall sales for BYD, Zhejiang Geely Holding Group and SAIC Motor in the first four months of this year, he estimated.

While Brussels has sought a level playing field for European companies, Germany’s car makers are concerned about blowback that could exacerbate challenges they’re already having in their most important market globally. Mercedes-Benz Group and BMW pressed Berlin to vote against the higher tariffs and urged the EU to negotiate with Beijing.

German car makers including Volkswagen, Mercedes-Benz and BMW would be hit hardest in a trade spat as China accounted for roughly a third of their car sales in 2023. — Alberto Nardelli and Jorge Valero, with Craig Trudell, Jenni Marsh and Stefan Nicola, (c) 2024 Bloomberg LP