Top of the list of frustrations that South Africans experience with companies is their relationship with their internet service providers, according to a new report from DataEQ.

Top of the list of frustrations that South Africans experience with companies is their relationship with their internet service providers, according to a new report from DataEQ.

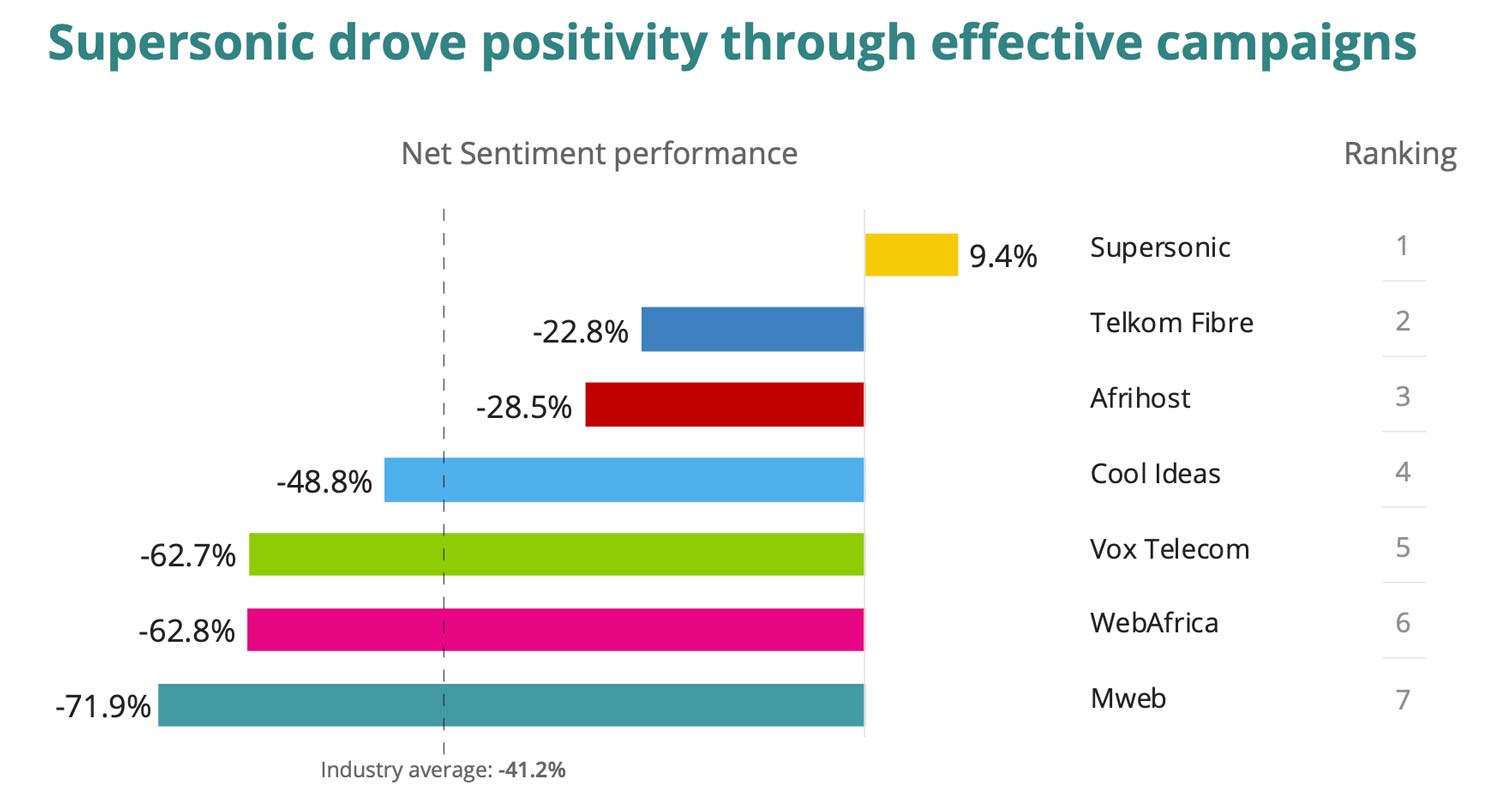

The 2023 SA ISP Sentiment Index report tracked how consumers feel about seven of the country’s leading internet service providers using more than 140 000 public posts on social media to gauge consumer net sentiment.

