US shares related to artificial intelligence surged in extended trade on Wednesday, adding almost US$300-billion in market capitalisation after chip maker Nvidia forecast strong revenue growth and said it was boosting production of its AI chips to meet surging demand.

Nvidia’s stock zoomed as much as 28% after the bell to trade at US$391.50, its highest level ever. That increased its stock market value by about $200-billion to over $960-billion, extending the Silicon Valley company’s lead as the world’s most valuable chip maker and Wall Street’s fifth most valuable company.

“With all the enthusiasm around AI and the fact Nvidia delivered a huge beat for first quarter results and second quarter estimates, this gives some actual evidence AI is for real,” said Daniel Morgan, senior portfolio manager at Synovus Trust in Atlanta. Morgan said Synovus owns Nvidia shares.

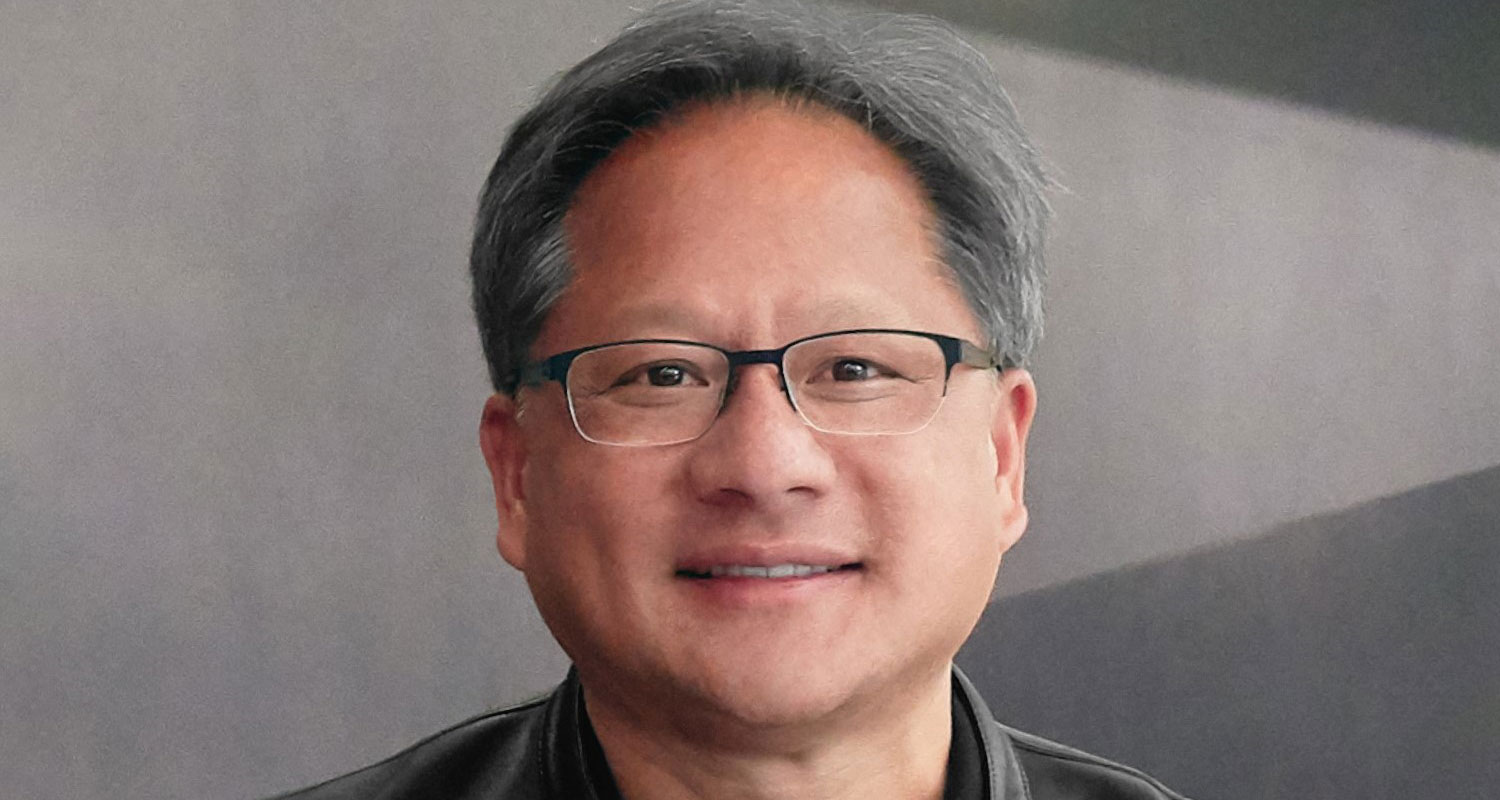

Nvidia forecast quarterly revenue more than 50% above Wall Street estimates, with CEO Jensen Huang saying in a statement the company is “significantly increasing our supply to meet surging demand” for its data centre chips.

Shares of other corporations related to AI rallied on the back of Nvidia’s strong report, adding another nearly $100-billion in stock market value after the bell.

Rival chip maker AMD jumped 10%. Microsoft and Google parent Alphabet, which are both rushing to incorporate generative AI into their web search platforms, each rose about 2%.

AI software maker C3.ai and Palantir Technologies, which recently launched its own AI platform, both soared about 8%.

Surged

Interest in AI surged this year after start-up OpenAI introduced ChatGPT, attracting over a million users within a week. Using past data, generative AI can create new content like fully formed text, images and software code.

Ahead of Nvidia’s report on Wednesday, optimism around AI had already fuelled a 109% surge in its stock so far in 2023, making the chip maker the S&P 500’s top performer year to date. That rally left Nvidia trading at about 60 times expected earnings, approaching its peak of 68 times expected earnings in 2021, according to Refinitiv data. — Noel Randewich and Sinead Carew, (c) 2023 Reuters