As the increasingly acrimonious dust-up between Vodacom and Cell C enters its next phase, South African consumers are enjoying a real reduction in retail mobile tariffs.

But it’s difficult to separate the clutter as the big operators try to convince customers where to spend their money. Who really is cheapest? TechCentral cleared through some of the complexity in an effort to find the answer.

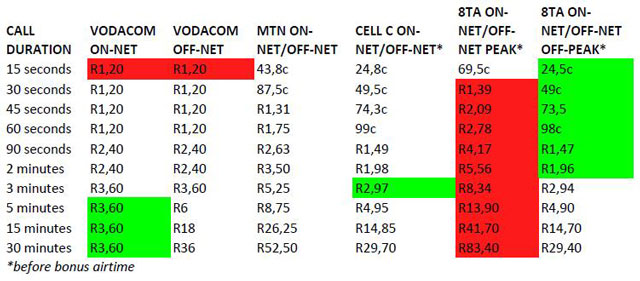

First of all, we chose what appear to be the cheapest prepaid packages on South Africa’s four licensed mobile operators. In the case of Vodacom, Cell C and 8ta, this was a simple choice.

With MTN, TechCentral had to select the company’s One Rate plan as it is impossible to work out the effective rate on MTN Zone, which offers discounts based on the time of day, network load and other factors.

MTN says that Zone is the most representative of its price plans, with 70% of its customers using it. The company describes it as the “leading and most affordable prepaid price plan in South Africa”, but, unfortunately, this publication has no way of calculating the average rate and must use published base rates for the sake of comparison.

For Vodacom, we chose the operator’s new prepaid plan, where consumers are charged R1,20/minute on per-minute billing day or night. For Vodacom-to-Vodacom calls, the first three minutes are billed for and the rest of the hour is free.

MTN’s One Rate costs R1,75/minute on per-second billing, day or night, to all networks, while Cell C’s “99c For Real” product is 99c/minute on the same per-second basis to all networks.

Cell C’s plan includes “Supacharge”, which offers a variety of discounts for recharges. The higher the recharge, the more extra value consumers receive in exchange. 8ta also offers bonus airtime for recharges — up to 100% additional value for recharges of R50 or more. However, for the sake of simplicity, the table uses base rates without bonus airtime.

What the comparison shows is that 8ta offers the best value for people who want to make calls at night. After 8pm, during off-peak time, consumers pay a base rate of 98c/minute on per-second billing, but this can fall to as little as 49c/minute if the maximum bonus recharge airtime is taken into consideration.

For those wanting to make longer calls — more than four minutes in duration — Vodacom offers the best deal, provided the calls are to other Vodacom subscribers.

If 8ta’s off-peak tariffs are excluded, Cell C offers the best value across the board, with the cheapest peak-time calls across all the networks. 8ta’s peak-time calls are consistently the most expensive, before recharge bonuses are applied. — (c) 2013 NewsCentral Media