FNB is reimagining help as it strives to make every day easier and tomorrow better for all its customers, taking a bold step forward on its journey into the future.

FNB CEO Jacques Celliers says: “For 184 years, our sense of care has been vital to our efforts to help millions of individuals, families and businesses realise their dreams and aspirations. Our efforts to transition beyond banking are still deeply rooted in our promise of helping customers with advice they can trust, solutions that are easy to use and safe, and a brand that is relevant at every life stage. Our journey to help customers navigate life is similar to the versatile Acacia tree, that has been deeply rooted within our brand and continues to grow and thrive withstanding the test of time.”

Reimagining advice

FNB is focused on being advice-led, rather than product-led in the delivery of its solutions. In its journey to transition beyond banking, it is striving to become an integrated advice partner connecting the dots between their customers’ day-to-day activities and their aspirations and goals. The bank continues to build competitive investment, insurance, lifestyle and business solutions to best deliver to customers’ goals. This is all underpinned by the ease and safety of its platform and extensive network of advisors.

“We aspire to be a trusted partner helping customers, their families and their businesses thrive and achieve their goals through positive changes in financial behaviour. To this end, we want to make it easy for our customers to free up cashflow through best value-for-money solutions that make their money go further to realise their investment and insurance needs in line with their goals. We want to help customers through various life stages for themselves, their families and their businesses, and to ensure we advise them on the right solutions for their needs,” explains Celliers.

