Cryptocurrencies out for world domination? You could say something like that. Maybe not in the dystopian sense, but regarding global interest. Simply muttering the words “blockchain” and “crypto” is a surefire way of getting a really interesting dinner table conversation going. But despite having a tremendous run and seeing its total market cap soar to more than US$2-trillion in April, the crypto market’s unpredictable nature hasn’t changed one bit — in fact, it’s always been this way.

Cryptocurrencies out for world domination? You could say something like that. Maybe not in the dystopian sense, but regarding global interest. Simply muttering the words “blockchain” and “crypto” is a surefire way of getting a really interesting dinner table conversation going. But despite having a tremendous run and seeing its total market cap soar to more than US$2-trillion in April, the crypto market’s unpredictable nature hasn’t changed one bit — in fact, it’s always been this way.

Veterans of the crypto space would be the first to dub crypto investing as the ultimate love/hate relationship. From a slew of technological risks to intense market volatility — oh, and all those stories you’ve heard about people staying up at night checking trading charts, getting ready to sell off their investments at a moment’s notice? Yup, it’s all true.

Getting into the market has also become easier than ever, with hundreds of exchanges, both big and small, offering a total of 10 415 cryptocurrencies to purchase as of writing this article. This ease of accessibility is good for getting started but can become problematic when wanting to make your dramatic exit and sell your portfolio. This becomes an apparent issue when large numbers of people get the same idea and rush to panic sell, which could lead to trouble converting certain currencies on different exchanges, as well as underlying technological delays due to the volume of sales and withdrawals.

Regulatory risk is also a big factor. While many countries and sectors have shown increased interest in crypto over the years, much of the world remains on the fence. In certain countries, crypto continues to clash with many anti-money laundering regulations set in place, not to mention the divided view on bitcoin mining’s environmental impact, which was recently brought to light by Tesla CEO Elon Musk.

When taking all of this into account, it’s hard to determine which coins will survive the next couple of years. One thing’s for certain, however: The majority of cryptocurrencies are going to fail, and that’s something every investor has to come to terms with — so why put all of your eggs into one basket?

The solution?

Diversification has proven to work in every investment category, so it should come as no surprise that it works in crypto, too. Proper diversification strategies can help ensure that the best returns are made, even while certain items on an investor’s portfolio are taking a bit of a dip. While diversification won’t help much when the entire crypto market decides to correct itself (the day it all goes to red and your friends call you crying at 3am), it’ll still minimise the damage when one or more assets are performing really poorly — or better yet, get pulled from the crypto market entirely.

Along with crypto’s continuous journey to eventual mainstream adoption comes a whole bunch of Internet personalities and public figures in the investment space voicing different opinions on the value of certain cryptocurrencies and their underlying technologies. Financial “gurus” have seemingly popped up all over YouTube and the far reaches of the Internet, dying to provide you with some “serious” financial advice after making the first successful day trade of their lives the day before. Choose your sources wisely.

The desire to find the next big altcoin is also a major driving factor for newer investors, with many placing blind bets on certain coins to explode in value overnight, despite having conducted no proper research on the purpose of the coins or the underlying technologies on which they’re built. The question remains simple, however: Would you invest in the stocks of a company you know absolutely nothing about?

The desire to find the next big altcoin is also a major driving factor for newer investors, with many placing blind bets on certain coins to explode in value overnight, despite having conducted no proper research on the purpose of the coins or the underlying technologies on which they’re built. The question remains simple, however: Would you invest in the stocks of a company you know absolutely nothing about?

Investors should diversify their portfolio, but at the same time really understand what’s going on in their basket. Figuring out why certain cryptocurrencies deserve to be there will go a long way in terms of ensuring that investments have the greatest chance of bringing positive returns over the long term. In reality though, it’s usually easier said than done, and even professionals struggle to choose cryptocurrencies that consistently outperform the overall market due to its immense volatility.

Diversify at the click of a button

Cryptocurrencies are high risk investments, and with higher risk comes the potential for higher returns — with diversification being the silver bullet for lowering risks involved. With all this said and done, having access to the world’s top cryptocurrencies through a single investment would be a sort of dream come true, right? Well, we’re happy to confirm that it’s not a dream, it’s very real and Revix offers it. There are three different types, in fact — they’re called Bundles.

Imagine a crypto version of the S&P 500, in that each Bundle enables investors to own a predefined “crypto basket” of the world’s top cryptocurrencies by making only a single investment.