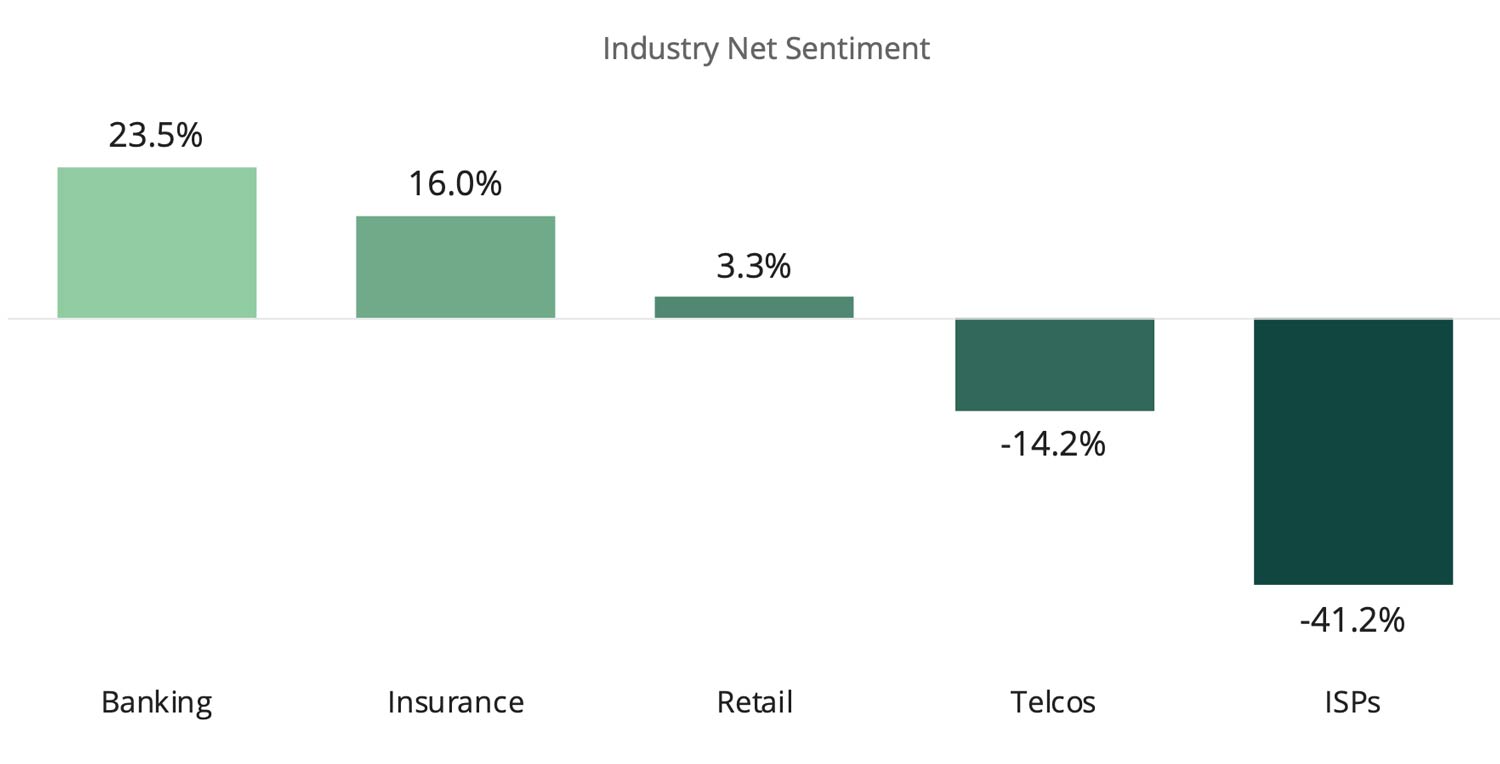

With an average net sentiment score of -41.2%, ISPs in South Africa are lagging far behind other industries – especially insurance and banking, which garnered scores of 9% and 23.5%, respectively. Even the often-criticised telecommunications industry fared better, posting a net sentiment of -14%.

Supersonic stands out as the only ISP with a positive net sentiment score of 9.4%, with consumers praising it for its pricing and network reliability. The score was heavily impacted by strategic campaigns aimed at driving consumer praise, however.

Telkom Fibre was deemed to be the next best ISP, followed by Vox, Mweb and Webafrica, which were particularly hard hit by service complaints and cancellation threats, contributing substantially to their poor net sentiment performance.

Customers expressed frustration over a range of issues, including delayed router installations, unreliable or intermittent internet connectivity, slow internet speeds, downtime and billing errors. Poor communication and unresponsive customer service further exacerbated negativity towards the providers.

Low net sentiment

ISPs only respond to half of priority conversations. On average, 66.9% of ISP conversation warranted some form of action or attention due to mentions containing purchase opportunities, service issues or cancellation threats.

Vox, Mweb and Webafrica had the highest percentage of actionable conversations, mostly driven by cancellation threats. Afrihost (43.7%), Supersonic (53.6%) and Telkom Fibre (58.1%) registered the least actionable conversations, denoting a higher proportion of campaign-driven “noise”, which made it more difficult for service agents to identify actionable posts.

Read: Is your ISP monitoring your online activity?

On average, ISPs engaged with 50.2% of priority conversations. Supersonic delivered the quickest response time with a nine-hour average. Webafrica had the highest response rate and relatively low response times but generally received poor customer service feedback.

Telkom Fibre and Mweb achieved the slowest response times of 26 and 64 hours, respectively. Telkom Fibre’s two-and-a-half day wait times significantly increased the industry average to just over 22 hours. Telkom Fibre also recorded the lowest response rate, effectively missing out on three-quarters of potentially actionable posts.

The industry-wide low net sentiment exposes a significant expectation gap.

“It’s clear that promotional campaigns can’t mask subpar service,” DataEQ client strategy head Liska Kloppers said in a statement. “Price-sensitive consumers are lured by attractive packages, but this tactic backfires when service delivery fails to meet expectations.

“In today’s digital age, consumers expect ISPs to deliver on price, network and service, and are quick to voice their dissatisfaction on social media when any one of these aspects fails to meet their expectations.” — © 2023 NewsCentral Media