Regulators will be watching closely when Facebook unveils its cryptocurrency project this week. Their vigilance is warranted.

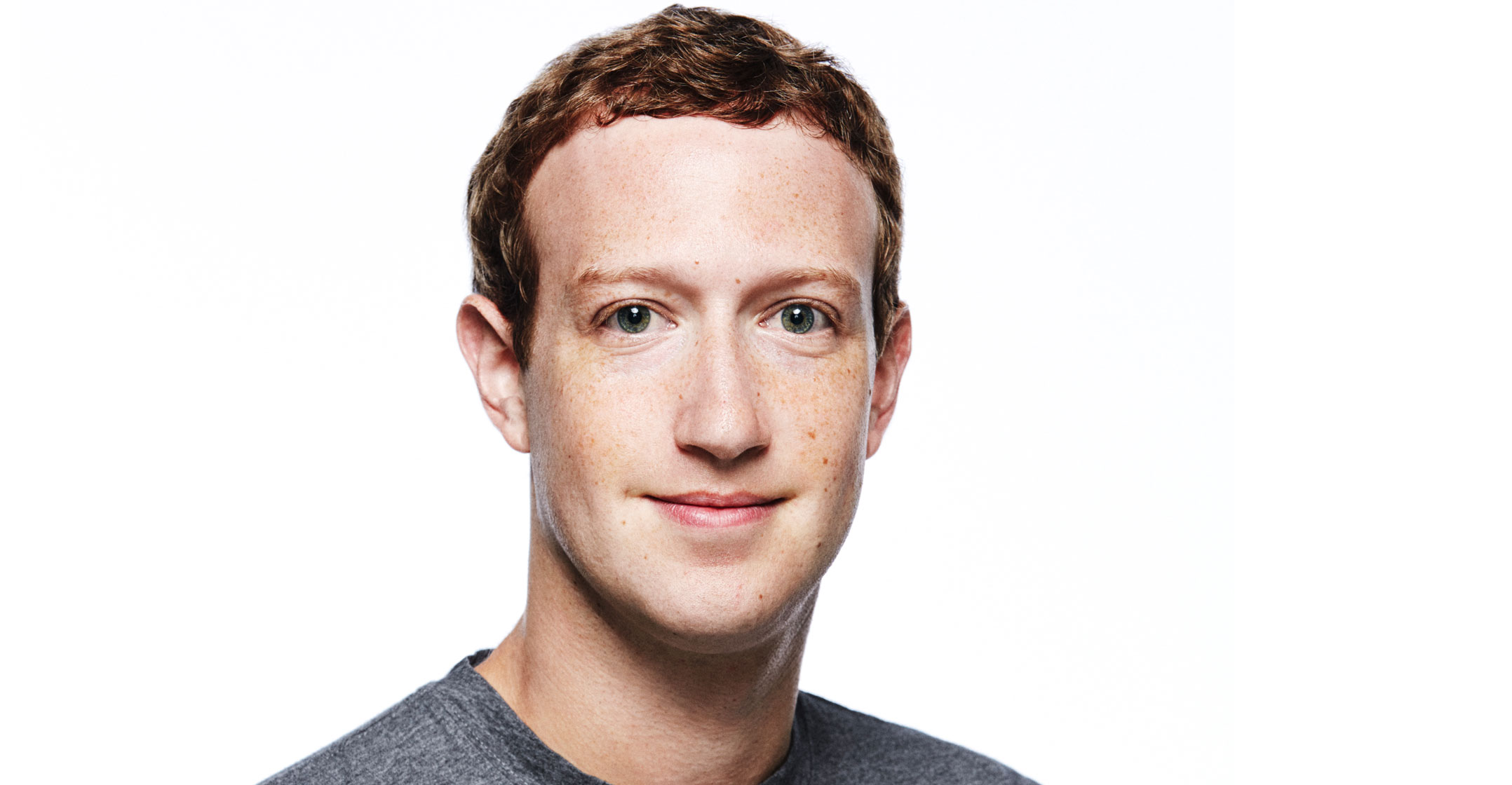

Mark Zuckerberg, the social network’s founder, isn’t going to gamble with what remains of his public image by replicating the worst excesses of the bitcoin craze. He’s not trying to create a speculative currency; a potential wave of mom-and-pop investment losses is the last thing he needs. He just wants a digital medium of exchange. Nevertheless, his bid to launch an online payments revolution carries plenty of risks, from antitrust concerns to the threat that it might pose to financial stability.

Weekend media leaks suggest that Facebook’s “Libra” project will be a continuation of its past efforts to expand its payments business and keep customers within the walled garden of its social media apps by creating their very own money.

While Zuckerberg is poised to unveil a team of partners — reportedly including eBay, Farfetch, Spotify Technology, Uber Technologies and Vodafone Group — so far this feels very much like Facebook’s baby. Tellingly, it’s not one that the big banks or the other Silicon Valley and Seattle giants seem ready to adopt quite yet, unless Zuckerberg surprises us with some bigger names at the launch. The target customer base for these new digital tokens looks certain to be the 2.6 billion-strong users of Facebook, WhatsApp and Instagram.

While Facebook will no doubt assure us that this project is all about making the lives of its customers ever easier, giving them the ability to actually buy stuff in a way that bitcoin has rarely offered, it’s hard to square it away with the political effort to curb Big Tech’s monopolistic tendencies (regardless of that roster of launch partners and their US$10-million participation fees).

Protective glue

It’s crucial that Libra doesn’t become a protective glue that binds Zuckerberg’s social networks even more closely together at a time when many regulators want to break them up. Libra will be presented as an open-source partnership whose benefits are available to all, but to what extent will it really be held at arm’s length from the Zuckerberg empire? Indeed, if the financial and business benefits of using Libra accrue mainly to Facebook, it will merely enshrine its market dominance.

As such, regulators must find out who will own the giant new data sets. They might even want to push the case that this kind of data should be made available to governments or rivals to avoid the problems of the past, where a handful of companies ended up owning all of the information about our online activities.

While Facebook barely makes any money from its payments business today — with payments and other fees accounting for less than 2% of last year’s $55.8-billion of revenue — some analysts reckon Libra could change things. Barclays is reportedly predicting $19-billion in additional revenue by 2021 if the tokens gain traction. Libra is scheduled to launch across a dozen countries in 2020. That’s a lot of potential data and new sources of revenue.

Financial stability is a worry, too, and regulators should ask for transparency on how Libra is structured. The token is expected to be a “stablecoin”, which is pegged to existing fiat currencies such as the US dollar or the euro. That will damp price volatility, unlike the free-wheeling bitcoin, whose price in the past five years has gone from $600 to $19 000, and now to $9 000. Regulatory oversight of which currencies are held in reserve to back the Libra coin would go some way to building faith in Facebook’s capacity to redeem tokens when customers ask for it.

While no one wants to choke innovation unnecessarily, Facebook hasn’t exactly done much to earn everybody’s trust in recent years. Any chance to put the necessary controls in at the beginning, rather than firefighting down the road, should be grabbed by the regulators. — (c) 2019 Bloomberg LP