First National Bank, which this week began offering discounted tablets and smartphones to its clients, says ultimately it would like to hand out free phones and tablets to “certain” of its customers.

CEO Michael Jordaan says the bank is on a big drive to encourage its customers to use electronic channels, especially mobile platforms, and the relative ease of use of smartphone and tablet apps over SMS and mobile Web banking is an important way of driving adoption.

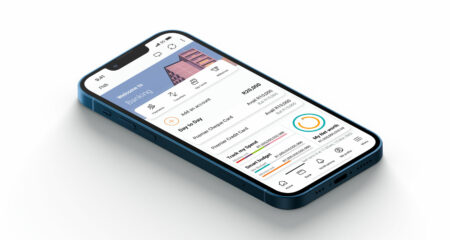

This week, the bank announced it would sell its customers discounted smartphones and tablets, including Apple’s iPad 2, that come preloaded with its FNB Banking application. Device costs would be included in customers’ monthly banking fees.

Jordaan claims FNB is the country’s first big bank to offer platform-specific smartphone apps to its customers: the FNB Banking app runs on Apple’s iOS, on BlackBerry devices, on Google’s Android and on certain Nokia devices. It offers transactional banking and other services.

“I’m surprised none of our competitors has come out with [smartphone apps] yet,” Jordaan says. “Some have tried to run us down [but] we want to grab as much of the territory for as long as we can.”

He says apps are one way FNB is attempting to take market share from its competitors in a depressed economy where jobs aren’t being created and where new financial services customers are few and far between.

With the release of a second version of the FNB Banking app this week, FNB has included an online “switching tool” and Jordaan says he hopes this will convince more people to move banks.

“You can switch to us online in less than 10 minutes,” he says. “The rest we do: we come to your house [to complete the process] and we have a team of 70 people now doing nothing but switching debit orders for our customers. The app is now a customer acquisition tool.”

He says a combination of what he calls a “smooth online acquisition process” as well as “lower fees, technology and rewards” is helping the bank win over customers from its rivals. “We have never taken on as many new cheque account customers as we are now.”

Mobile technology will propel retail banking for the foreseeable future, Jordaan says. “That’s perhaps even more so in SA, because fixed-line infrastructure has held back the Internet more than in other countries.”

He says FNB’s research shows many people would rather use smartphone apps to do their banking than sit at their PCs. And he expects that as the cost of smartphones and tablets comes down, banking apps will also become popular among people in lower living standards measures. “In future, all our customers will be using smart apps.”

As entry-level smartphones fall below the US$100 cost barrier, Jordaan expects a big uptake in the mass market.

He says FNB has a team of developers working “flat out” on building smartphone and tablet apps and the bank has “enough ideas” to keep the team busy for the next three years.

However, he declines to say when an iPad-specific version of the FNB Banking app — demanded by some customers — will be available. For now, iPad users can use the iPhone app “upscaled” on their tablets.

Jordaan admits it’s “quite an issue” covering all the available technology platforms. “It’s much easier developing for the Internet,” he says. “We’d like to add functionality for the iPad, but at this stage we’d rather cover broader and deeper. You have to make trade-offs. We want to put more functionality into the app itself.”

Another way FNB is attempting to use technology to lure customers is through a telecommunications offering. The company’s FNB Connect division offers discounted mobile and fixed-line broadband and voice calls to its banking clients. It has developed an app that allows people to make low-cost voice-over-Internet Protocol calls. On-network calls between Connect customers are free.

“We have a telecoms licence and we’d like our 8m customers to be speaking to each other for free,” Jordaan says. “We don’t see this as a profit centre or as a core business, but rather a way we can bring value to our customers. We want all FNB customers to speak to each other and send SMSes for free and we don’t want to make money out of it.”

Of course, moving clients to electronic channels like mobile helps FNB reduce its costs. Jordaan wants to move customers out of the bank’s branches.

“We’re now at the tipping point, with manual transactions in branches falling at double-digit rates annually,” he says. This will inevitably result in smaller branches that have a very different focus, he says. — Duncan McLeod, TechCentral

- Subscribe to our free daily newsletter

- Follow us on Twitter or on Facebook

- Visit our sister website, SportsCentral (still in beta)