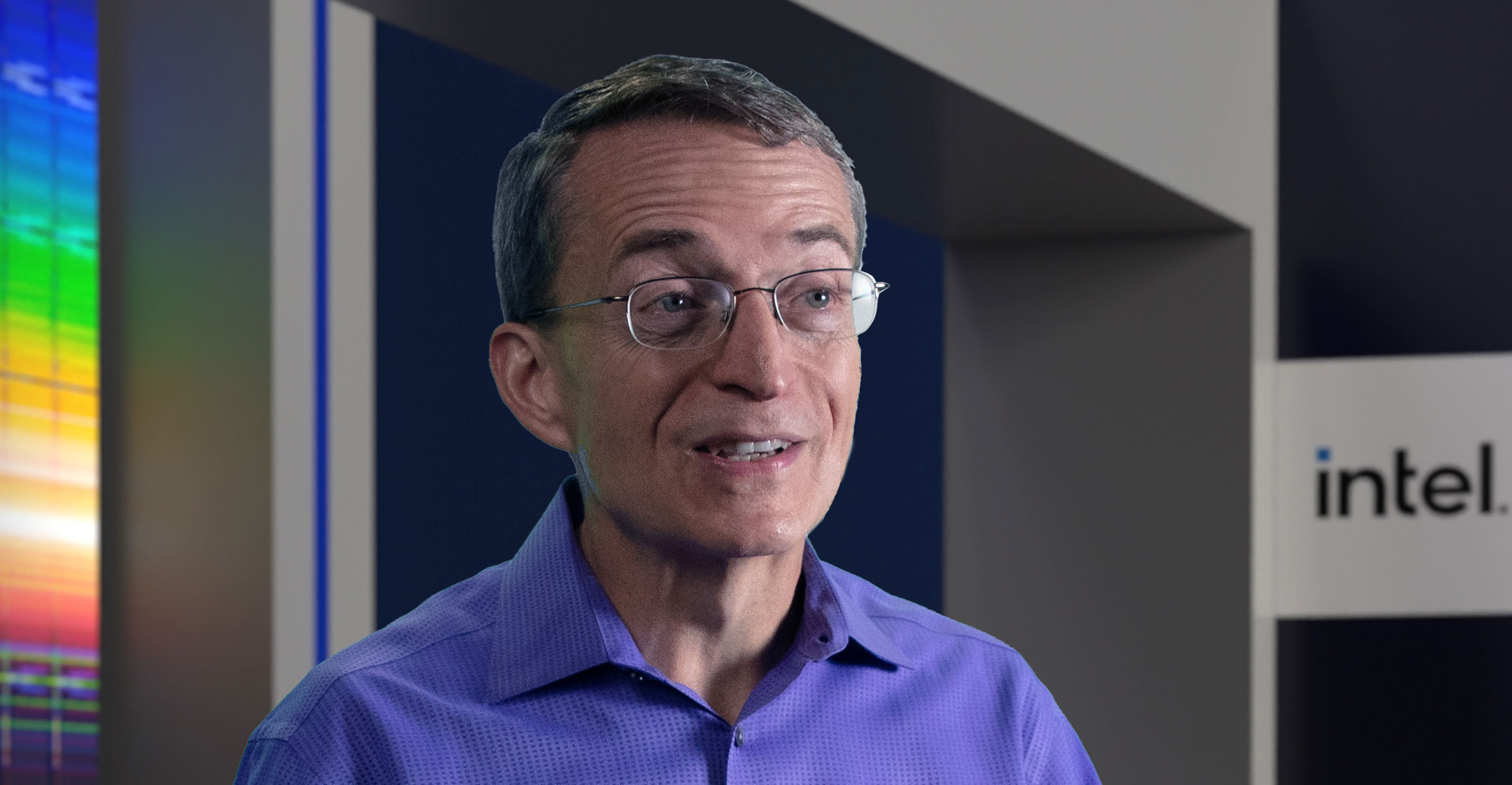

Intel CEO Pat Gelsinger, who took the job in February 2021, gives himself an A- grade for his first year running the chip maker. Investors are proving to be tougher graders.

No one is faulting the 60-year-old’s energy level and ambition. But he’s trying to reshape the competitive landscape of the US$500-billion chip industry, turn around its most iconic company, and change industrial policy in the US and Europe — at a pace he likes to call “torrid”.

And the plan is going to be expensive. Very expensive. In the US state of Ohio, Gelsinger is spending $20-billion to build the world’s biggest chip-making facility. He’s also planning an expansion in Europe, making deals and ramping up research spending — weighing on Intel’s once-dependable profit margins. That’s testing the patience of investors, who have sent the shares down 22% in the past year.

Just this week, Intel agreed to buy Tower Semiconductor for $5.4-billion, part of a push into making chips on a contract basis for other companies.

In a Bloomberg Television interview, Gelsinger acknowledged that Intel’s comeback won’t happen overnight but slammed Wall Street analysts for sticking to a negative view. The executive said he’s “pissed” off at what he calls perma-bears. But Gelsinger believes that others are getting excited about the company restoring its prowess and creating “the new old Intel”.

