Few things motivate Samsung employees like the opportunity to take advantage of weakness at Apple.

Earlier this year, managers at the Korean company began hearing the next iPhone wouldn’t have any eye-popping innovations. The device would look just like the previous two models, too. It sounded like a potential opening for Samsung to leap ahead.

So the top brass at Samsung, including phone chief DJ Koh, decided to accelerate the launch of a new phone they were confident would dazzle consumers and capitalise on the opportunity, according to people familiar with the matter.

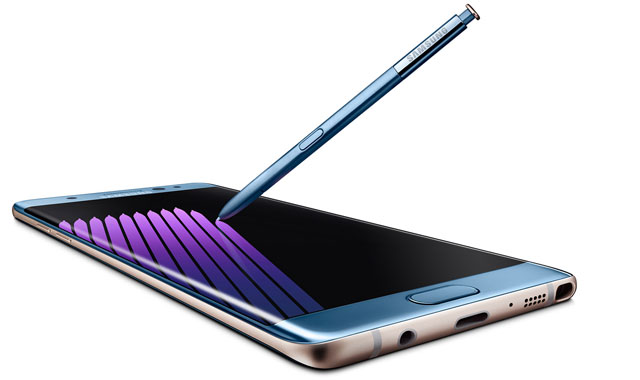

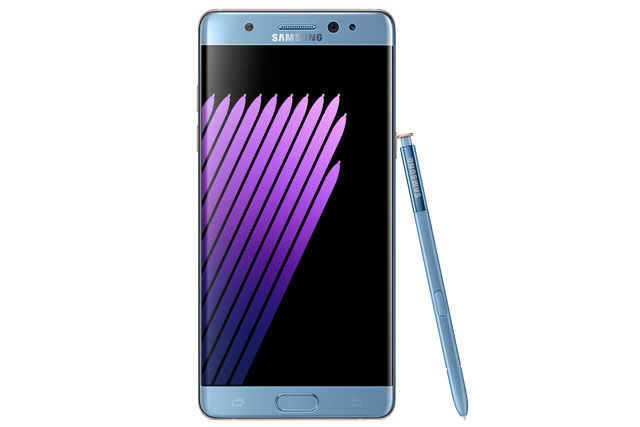

They pushed suppliers to meet tighter deadlines, despite loads of new features, another person with direct knowledge said. The Note7 would have a high-resolution screen that wraps around the edges, iris-recognition security and a more powerful, faster-charging battery. Apple’s taunts that Samsung was a copycat would be silenced for good.

Then it all backfired.

Just days after Samsung introduced the Note7 in August, reports surfaced online that the phone’s batteries were bursting into flames. By the end of the month, there were dozens of fires and Samsung was rushing to understand what went wrong.

On 2 September, Koh held a grim press conference in Seoul where he announced Samsung would replace all 2,5m phones shipped so far. What was supposed to be triumph had turned into a fiasco.

Samsung drew criticism for the recall, too. It announced the plans publicly before working out how millions of consumers in 10 countries would actually get replacements. Then it sent mixed signals about what customers should do. First, Samsung told people to shut off their phones and stop using them. A few days later, it offered a software patch to prevent batteries from overheating, signalling consumers could keep using the phones.

“This is creating an enormous problem for the company — for its reputation and ability to support its customers when there’s a problem,” said David Yoffie, a management professor at Harvard Business School and board member at Intel.

Samsung declined to comment specifically on whether it moved up the Note7 launch because of its perception of the iPhone. “Timing of any new mobile product launch is determined by the Mobile business division based on the proper completion of the development process and the readiness of the product for the market,” the company said in a statement.

The misstep has set off soul-searching at the Samsung conglomerate and in Korea, where the company employs hundreds of thousands and is revered for leading the nation’s rise since the Korean War. Samsung’s flagship electronics unit built its reputation on high-quality products and cutting-edge technology, becoming the largest phone maker in the world and a powerful rival to Apple in innovation. One employee, in an online discussion group, called the episode “humiliating”.

The crisis is straining a management team that’s been without clear leadership for more than two years. Lee Kun-Hee, the Samsung patriarch who is chairman of both the electronics unit and the broader conglomerate, suffered a heart attack in 2014 and hasn’t been back to the business since. His son, Jay Y Lee, is heir apparent, but hasn’t taken his father’s title because Korean culture precludes such a move while the elder Lee is alive. The result is that no one appears to have the kind of authority that, say, Tim Cook wields at Apple to take responsibility and hammer out solutions.

