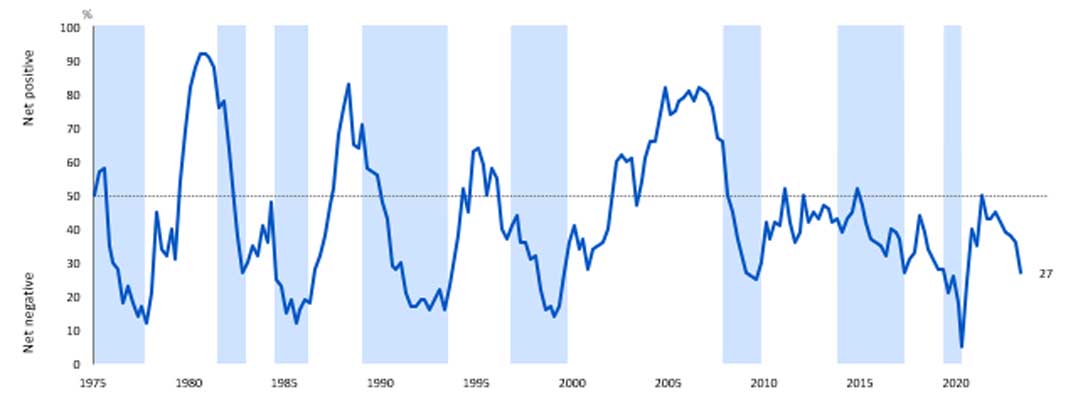

The RMB/BER Business Confidence Index declined for a fifth consecutive quarter in the second quarter of 2023, down nine points from the first quarter to 27 points – the lowest level of confidence since 2020.

The RMB/BER Business Confidence Index declined for a fifth consecutive quarter in the second quarter of 2023, down nine points from the first quarter to 27 points – the lowest level of confidence since 2020.

This suggests that only roughly a quarter of respondents are satisfied with prevailing business conditions.

The decline in confidence was on the back of another decrease in business activity, although this likely does not explain the full extent of the deterioration in sentiment. A challenging business environment amid, among other factors, persistent load shedding, rising interest rates and cost pressures weighing on profitability also affected confidence.

The second quarter survey was conducted by the BER between 10 and 30 May this year. The survey covered 1 050 senior executives in the building, manufacturing, retail, wholesale and motor trade sectors.

The gloomy sentiment was shared among respondents, with three of the five sectors seeing their confidence level decline while the other two remained unchanged.

Of those that declined, consumer-facing new vehicle dealers and the retail sector experienced the most notable deterioration in confidence. New vehicle dealer confidence plunged by 21 points to 23, while retail confidence declined by 14 points to 20 in the second quarter. The deterioration in retail confidence reflects increased pressure on profitability and a worsening of business conditions.

Traders in non-durable goods (food, beverages, etc) struggled the most amid a steep decline in sales volumes. Semi-durable goods (including clothing) retailers did see a slight uptick in volume growth.

There were diverging trends within the durable goods sector as hardware traders were under pressure, but furniture and appliance sales have been supported by load-shedding essentials, and replacement purchases of electronics broken due to load shedding and power surges.

The third sector where business confidence declined was wholesale traders. Confidence declined by eight to 32 index points in the second quarter as sales volumes of consumer goods came under pressure. Like most other sectors, the wholesale confidence level is well below its long-term average level.

Respondents in the manufacturing sector remain the most downbeat. Confidence stayed at 17 index points in the second quarter, meaning that fewer than two in 10 businesspeople in the sector were satisfied with prevailing business conditions. The sector continues to be plagued by load shedding, which also presents an additional cost burden. Respondents saw demand and activity deteriorate further and are even more worried about future business conditions.

Bottomed

Finally, the drop in the overall RMB/BER Business Confidence Index would have been more pronounced were it not for the figure for building contractors remaining unchanged at 43 index points. Confidence was stable despite a notable deterioration in activity. The sector bottomed out in the second half of last year, although the growth momentum has eased since a few months ago due to the tighter interest rate environment. Interestingly, subcontractors continued to fare better in the second quarter due to spending on load-shedding mitigation measures such as solar power and inverters.

Confidence was still supported by the consumer-facing sectors in the first quarter of 2023, but with a steep deterioration in sentiment for new vehicle dealers, retailers and, to a lesser extent, wholesalers, the overall RMB/BER index plunged lower in the second quarter. This was in part due to a decline in activity, but when the relationship between activity and confidence is considered over time, confidence would generally be somewhat higher with current activity levels.

This underscores that there is more dragging down confidence than just a drop in output. Respondents flagged load shedding as a continued drag on sentiment as it hurts production capacity, increases costs and negatively affects profitability.

Respondents highlighted that any available capital is going towards load-shedding mitigation measures (such as the installation of solar power) rather than investment to build additional capacity. Some respondents also mentioned the weak rand exchange rate and concerns about South Africa’s diplomatic relations with the rest of the world, as well as its possible impact on trade relations. The increased interest rate environment, while inflation remains elevated, is also a challenge, according to the survey.

RMB chief economist Isaah Mhlanga said: “It remains unclear as to what will meaningfully lift confidence over the short term, especially as load shedding could get worse over the winter months. Indeed, while just skirting a recession in the first quarter of 2023, the South African economy is far from being out of the woods.

RMB chief economist Isaah Mhlanga said: “It remains unclear as to what will meaningfully lift confidence over the short term, especially as load shedding could get worse over the winter months. Indeed, while just skirting a recession in the first quarter of 2023, the South African economy is far from being out of the woods.

“More concerning is the fact that consecutive quarters of business confidence below 30 has historically coincided with contractions in either fixed investment, economic growth or both. However, some of the drivers of negative sentiment such as strained geo-diplomacy could be resolved in the coming months while current constraints on business conditions such as load shedding could look somewhat better in 2024 and may support an improvement in confidence over time.”

More structurally, an improvement in business confidence will require continued implementation of economic reforms under the presidency’s Operation Vulindlela, particularly in energy procurement and logistics. – © 2023 NewsCentral Media