Reimagining user experience

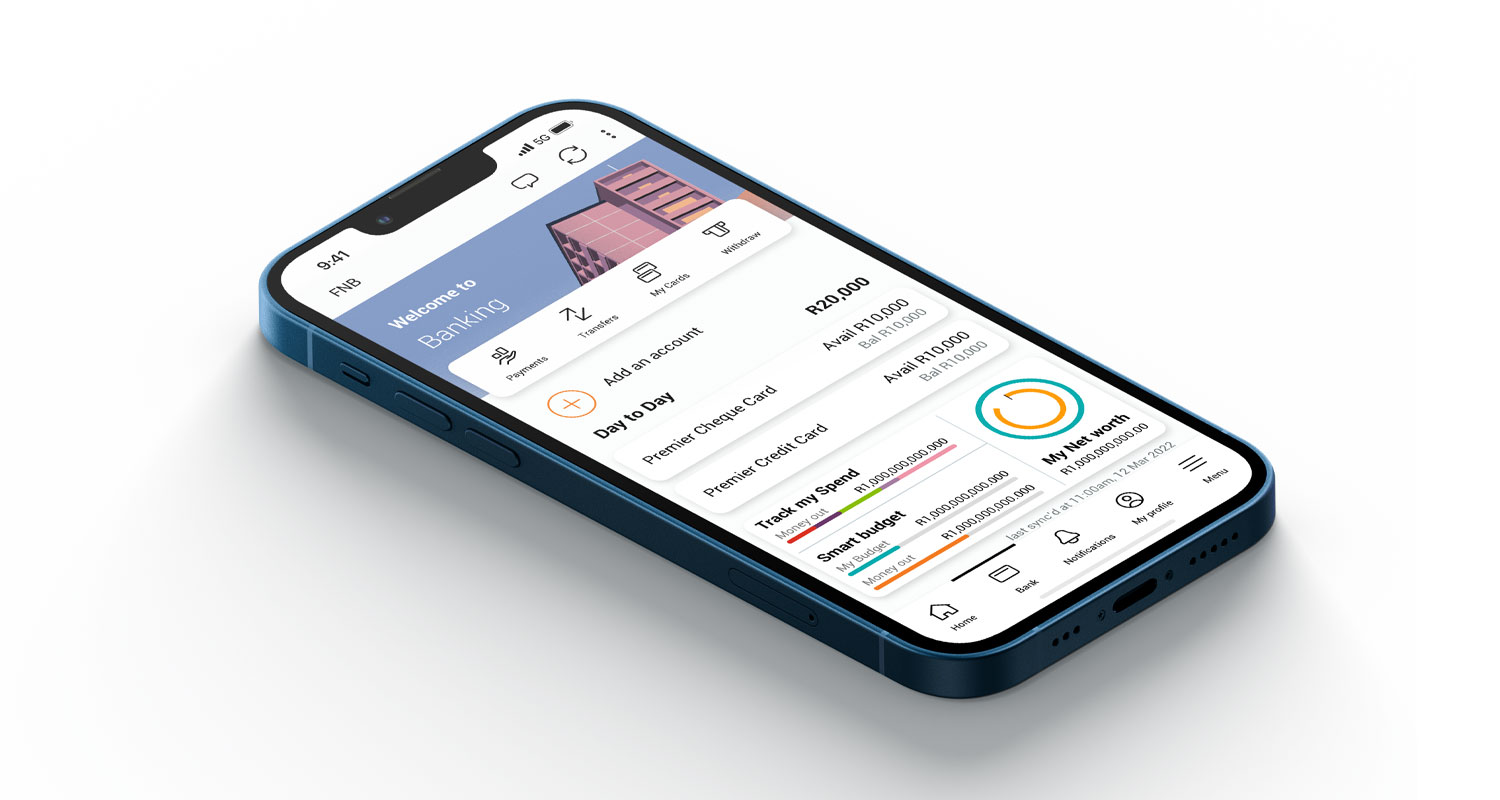

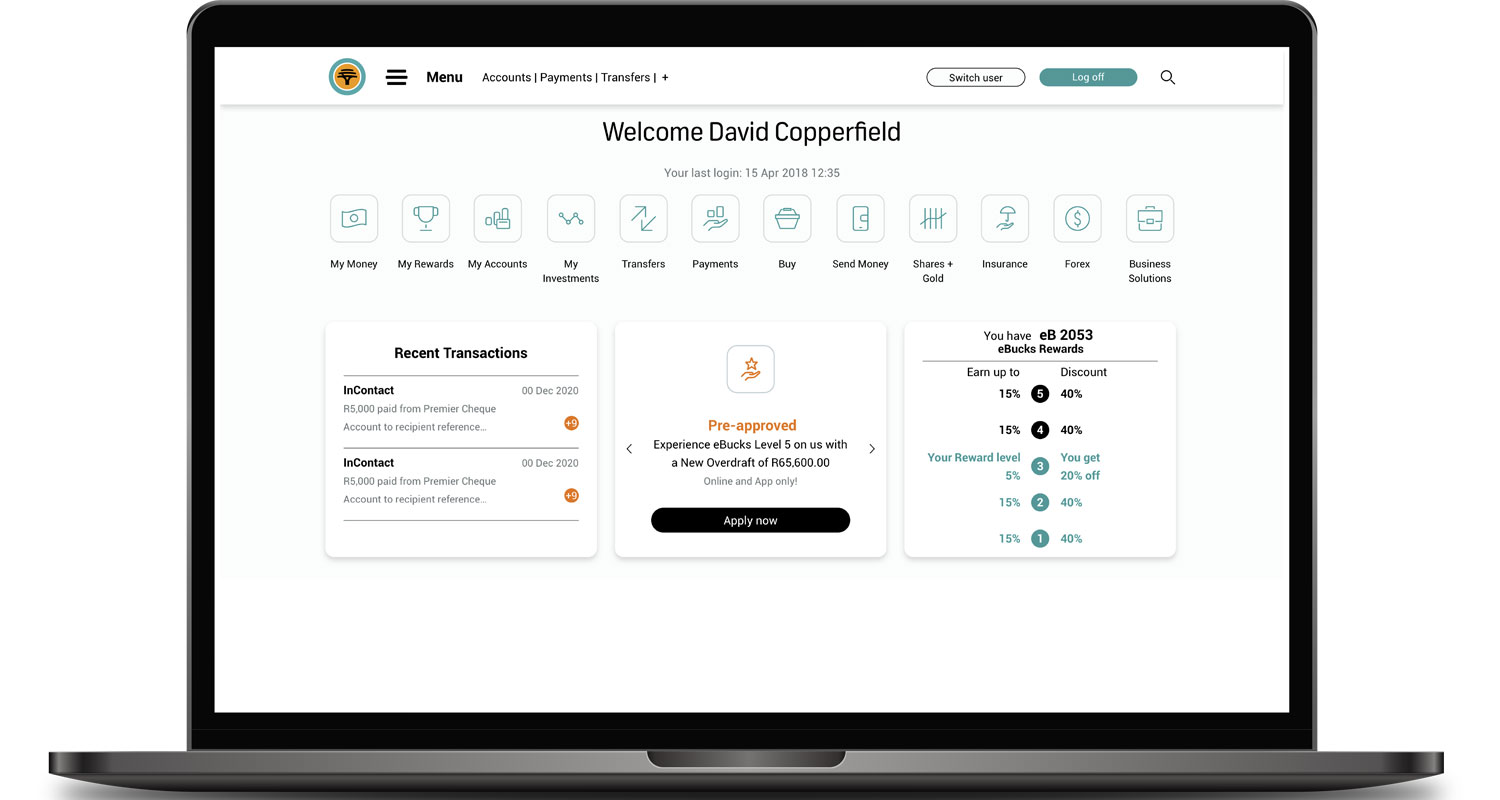

The FNB App, Africa’s first banking app, has been redesigned to offer even more intuitive help through its ease of use and a safer digital experience. We have listened to our customers and have set out on a journey of a new user experience underpinned by personalisation. Customers can now personalise their FNB App by customising its home screen and selecting frequently used or preferred features. Customers can also view a snapshot of their transactional accounts, credit, investments, insurance and value-added services. In addition, the search function has been improved to help customers find services much quicker. Similar enhancements are being made to the Internet banking channel.

FNB has also introduced Money Protect, a new and industry-first benefit of free insurance cover for certain fraud-related losses when using interfaces such as the FNB App and ATMs. The benefit demonstrates FNB’s commitment to helping customers transition to safer digital interfaces.

“We continue to facilitate our customers’ journey from analogue to digital and digital to platform. We’re excited to see millions of our customers embracing the migration to more accessible, user-friendly and safer interfaces. Our digital interfaces have become a one-stop shop for customers’ financial and lifestyle needs, with over three billion transactions and 1.6 billion digital interactions over the past 12 months. Likewise, we recognise that fraud is a reality in our society, and we are continuously enhancing our measures to assist millions of our digitally active customers in mitigating these risks,” says Celliers.

Reimagining payments

“While our digital interfaces give our customers access to a wide range of credit and investments solutions tools, payments and cashflow are the lifeblood of any economy, and today we’re proud to highlight some of our unmatched standout offerings available within our digital payments ecosystem, making it more inclusive and convenient for customers to pay and get paid. The facilitation of payments for individuals and businesses is one of the key features of the power of network effects of our platform,” adds Celliers.

FNB Pay is now the payments umbrella in the FNB App. With a few taps, customers can now split a bill and those who run businesses can receive contactless payments easily and safely on their Android smart devices, without the need for a separate point-of-sale device. The new or enhanced payment solutions that are available on the FNB App include:

- Instant Payments — a first-to-market instant payment solution that enables customers to digitally pay anyone via the FNB App using just a card number. The recipient gets the money instantly in their bank account, irrespective of where they bank.

