Nvidia late on Wednesday forecast a roughly threefold surge in quarterly revenue that handily beat estimates as the company banked on towering demand for its industry-leading artificial intelligence chips, sending its shares up 10% after hours.

The already-hefty demand for the company’s data centre chips and graphics processing units (GPUs) continues to grow as firms scramble to expand their AI offerings. Nvidia’s silicon dominates the global market for AI chips, where it counts the likes of Microsoft among its customers.

“The market was poised to sell the news following Nvidia’s earnings, given the sky-high expectations and deteriorating macro conditions,” Investing.com analyst Thomas Monteiro said. “However, once again, the company left no doubt that the AI boom is much more than just a stock market narrative, but rather the most significant bet from corporations worldwide at this moment.”

The late-day stock jump lifted the market capitalisation of the Santa Clara, California company by more than US$129-billion, and pushed up the shares of other AI-related companies including chip designer ARM Holdings. Nvidia and other hardware suppliers linked to AI computing added $160-billion of combined stock market value.

Nvidia on Wednesday forecast first-quarter revenue growth of 233%, ahead of Wall Street expectations of 208% growth. For the first three quarters of 2023, Nvidia reported quarterly revenue that beat analyst estimates by between 10% and 20%.

Some analysts raised questions about how long Nvidia will be able to sustain this pace of growth.

Sales surge

The company forecast revenue for the current quarter of $24-billion, plus or minus 2%. Analysts on average were expecting revenue of $22.17-billion, according to LSEG data.

Sales at the data centre segment — its largest by revenue share — grew 409% to $18.4-billion in the fiscal fourth quarter, coming in above estimates of $16.8-billion, according to LSEG data. Data centre revenue grew close to 280% in the previous quarter.