“The battery issue arrived at the worst moment for Samsung and it seems like there was a delay in reacting to this communication crisis,” said Thomas Husson, an analyst at Forrester Research. “This may indeed be due to the change in top management.”

Clearly there were procedural missteps and the company will have to restore consumer and investor confidence

Samsung said in the statement that its focus now is on doing the right thing for customers and that it is working to replace the Note7s as quickly as possible. “For us at Samsung, to earn consumers’ trust back is very important.”

The roots of the battery crisis can be traced back more than a year, when Samsung was contemplating what features to include in new phones. The Korean company has two primary lines of premium devices, the Galaxy S and the larger Note. When the Note was first unveiled in 2011, it was panned by some critics, who mocked its massive screen. But it was a surprise hit with customers seeking the added real estate to watch videos, play games and browse the Web. Samsung pretty much had the high end of the oversized smartphone market to itself until Apple followed with its larger iPhone 6 Plus in 2014.

Pressure from the Plus

The Plus’s debut put pressure on Samsung to defend its turf and it moved up the 2015 introduction of the new Note from September to August, just weeks before Apple unveiled the iPhone 6s. Samsung’s engineers met the deadline, but Apple still grabbed a chunk of market share. In December, the chief of Samsung’s mobile division was replaced. The 55-year-old Koh, a company veteran who had managed development of several Galaxy phones, took his place on the hot seat.

Koh faced not just intensifying competition with Apple but slower growth as the whole smartphone market became saturated. When Samsung became aware that Apple didn’t plan any major design changes, the Korean executives saw an opportunity. After a select group of top managers got their hands on early versions of the Note, they gushed over the upgrades and praised each other’s work, according to one of the people. If Apple wasn’t going to offer consumers anything exciting, Samsung certainly would.

With chairman Lee in the hospital, the younger Lee and co-vice chairman GS Choi huddled with Koh and executives of other Samsung affiliates, which make semiconductors, glass panels and batteries. They went ahead with a slew of new features that had been on the company’s product road map, including an improved screen and stylus — and then approved a launch date 10 days earlier than last year, according to one of the people familiar with the matter. Samsung’s unveiling was on 3 August this year, compared with 13 August last year.

The battery is a critical component. Smartphone makers have been pushing the boundaries of the technology for years as they try to satisfy consumer demands for long-lasting devices that charge faster. That increases manufacturing challenges and raises the risks of defects.

Samsung opted to give the Note7 a 3 500mAh battery compared with 3 000mAh for the previous model. For comparison, the iPhone 7 Plus has a 2 900mAh battery. The main battery supplier for the Note7 was Samsung SDI, a person with knowledge of the matter has said. The company, founded in 1970 and 20% owned by Samsung Electronics, makes batteries for other phone makers, too, including Apple.

As the launch date approached, employees at Samsung and suppliers stretched their work hours and made do with less sleep. Though it’s not unusual to have a scramble, suppliers were under more pressure than usual this time around and were pushed harder than by other customers, according to a person with direct knowledge of the matter.

One supplier said it was particularly challenging to work with Samsung employees this time, as they repeatedly changed their minds about specs and work flow. Some Samsung workers began sleeping in the office to avoid time lost in commuting, the supplier said.

Samsung declined to comment on whether deadlines were moved, reiterating that products are only introduced after proper testing.

Then the fires began

Still, by August, it looked like Samsung had made it. The company shipped early models of the Note7 to wireless operators around the world, including AT&T in the US and Telstra in Australia. An executive at one carrier said his team started testing the device in May and had the typical amount of time to check its capabilities. They focused on antenna performance and data speeds and didn’t uncover the battery problem, the executive said.

But when customers started using the phones, the fires began. The first signs of trouble emerged online, as they’re wont to do in this age of social media. Photos and videos of charred phones were posted on the Web. “Hey YouTube,” said one man, as he described how his phone had burst into flame and showed off the blackened remains. “Be careful out there. Everyone rockin’ the new Note7, it might catch fire y’all.”

Executives at Samsung headquarters in Suwon were in shock. Choi, the co-vice chairman, gathered senior managers, demanding to know what went wrong, according to one of the people familiar with the matter. The phone division pointed fingers at battery maker Samsung SDI, while managers there argued the problem could be elsewhere, including in the phone design or insulation. Samsung said there is no ongoing debate on the issue and that the phone unit has taken responsibility.

