Safaricom shares fell the most in four months after East Africa’s biggest company by market value said profit growth will slow even as the wireless carrier expands its popular mobile banking service.

Earnings before interest and taxes will rise by as much as 9% in the year to March, compared to a 13% increase in the prior period, the Nairobi-based company said in a statement on Friday. Higher taxes and inflation are among factors putting pressure on the consumer, chairman Nicholas Nganga said at an investor briefing.

The guidance for 2019/2020 earnings “is weak”, Tracy Kivunyu, a senior analyst with Tellimer Markets, said by phone from Nairobi. “That’s worrying.”

The outlook overshadowed Safaricom’s declaration of a special dividend on the back of a strong balance sheet and growth in mobile money to almost a third of total revenue. Part-owned by South Africa’s Vodacom Group, the carrier controls about two-thirds of the Kenyan market and is seeking to expand into other countries.

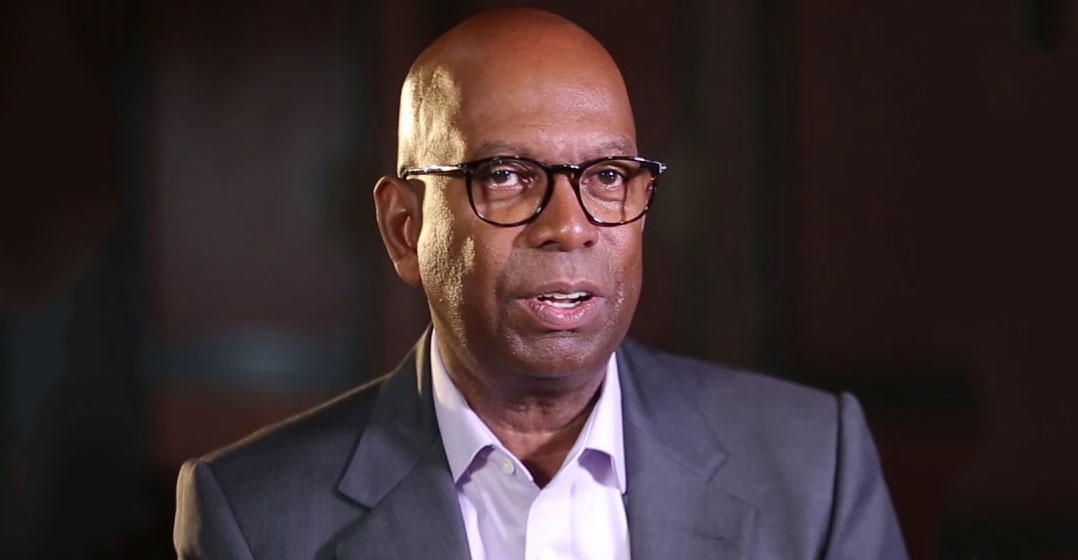

Vodacom and Safaricom plan to take over the intellectual property rights for M-Pesa, the main mobile money product, from Vodafone Group, Vodacom’s parent, and roll out the service to other African nations, CEO Bob Collymore said in an interview after the presentation.

Safaricom plans to provide a mobile money services platform for a bank operating in South Sudan, the CEO said. In Ethiopia, Safaricom is already providing state-owned monopoly Ethiopia Telecommunications with fibre connectivity, call termination and airtime advance for customers, he said, and the partnership has potential to be expanded.

Shares fall

“We are looking at a broader relationship with EthioTel,” he said, without giving details. “No agreements have been signed yet, but we are hopeful about signing something this year.”

Ethiopian Prime Minister Abiy Ahmed has indicated an intention to part-privatise EthioTel, a move likely to attract major telecommunications players keen to tap into Africa’s second most populous country.

Safaricom shares slumped as much as 4.1%, the most since 4 January, and traded 1.9% lower at the close in Nairobi. The stock has gained 31% this year. — Reported by Bella Genga, (c) 2019 Bloomberg LP