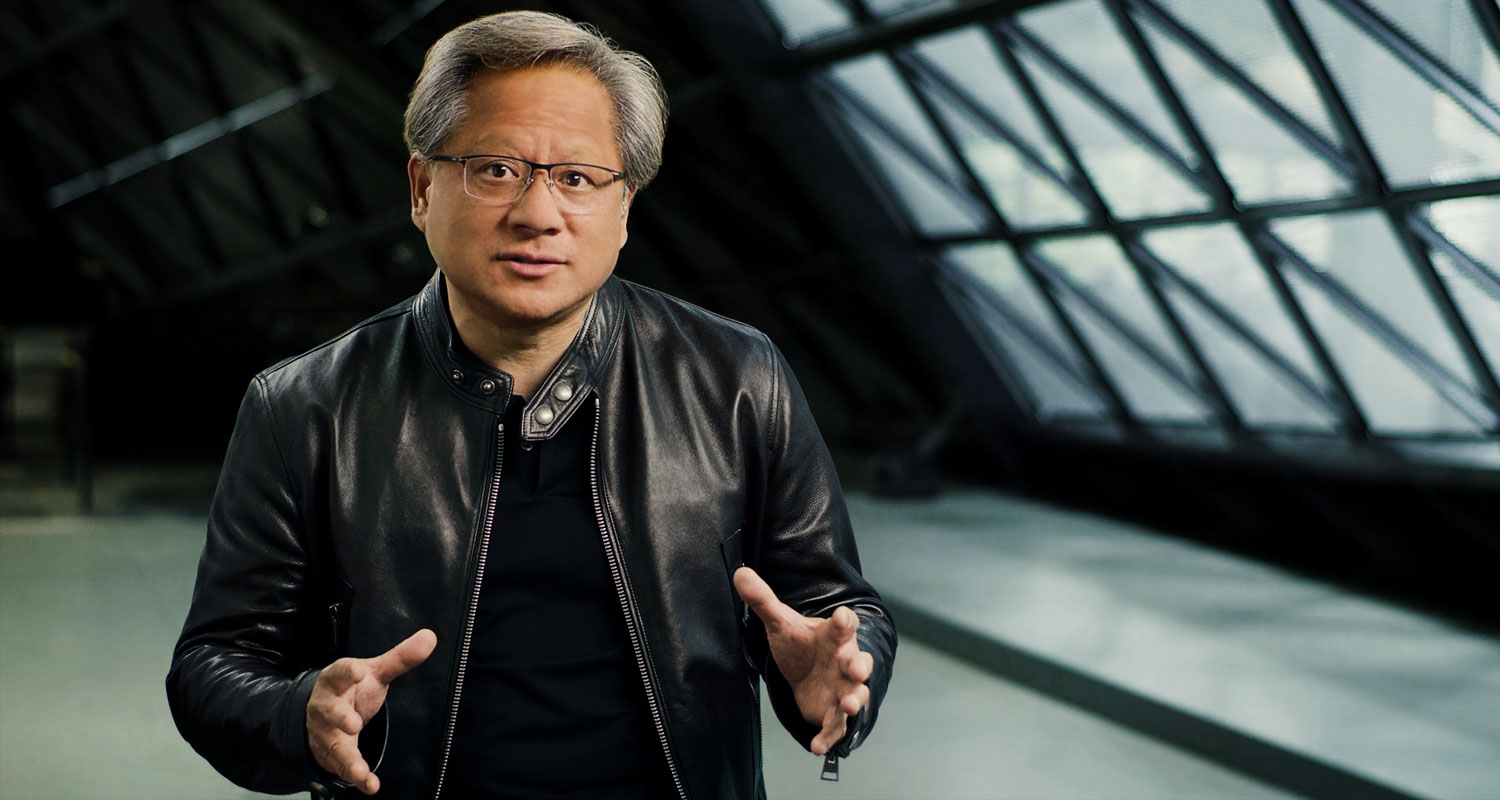

The AI frontrunner’s supply chains, which have been unable to match the soaring demand for Nvidia’s chips, are also improving. But CEO Jensen Huang told analysts on a post-earnings conference call that there was no way the company can “reasonably” keep up on demand in the short term as it ramps up production.

Read: And now for Nvidia’s next act

“The biggest question on minds for growth is how supply-constrained they remain and what demand looks like over time,” said Ben Bajarin, CEO of consulting firm Creative Strategies.

Analysts expect major supplier TSMC’s advanced packaging capacity to improve in the first half of the year. This will allow Nvidia to work through the central bottleneck to deliver more chips to customers.

Nvidia reported fourth-quarter revenue of $22.1-billion, beating estimates of $20.62-billion. Adjusted for certain items, fourth-quarter earnings were $5.16/share, compared with estimates of $4.64/share, according to LSEG data. Nvidia expects its first-quarter adjusted gross margin to be 77%, plus or minus 50 basis points. Analysts on average forecast gross margin of 75.6%.

Nvidia reported fourth-quarter revenue of $22.1-billion, beating estimates of $20.62-billion. Adjusted for certain items, fourth-quarter earnings were $5.16/share, compared with estimates of $4.64/share, according to LSEG data. Nvidia expects its first-quarter adjusted gross margin to be 77%, plus or minus 50 basis points. Analysts on average forecast gross margin of 75.6%.

Nvidia stock has gained more than 30% so far this year as it jockeys with Amazon.com and Alphabet for a spot among the most valuable companies.

The AI poster child’s revenue has continued to grow despite tightened restrictions on trade with one of its largest markets: China.

Read: Nvidia’s breathtaking rise – firm is now worth more than Google

Nvidia said in a filing on Wednesday it had received requests from antitrust regulators in France, the EU, the UK and China over its sale of GPUs and efforts to allocate supply. The company said it expects to receive additional requests from antitrust regulators in the future.

In December, US commerce secretary Gina Raimondo said the Joe Biden administration is in discussions with Nvidia about permissible sales of AI chips to China. She said she had spoken with Nvidia’s CEO, Huang, and that he was clear that Nvidia will work within the rules the commerce department establishes. — Max A Cherney and Arsheeya Bajwa, with Stephen Nellis and Noel Randewich, (c) 2024 Reuters