Mastercard and MTN Group on Tuesday announced that they have formed a partnership that will allow millions of MTN Mobile Money customers to pay for goods and services on global e-commerce platforms.

Mastercard and MTN Group on Tuesday announced that they have formed a partnership that will allow millions of MTN Mobile Money customers to pay for goods and services on global e-commerce platforms.

The Mastercard virtual payment solution will be available in 16 countries across Africa where MTN offers MoMo e-wallets.

“Consumers and merchants can engage with brands and businesses abroad through digital commerce, extending their reach to an international marketplace and unlocking a host of opportunities,” the companies said in a joint statement.

Mobile financial services have become the dominant form of digital payments across many African markets, with twice as many mobile money accounts as bank accounts in the region.

“As a result, consumers increasingly expect to have access to a broader range of digital financial services,” MTN and Mastercard said. “However, consumers and merchants are mostly restricted to a local base of online and offline businesses, therefore curtailing customers’ ability to engage in global commerce.”

No bank account needed

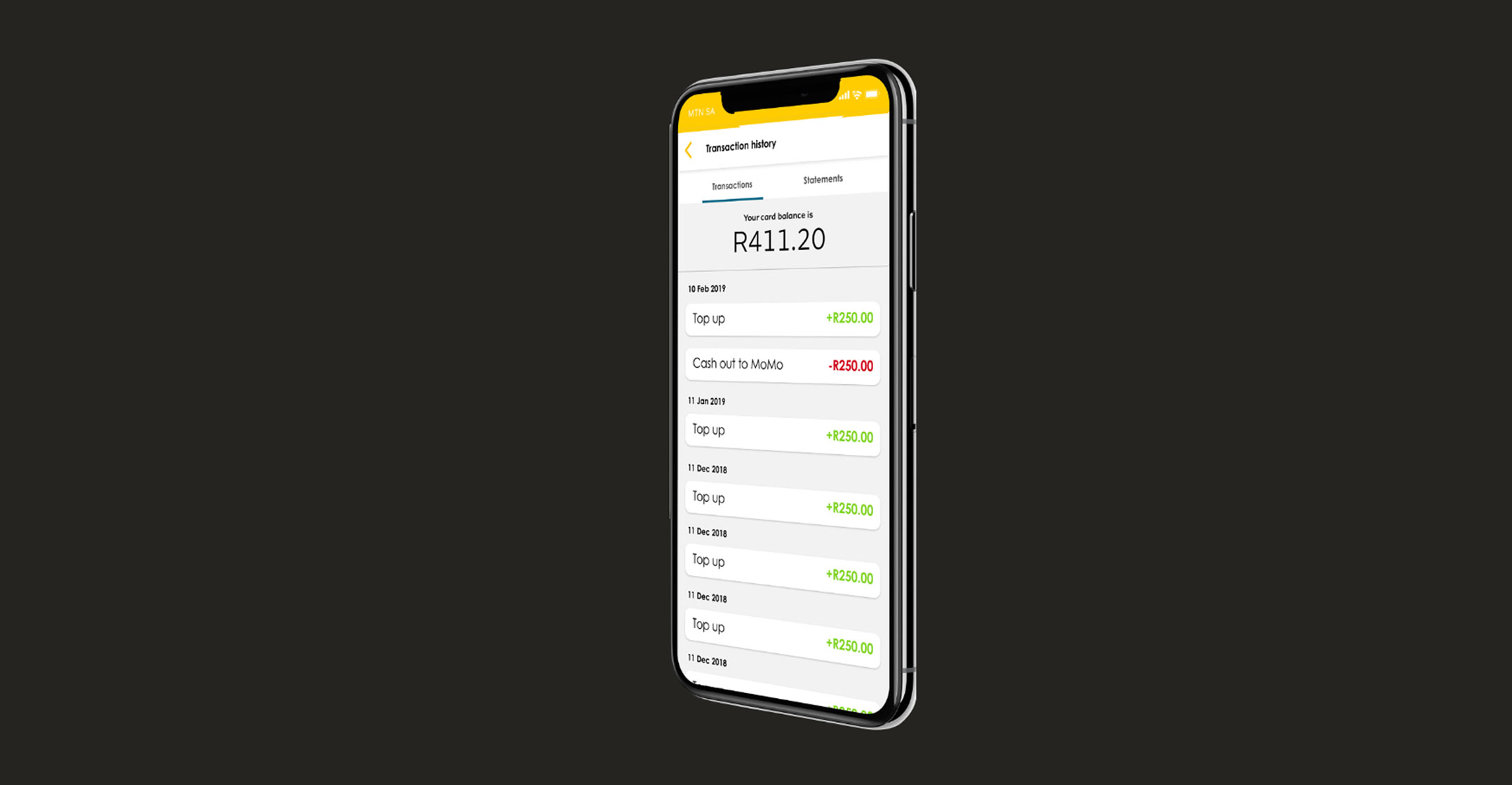

Through the new partnership, MTN MoMo customers with a Mastercard virtual payment solution linked to their e-wallets can make payments to global online merchants through a secure digital payment experience on websites and mobile applications. The service is available regardless of whether or not the customer has a bank account.

“The solution will allow consumers to explore and shop at well-known global e-commerce brands and pay quickly and securely for leisure shopping, travel, accommodation, entertainment and streaming services,” they said. “It will also allow small business owners to purchase from suppliers abroad and pay with the virtual payment solution.”

MTN plans to extend the virtual payment solution throughout its fintech footprint. Initially designed to facilitate the transfer of cash between mobile users, MTN’s MoMo offering is now broader, offering customers access to loans, insurance, remittances and payments. — (c) 2021 NewsCentral Media