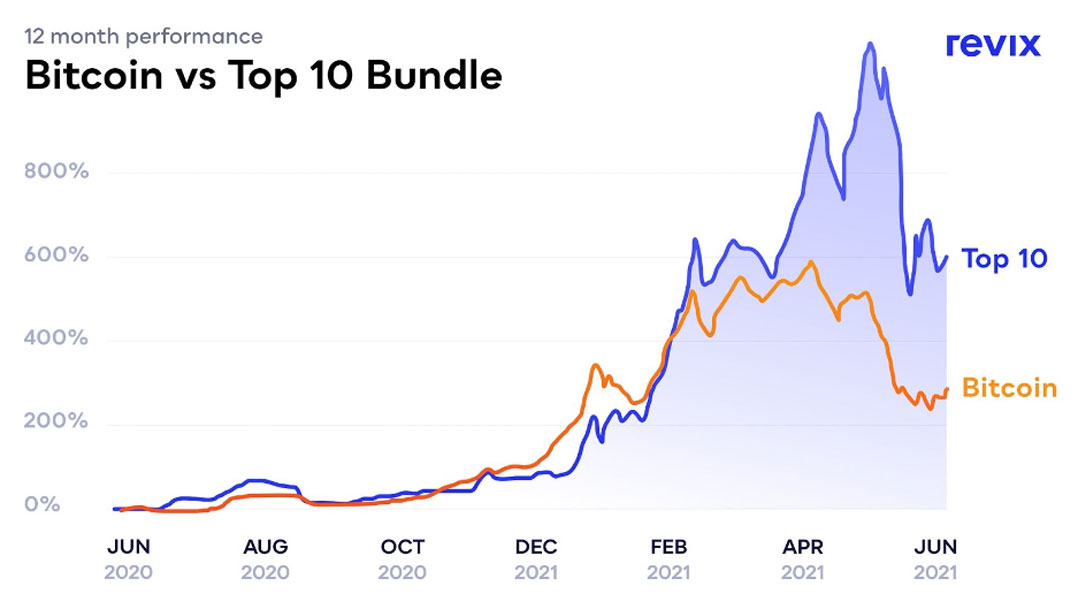

The most popular of the bunch, the Top 10 Bundle, has outperformed an investment in bitcoin alone over one, three and five years. This bundle gives investors diversified, equally weighted exposure to the 10 largest cryptocurrencies as measured by market value. It aims to mimic the performance of the broader cryptocurrency market and deliver on one promise: to ensure that you own the 10 largest and top-performing success stories in the crypto space, whatever they may be.

The most popular of the bunch, the Top 10 Bundle, has outperformed an investment in bitcoin alone over one, three and five years. This bundle gives investors diversified, equally weighted exposure to the 10 largest cryptocurrencies as measured by market value. It aims to mimic the performance of the broader cryptocurrency market and deliver on one promise: to ensure that you own the 10 largest and top-performing success stories in the crypto space, whatever they may be.

If you’ve also been keeping tabs on the latest happenings in the crypto space, you’ve probably heard of NFTs (non-fungible tokens) making a massive impact on the digital arts industry across the globe. Well, to keep it short, NFTs are just one of many amazing things built on smart contracts, which have arguably become an integral part in crypto’s success and adoption in many countries and industries worldwide.

In much the same way that Android and iOS work with mobile applications, smart contracts are offered by smart contract-focused cryptocurrencies that allow developers to build applications on top of their blockchains. The majority of projects being built using smart contracts is on the Ethereum blockchain, which has proven to be the new go-to for anything smart contract-development related.

When taking this sector into consideration and its serious potential for growth – heck, we’ve seen an entire industry get revolutionised within the timeframe of the pandemic alone – offering something like the Smart Contract Bundle was an absolute no-brainer. It consists of the five largest smart contract-focused cryptocurrencies, which include ether, cardano and polkadot – all providing blockchains with full smart contract programming functionality. Unlike bitcoin, which aims to disrupt the banking system with its own digital currency, smart contract-focused cryptocurrencies like ether aim to use blockchain technology to replace unnecessary third parties when making transactions, particularly those that store data.

Payments

Seeing as we’ve just landed on the topic of transactions, let’s also touch on payments for a second. Bitcoin may have paved the way for digital payments, but other cryptocurrencies are making peer-to-peer, business-to-business and country-to-country payments cheaper and faster than ever. Cryptocurrencies more focused on disrupting the payment system are unique because they allow users to digitally transfer value directly to someone else without any middlemen. They can also be used to buy and sell goods and services, and are competing to replace the physical money that’s in your wallet!

The Payment Bundle was designed to provide exposure to the cryptocurrencies looking to make digital payments cheaper, faster and more global. These cryptos include the likes of bitcoin, ripple, bitcoin cash, stellar and litecoin, and make up the last of the three bundles offered by Revix.

Market volatility is a real thing and has caused a lot of tears over the years. In the blink of an eye, it’s possible for any currency to fall victim to losing the majority of its value overnight and because of this, all three Revix bundles are subject to monthly rebalancing to compensate for the ever-changing nature of the market. Once a month, Revix automatically reconstitutes and rebalances a user’s bundle, reweighting their crypto holdings so that they always stay up to date with changes in the fast-paced cryptocurrency market.

Market volatility is a real thing and has caused a lot of tears over the years. In the blink of an eye, it’s possible for any currency to fall victim to losing the majority of its value overnight and because of this, all three Revix bundles are subject to monthly rebalancing to compensate for the ever-changing nature of the market. Once a month, Revix automatically reconstitutes and rebalances a user’s bundle, reweighting their crypto holdings so that they always stay up to date with changes in the fast-paced cryptocurrency market.

All in all, crypto remains a serious love/hate relationship we can’t help but fall in love with. Many feel that they’ve already missed out; in reality the market’s value today is only a tiny fraction of the trillion-dollar markets that crypto stands to disrupt. It’s wild, unpredictable and even scary at times — but if you’re ever in need of a helping hand, you know where to find us.

About Revix

Revix brings simplicity, trust and great customer service to investing. Its easy-to-use online platform allows anyone to securely own the world’s top investments in just a few clicks. Revix guides new clients through the sign-up process to their first deposit and first investment. Once set up, most customers manage their own portfolio but can access support from the Revix team at any time. For more information, please visit www.revix.com.

Disclaimer

This article is intended for informational purposes only. The views expressed are not and should not be construed as investment advice or recommendations. This article is not an offer, nor the solicitation of an offer, to buy or sell any of the assets or securities mentioned herein. You should not invest more than you can afford to lose, and before investing, please take into consideration your level of experience and investment objectives, and seek independent financial advice if necessary.

- This promoted content was paid for by the party concerned