- PayMe — allows customers to request a payment digitally to any FNB-banked cellphone number. The person requesting the money simply follows a few prompts, and the “payer” is immediately notified and simply needs to accept the request to make an immediate payment.

- ChatPay — allows customers to pay or request payment from any FNB customer using the FNB App’s chat functionality without the need for an account number. Customers can initiate a chat using their contact list, and because the interaction takes place within FNB’s platform, they can be confident that it is safe.

- Bill Payments — a quick and convenient way for customers to use the FNB App to pay their EasyPay or Pay@ bills including municipal rates, medical and other services.

- Speedee App — allows businesses to receive contactless payments easily and safely on their Android smart devices, without the need for a separate point-of-sale device.

Reimagining our iconic brand

FNB is also refreshing its iconic brand to become more versatile and resonate beyond banking and financial services. FNB chief marketing officer Faye Mfikwe explains the brand’s evolution by acknowledging that change is important to staying relevant to customers.

“The refresh helps us to create a versatile brand look and feel that aligns with our accelerating transition to helping customers beyond banking into lifestyle and business solutions categories,” she says.

“We intend to embark on this journey while remaining deeply rooted in our brand heritage and brand promise of ‘How can we help you’. At the heart of our evolution is the appreciation of our responsibility to keep up with the step change in customers’ needs and the global transition to a platform era. We believe that our efforts set us apart as a formidable provider of advice-led financial and lifestyle services, underpinned by exponential help,” adds Mfikwe.

“We intend to embark on this journey while remaining deeply rooted in our brand heritage and brand promise of ‘How can we help you’. At the heart of our evolution is the appreciation of our responsibility to keep up with the step change in customers’ needs and the global transition to a platform era. We believe that our efforts set us apart as a formidable provider of advice-led financial and lifestyle services, underpinned by exponential help,” adds Mfikwe.

Celliers expresses a similar sentiment. “Our platform journey continues. Whether our customers need help navigating life, making every day easier, or realising their dreams for a better tomorrow, we are invested in helping them realise their goals.”

- This promoted content was paid for by the party concerned