“In some regards, we’re ahead of where I thought we’d be; in some areas, we’re not as far as I thought we’d be,” Gelsinger said. “And it really is more a statement of the massive challenge in front of us.”

This is Gelsinger’s second stint at Intel, having spent decades at the chip maker before leaving to run VMware in 2009. When he returned as CEO last year, the hope was he could chart a new course — but also remember what made Intel great in the first place.

Aggressive strategy

Within a few weeks of rejoining the company, Gelsinger outlined an aggressive strategy aimed at reclaiming the manufacturing leadership that his predecessors had allowed to slip. He followed that up with his plans to rebuild production in the US and Europe, aiming to counterbalance a shift of manufacturing to Asia. He’s also lobbied for billions of dollars in government support.

But it could be an uphill fight. Longtime underdog AMD has become a fierce competitor, and some of Intel’s most prized customers — including Apple — are developing their own chips.

For now, investors such as NZS Capital are taking a wait-and-see approach. “I think he deserves good marks for what he’s done,” said Jon Bathgate, a fund manager at the firm in Denver. “But the lift is just extremely heavy, and people that think that this can be resolved in a handful of quarters — even a handful of years — probably don’t understand the challenges that he was facing coming in in the first place.”

Bathgate said NZS isn’t investing in Intel because there are other companies that are “firing on all cylinders”. Intel will have to show better financials, prove it can land big outsourced chip customers and stop losing market share, he said.

Other investors agree. Intel’s performance over the past year puts it at 27th in the Philadelphia Stock Exchange Semiconductor Index of 30 stocks. And its shares have declined sharply each time Intel has reported earnings — a sign investors aren’t happy with Intel’s progress.

Take Intel’s gross margin — the percentage of revenue remaining after deducting the cost of production — a key sign of health for a manufacturing company. It’s expected to be about 52% this year. That figure would be stratospheric in the automotive industry, but it’s 10 percentage points below Intel’s historical levels. It’s also below those of some peers. Texas Instruments is close to 70%, and AMD — not known for its fat margins in the past — reached 50% last quarter.

Take Intel’s gross margin — the percentage of revenue remaining after deducting the cost of production — a key sign of health for a manufacturing company. It’s expected to be about 52% this year. That figure would be stratospheric in the automotive industry, but it’s 10 percentage points below Intel’s historical levels. It’s also below those of some peers. Texas Instruments is close to 70%, and AMD — not known for its fat margins in the past — reached 50% last quarter.

In many ways, Gelsinger is trying to turn back the clock and restore Intel to what it looked like in 2009, when he left to run VMware. Back then, the computer industry bought Intel chips because they had to: its Xeons and Core processors were so much better than the few viable alternatives. That position gave Intel a level of profitability that was the envy of the chip industry and enough cash to let it spend more than any rival on technology and manufacturing.

Gelsinger started his career at Intel in 1979 and was the lead architect of the original 80486 chip. He likes to say he “went through puberty there”, working for chip-industry pioneers like Gordon Moore and Andy Grove.

But these days, the company is playing catch-up. Gelsinger plans to spend as much as $28-billion on new plants and equipment this year, up from roughly $10-billion a year earlier. Taiwan’s TSMC expects to shell out $40-billion and Samsung Electronics, which spent $36-billion in 2021, will likely exceed that level this year, according to analysts’ estimates.

Gelsinger said he’s trying to overcome a decade of “bad decisions and poor execution”. But even with a spending spree underway, Intel isn’t keeping up with its fellow chip giants.

The year before Gelsinger left Intel, the chip maker had the same annual revenue as Apple: about $37-billion

Intel’s customer base has undergone a transformation, too. The year before Gelsinger left Intel, the chip maker had the same annual revenue as Apple: about $37-billion. Intel was about $5-billion ahead in market capitalisation. Since then, Intel has roughly doubled in revenue. But Apple now has a valuation of $2.8-trillion, annual sales of $365-billion and a cash position that exceeds Intel’s total market capitalisation. Other big buyers chips — Amazon.com, Microsoft, Google and Meta Platforms — also dwarf Intel in size.

Intel is setting ambitious goals, but from “a position of relative weakness”, said Tom Fitzgerald, a fund manager at EdenTree Investment Management. The competition has evolved over the past decade, he said, and so have the customers.

Many of Intel’s biggest customers are designing their own chips. Apple has already abandoned Intel parts in its Mac line of computers, relying instead on technology from ARM. Amazon and Microsoft are taking similar steps with their server processors.

With that in mind, Gelsinger’s mantra to his design team is to build a better chip. “We have to create products and technologies that Apple says, ‘Huh, that’s better than I could have done myself,’” he said.

Bigger pie

The good news is the proliferation of chips means there will be a bigger pie for the whole industry to carve up. More semiconductors are going into cars, household appliances and buildings — anything that needs to think for itself and connect to the Internet. The Covid-fuelled supply crisis of the past year has spotlighted just how reliant the world is on chips.

Semiconductor industry sales topped half a trillion last year, and Gelsinger believes that figure will double within the next decade.

And as Intel makes a wider variety of chips, it looks to become as indispensable as ever. “It’s going to take awhile, but we’re well on our way,” Gelsinger said. — (c) 2022 Bloomberg LP