Microsoft beat Wall Street’s estimates for quarterly revenue and profit on Tuesday, driven by growth in its cloud computing and Office productivity software businesses, and the company said artificial intelligence products were stimulating sales.

The company forecast revenue in its main segments for the current quarter would match or top Wall Street targets.

Shares gained 8.3% in after-market trading following a report by Redmond, Washington-based Microsoft that profits were US$2.45/share in the fiscal third quarter, beating Wall Street estimates of $2.23, according to data from Refinitiv.

“The bottom line is that despite all the concerns that the sky is falling in big tech, the truth is companies still see value in cloud computing and there’s still a huge percentage of workloads that can be moved to the cloud,” said Bob O’Donnell, an analyst for Technalysis Research.

Microsoft said growth at its cloud business Azure was 27% in the latest reported quarter, beating analyst expectations for 26.6% growth, according to the consensus from 23 analysts polled by Visible Alpha.

Alphabet, which also has a large cloud business, reported strong results Tuesday, lifting its shares 2.4% after the bell. Those results and Microsoft’s helped boost shares of Amazon.com, another major cloud operator, 4.8% in after-hours trading.

Microsoft revenue rose 7% to $52.9-billion in the quarter ended March, inching past analyst estimates of $51.02-billion, according to Refinitiv.

The bulk of Microsoft sales still come from selling software and cloud computing services to customers. But the company has grabbed headlines this year with its partnership with ChatGPT creator OpenAI and sprucing up the Bing search engine with AI technology.

Wide array

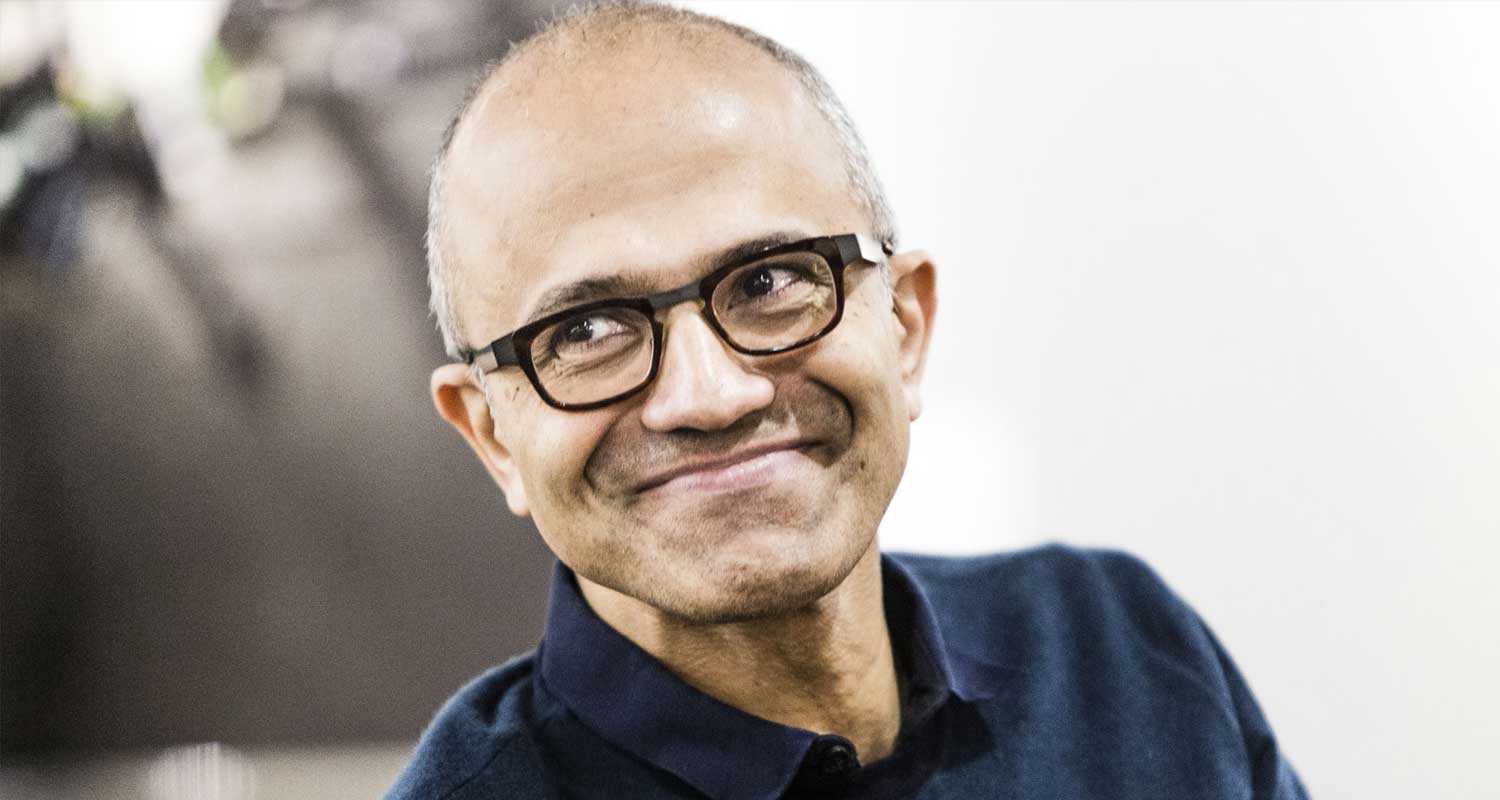

CEO Satya Nadella told investors on a conference call the company had more than 2 500 Azure-OpenAI service customers and said AI was integrated into a wide array of products.

Bing, long an also-ran to search engine Google, has 100 million daily users and has seen downloads jump since the addition of AI features, Nadella said.

Analysts had expected a gloomy economic outlook to hit Microsoft’s Windows business, which depends heavily on PC sales that have sagged in recent quarters. The sales drop in the segment was less severe than analysts expected, with Microsoft reporting revenue of $13.3-billion versus analyst estimates of $12.19-billion, according to Refinitiv data.

Read: South Africa okays Microsoft’s Activision acquisition

The company’s productivity segment, which includes its Office software and advertising sales for the LinkedIn social networking site, also beat analyst expectations with revenue of $17.5-billion versus estimates of $16.99-billion, according to Refinitiv. — Yuvraj Malik, Stephen Nellis and Jane Lee, (c) 2023 Reuters