Clearly, they missed something. They were rushing to beat Apple and they made a mistake

Samsung’s top managers knew they needed to move fast. Internally, there was a debate about whether to do a full-blown recall or to take less dramatic steps, like a battery replacement program. Then, on 1 September, an engineer wrote on the company’s internal online bulletin board. “Please recall all Note7s and exchange them with new ones. I don’t have to get my PS,” he said, referring to his profit sharing, or bonus. “It’s humiliating.”

The post prompted many impassioned responses, mostly in support of the idea. Another worker said Samsung had trained everyone at the company to make no compromises with customers and the company needed a recall to live up to that standard. Then Koh himself weighed in. He apologised to employees and said he would consider their input in taking the appropriate steps. The next day, Koh went public with the full recall.

Samsung engineers rushed to determine the cause of the problem, working through the Harvest Festival holiday last week. The company’s most complete explanations so far have come in reports to government agencies in Korea, China and the US. The initial conclusions indicated an error in production that put pressure on plates within the battery cells. That in turn brought negative and positive poles into contact, triggering excessive heat that caused the battery to explode.

The chairman of the US Consumer Product Safety Commission was more explicit when his agency announced an official recall on Thursday. He said the phone’s battery was slightly too big for its compartment and the tight space pinched the battery, causing a short circuit. “Clearly, they missed something,” said Anthea Lai, an analyst with Bloomberg Intelligence. “They were rushing to beat Apple and they made a mistake.”

As it investigates, Samsung has stopped buying batteries for the Note7 from the SDI affiliate. It shifted purchases to Amperex Technology, a unit of Japan’s TDK, according to local media reports. “After extensive testing and as reported to multiple regulatory agencies, this issue is isolated to the battery cell from one supplier only,” the company said in its statement. “All replacement Galaxy Note7 devices will have batteries from other suppliers.” A spokesman for Samsung SDI said the company’s stance on the recall is in line with what’s been previously announced by Samsung’s mobile unit and declined to elaborate.

The replacement programme is prompting more reflection. The fast response was driven by good intentions. Samsung managers have studied past product recalls, including those at Toyota, and the conclusion seemed clear: move quickly and dramatically.

The potential damage to reputation is far greater than short-term financial losses

But Samsung moved so fast it got ahead of regulators who help organise such programmes. In the US, for example, companies are supposed to notify the Consumer Product Safety Commission within 24 hours of uncovering problems. Instead, Samsung went public on its own and consumers didn’t have clear guidance on how to exchange their phones. “The official recall process provides a lot of clarity to consumers and there’s someone checking to make sure the fix is a good one that serves the consumers in terms of safety,” said Jerry Beilinson, a technology editor at Consumer Reports.

Samsung, which may pay as much as US$2bn for the recall, said on Sunday it sold stakes in ASML, Seagate, Rambus and Sharp for a total value of about a trillion won ($891m). While Samsung says Galaxy Note7 sales will resume in Korea around 28 September, it has yet to specify when global sales would resume.

A crisis

The tumult has raised questions about whether Samsung’s current management approach is sufficiently robust to handle the crisis fallout. In the wake of the recall, Samsung said it had nominated the younger Lee to join the company’s nine-member board, a move that will give him a more active, and legitimate, role across its businesses. However, the younger Lee, who has kept a low profile inside and outside the company, is still far from having the kind of direct authority his father had. In addition to the corporate strategy office that oversees about 60 Samsung companies, Samsung Electronics has three CEOs.

“This is a crisis and a blow to Samsung’s image,” said Kim Sang Jo, economics professor at Hansung University in Seoul. “Clearly there were procedural missteps and the company will have to restore consumer and investor confidence.”

Apple’s iPhone 7 also wasn’t as uninspiring as Samsung may have anticipated. Though it kept the same physical design with modest technology changes, loyalists still lined up at stores around the world on Friday to get the company’s latest gadget.

Twenty years ago, in a chapter of Samsung Group history that employees can recite by heart, chairman Lee grew so frustrated by faulty mobile phones that he piled up thousands of the devices and lit the whole heap ablaze. Never compromise on quality, he exhorted the workers watching, putting Samsung on course to become the top seller of mobile phones in the world.

Today, Samsung phones are ablaze once again, only this time the flames threaten the company’s hard-won image. “The potential damage to reputation is far greater than short-term financial losses,” said Chang Sea Jin, a professor at National University of Singapore. — (c) 2016 Bloomberg LP