JSE-listed technology group Altron will in future be a significantly smaller business focused on the IT and telecommunications industries as it sheds non-core assets and loss-making businesses, especially in the legacy power infrastructure side of its business.

Robbie Venter has resolved to stay on as CEO of the troubled group until it is on a stronger footing, delaying a plan, announced six months ago, to seek a new leader for the business.

Altron was founded 50 years ago by Venter’s father, Bill Venter, who, at 81, still chairs the board of directors. The Venter family, which retains control of the group, has seen its wealth plummet in the past 12 months as Altron’s share price has given up more than two-thirds of its value in that time. Its market cap has fallen to R2,7bn (as at Friday’s close).

Its latest financial results are unlikely to lift the mood of investors, with Altron this week reporting shocking numbers for the six months to 31 August 2015. Although revenue from continuing operations shrank by 7% to R13,3bn (8% to R10,5bn for continuing operations), the real horror story is on the bottom line.

The group went from a profit from total operations of R190m in the same period last year to a loss of R569m now. The loss from continuing operations was R240m, a reversal from a profit previously of R235m. Headline earnings per share slumped from 72c to a loss of R1,89.

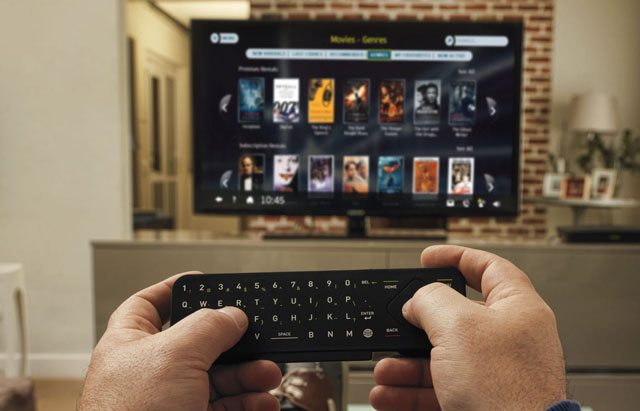

Knocking the headline earnings number were big impairment losses, especially in the Powertech subsidiary. The group also fully impaired its failed Altech Node video-on-demand set-top box platform to the tune of R44m. This was after it decided to close down the Node business due to lack of consumer interest.

Altron had previously said it was close to a deal to sell the Node to a third party, but Venter said in an interview this week that the terms and conditions that the unnamed buyer wanted to impose were too onerous.

“We felt that it was in the best interests of shareholders not to do a deal with onerous conditions but rather consider cutting our losses and closing the business. We have retained all of the technology related to the Node.”

Venter described the Node as a “very expensive lesson learnt in terms of capital allocation”.

Altron is also in the process of selling the customer base of Altech Autopage, the country’s largest independent cellular service provider, to the network operators. Margin pressure in the mobile industry, caused in part by cuts to wholesale inter-network call charges, has led to operators putting the squeeze on channel partners like Autopage.

Operating profit at Autopage slumped by two thirds year on year, despite a slight uptick in revenue. Venter blamed the decline in profits on the need to retain customers by absorbing the rising cost of smartphones, which became much more expensive due to the sharp decline in the value of the rand this year.

The Autopage subscriber base disposal follows a similar decision by Reunert to sell the subscribers of subsidiary Nashua Mobile and shut down that business.

Altron expects to realise a net R1,2bn to R1,3bn from the sale of the Autopage subscribers, which it will use to reduce group debt, which is sitting at a high R3,8bn.

The group has also decided to offload its troubled Powertech Transformers business, where orders from Eskom, its biggest customer, have dried up. It expects to conclude a deal, possibly involving an international company, within the next 12 months. The business, which has shed about 350 factory jobs in the past 12 months, is now being accounted for as a discontinued operation.

Another poor performer was Altech UEC, Altron’s set-top box business, which came under immense pressure due to delays in orders for digital television decoders, especially from the rest of Africa. UEC has embarked on wide-scale retrenchments.

The only real bright spot in the results came from Bytes, the IT services business, which managed to notch up double-digit headline earnings growth on an adjusted basis.

Venter said conditions would remain challenging for the rest of the financial year, with low economic growth, unfavourable manufacturing conditions and limited orders from Eskom all contributing to a depressed business environment. The benefits of the sale of assets and other restructuring taking place at the group would only likely flow through in the 2017 financial year.

Venter’s brother, Craig, recently stepped down as CEO of Altron TMT (the Altech and Bytes businesses). But Robbie Venter said he intends getting Altron onto a stronger footing before passing the baton to a new CEO.

“I remain focused on addressing the challenges and progressing our group into a more focused IT and telecoms operation. This is work in progress. Once it’s completed, we will review the leadership of the group,” he said.

- This piece was first published in the Sunday Times

- Subscribe to TechCentral’s free daily newsletter

- This piece was updated to correct Altron’s market capitalisation