BlackBerry’s new devices are too data intensive to use the company’s flat rate — and heavily compressed — BlackBerry Internet Service (BIS), provoking concern from South African BlackBerry lovers that it will be much more expensive to use the company’s new smartphones.

Combine the need to pay for data according to usage with the fact that the new devices — at least the early ones — are likely to cost the same as other top-end smartphones, the question arises: has BlackBerry, which was known as Research in Motion until this week, created a viable upgrade path for users in emerging markets like South Africa?

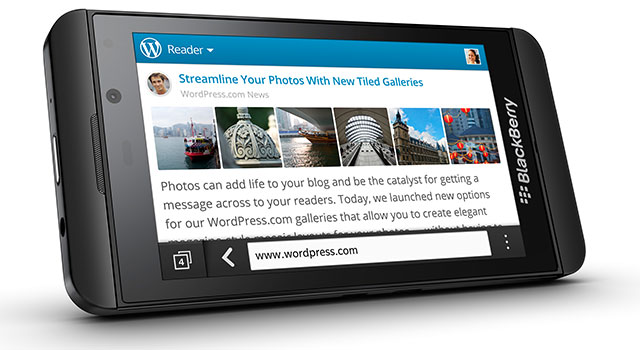

On Wednesday, the Canadian company announced two new handsets running the long-delayed BlackBerry 10 (BB10) operating system. Though South African pricing hasn’t been released, the first, the Z10, looks set to cost in the region of rivals such as the iPhone 5, the Samsung Galaxy S3 and the Nokia Lumia 920.

The Z10 is evidently aimed at high-end consumers rather than the bulk of BlackBerry’s existing user base. The second of the phones, the Q10, will only go on sale in April.

Technology consultant Liron Segev says he’s not at all surprised that BlackBerry has decided to aim high with the Z10 because its existing devices haven’t been able to match the best devices from its rivals, which has seen some users defect as a result.

Segev says the Z10 is positioned to appeal to those who want the functionality and applications offered by other high-end devices, alongside having the popular BlackBerry Messenger service.

For these users, the lack of BIS is unlikely to be a problem, he argues. “If you’re a high-end user, you’re probably paying for a data bundle already. It’s very smart of BlackBerry to launch to the high end because pitching only to the low-end would look like giving up.”

BlackBerry has been vocal about its efforts to ensure a healthy selection of applications and content for BB10 users, including paying developers US$100 to port existing apps to the platform. Segev says this demonstrates the company’s desire to be taken seriously, and that it’s learnt its lesson with the PlayBook, its tablet computer that failed to win favour with consumers.

“The PlayBook died because of a lack of apps, among other things,” Segev says. “The hardware was superb, but the software wasn’t. Hence the delays in releasing BB10; BlackBerry couldn’t make the mistake of launching a half-cooked product again. To win back the customers it’s lost, it had to get it right out of the box.”

Segev says BlackBerry made the right moves at the launch, but feels it left too many questions unanswered, particularly around pricing and device availability. In addition, the company should have spoken more about its other BB10 device, the Qwerty and touch hybrid handset, the Q10, he feels.

“BlackBerry should’ve told South African customers when they can get the Z10 and for how much. Now people have to wait. The uncertainty is what’s always been BB’s problem. I’ve got an upgrade due now, do I wait or do I get something else? There are going to be lots of other people asking the same question.”

Although the Z10 is a new device for BlackBerry in terms of styling, the Q10 looks like its earlier products. “The Q10 looks familiar, it’s a device existing users can relate to. People wanted to know about it.”

No BIS

Neither the Z10 nor the Q10 will support BIS because they’re too data intensive, and that could be the real obstacle for attracting lower-end users like those in India and South Africa.

However, World Wide Worx MD Arthur Goldstuck says those who suggest that without BIS BlackBerry is as good as dead are missing a number of subtleties of the company’s proposition.

“We’re actually currently doing research to test potential uptake of the phones before and after the launch,” Goldstuck says.

“We’ve done the ‘before’, now we’re working on the ‘after’ among feature phone users here and in Nigeria.” South Africa and Nigeria are BlackBerry’s two largest African markets.

“Initial indications suggest there is a huge appetite for current and new BlackBerry devices among feature phone users. The brand momentum for BlackBerry is still strong.”

Goldstuck says what made BIS possible was that all data was compressed and flowed over BlackBerry’s own network. “But that meant poorer browsing performance than on any other smartphone. Now you enter this new data-intensive ecosystem and it’s not feasible to run it through the same security and compression.”

This means BB10 devices lend themselves to a data-bundle model where other brands play. However, Goldstuck says the text component of the revised BBM application will still run over the existing BIS architecture, meaning operators may sell a data bundle with BBM as a value-add at no cost.

“That is the one element that makes BIS so attractive — that unlimited BBM chat. It’s a pretty low-cost service if you think about it. Alternatively, when you get a data bundle, the operator could allocate R15 of it to BBM.”

According to Goldstuck, it’s quite likely that by the time the enthusiasm for the low-end devices begins to wane, the low-end of the market will have BB10 devices catering to it.

Unique interface

BlackBerry has been adamant that one of its key goals with BB10 is to offer a unique user experience. Adam Leach, principal analyst at Ovum, thinks it’s succeeded on that front.

“The BB10 platform offers a differentiated user experience in today’s crowded and homogenous smartphone market. The Blackberry Z10 and Q10 will stand out from the Android masses and look distinct from Apple’s iPhone.”

Leach says the BB10 user experience introduces “some nice new features” while building on the company’s user interface heritage, which should make it appealing to existing BlackBerry users. “However, the challenge for the company will be to attract new users and those that have already moved to alternative smartphones,” he says.

“BlackBerry has rightly focused on ensuring that the BB10 devices have a large catalogue of content and applications which is now essential for any modern smartphone, and achieving 70 000 applications at the launch of a new platform is good start.”

But Leach says that despite BB10 being a well-designed platform which will attract short-term interest from existing users, the company will “struggle to appeal to a wider audience and in the long-term will become a niche player in the smartphone market”. — (c) 2013 NewsCentral Media