Montegray Capital chairman Michael Jordaan said this week that South Africa has more important investment priorities than making bitcoin a component of the country’s strategic reserve.

The bitcoin strategic reserve lobby has grown louder following successful trials in El Salvador and the election of Donald Trump as US president, who promised he is going to be the “crypto president”.

Speaking to VALR CEO Farzam Ehsani in a podcast on Monday, Jordaan said South Africa’s biggest challenge is growing the economy so that jobs are created and poverty is alleviated – outcomes he believes are better served by “real” investments in the economy instead of financial instruments that only have the “potential” for growth.

“I would say the debate is not a South African debate; I think it’s one for the wealthy countries who feel that they don’t have those opportunities to make the economy grow,” Jordaan, co-founder and chairman of Bank Zero and a former CEO of First National Bank, told Ehsani.

The South African Reserve Bank defines its strategic reserve as a “collection of assets that are managed to help the country prepare for economic crises, natural disaster and conflict”. These assets include gold, foreign exchange, “special drawing rights” and forex deposits.

“In a country like South Africa, I wonder whether we should be investing in reserves or whether we should be investing in the economy, in real assets and in education and things that make the country grow,” said Jordaan.

He said the question of converting portions of existing gold reserves into cryptocurrency is one every country in the world will have to face at some point because “crypto is the digital version of gold”. He described himself as “bullish about bitcoin” but warned against the intent of those lobbying government to include it in South Africa’s strategic reserves.

‘We need growth’

“Where I struggle a bit is I think there are a lot of punters who want the government to enter the market for bitcoin and buy these coins so that their investments go up,” he said.

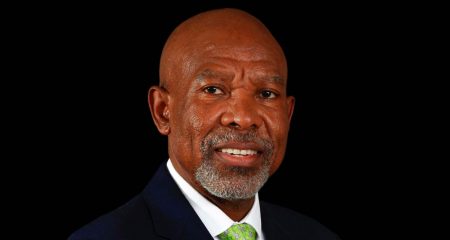

Jordaan’s warning echoes similar remarks by Reserve Bank governor Lesetja Kganyago at the World Economic Forum last month, where he said governments should be wary of lobbyists who have a “particular interest in a particular product” and seeking to impose that on societies.

“I would have a significant problem with a lobby that says governments should hold this or that asset without consideration for the strategic intent of government. There is a history to gold, but if we now say bitcoin, then what about platinum or coal? Why don’t we hold strategic beef reserves, or mutton reserves or apple reserves? Why bitcoin?” asked Kganyago.

According to Jordaan, South Africa’s challenge is not building up huge strategic reserves. “It is actually about investing funds to the maximum because we need growth. As bullish as I am about crypto, I don’t think we should be doing financial investments, we should be making real investments now,” said Jordaan.

Democratic Alliance federal chair Helen Zille also recently questioned the rationale of including bitcoin in South Africa’s strategic reserve. Speaking at the Adopting Bitcoin conference in Cape Town last month, Zille described the steps taken by El Salvador and others as “important experiments” but warned that there are many risk factors South Africa’s financial regulators must consider before thinking about making a similar move here.

According to Zille, quoting deputy finance minister and DA MP Ashor Sarupen, the scale of debt in South Africa is such that if government started using unclassified assets, it could trigger a big increase in the risk premium in the bond market, which in turn could trigger currency issues.

‘Digital gold’

But Stafford Masie, the well-known South African technology entrepreneur and a leading advocate for a bitcoin reserve, said Saropen’s remarks are “premised on an all-or-nothing approach, which makes it invalid and silly at best”.

“The argument against a ZA SBR (South African strategic bitcoin reserve) primarily hinges on the risk perception in bond markets, potential increases in borrowing costs and the possibility of a currency crisis. While these concerns are valid, they assume an all-or-nothing approach rather than a measured, strategic integration of bitcoin into national reserves,” said Masie, who has described himself as a bitcoin “maximalist”.

“Bitcoin as a diversified reserve asset would enhance, not undermine, sovereign stability.”

Read: Keep bitcoin away from South Africa’s strategic reserve: Helen Zille

He said countries around the world already diversify their strategic reserves. “Most central banks diversify reserves beyond fiat currencies (dollars, euros) by holding gold and other assets. Bitcoin ‘digital gold’ can serve a similar role,” Masie said.

“We propose a small-scale adoption initially; a ZA SBR does not need to replace core reserve assets but can be introduced at a modest scale (for example, 1-5% of reserves). This would mitigate concerns about excessive volatility while testing bitcoin’s role in financial stability.

“Market confidence is based on fiscal discipline, not just asset choice. Debt markets react to policy, not just reserves. For example, bond markets primarily assess a country’s fiscal discipline, economic policies and ability to service debt. A bitcoin reserve, if part of a well-structured policy, would not inherently drive borrowing costs higher,” Masie said.

“A clear framework for how bitcoin reserves are acquired, managed and utilised would prevent uncertainty that could negatively impact investor confidence,” he said.

“Bitcoin’s liquidity and global recognition actually reduces sovereign risk. Bitcoin has a daily trading volume in the billions of dollars, making it a highly liquid asset. If South Africa needed to sell bitcoin reserves to support the rand or service debt, it could do so efficiently.

“Major financial institutions, hedge funds and even some governments (like El Salvador) hold bitcoin, increasing its credibility. South Africa integrating bitcoin in a measured manner would align with global trends.”

Masie said bitcoin’s fixed supply – only 21 million will ever be “minted” – also means it is a hedge against inflation, unlike fiat currencies like the rand.

“The ‘debt recall’ argument is such an exaggeration. Sovereign debt is structured through long-term bonds, not short-term recalls. Introducing bitcoin as a reserve asset would not suddenly invalidate our ability to repay existing obligations. If bitcoin reserves are introduced as part of a structured fiscal policy rather than a reactionary measure, the risk premium would not necessarily spike … at all!” – © 2025 NewsCentral Media

Get breaking news from TechCentral on WhatsApp. Sign up here.