Samsung Electronics has posted profit that beat estimates as buoyant memory chip prices helped the world’s largest smartphone maker bounce back from the death of its fire-prone Galaxy Note7.

Operating income rose by 50% to 9,2 trillion won (US$7,8bn) in the quarter ended December, its biggest profit in three years, the Suwon, Korea-based company said in preliminary results on Friday. That compares with the 8,3 trillion won average of analysts’ estimates compiled by Bloomberg in the past four weeks. Shares rose.

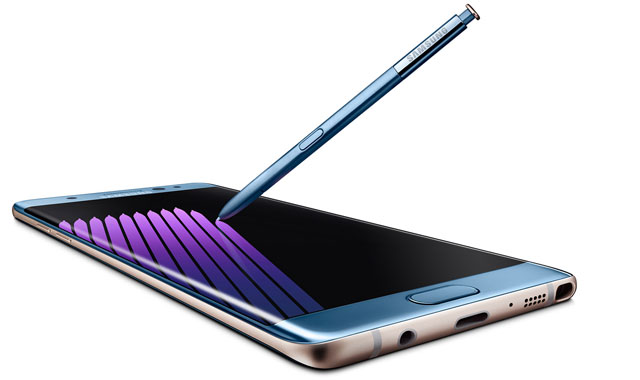

A persistent rise in chip prices spurred by Chinese demand and growth in displays using organic light-emit diodes mitigated the fallout from Samsung’s biggest corporate crisis, when incendiary Note7s forced the Korean company to kill off the gadget. It still hasn’t revealed the results of a subsequent investigation into an episode that cost Samsung more than $6bn and assured Apple of the lead in premium devices.

“It came in as a big surprise,” said Greg Roh, an analyst at HMC Investment Securities. “The biggest contributors are of course the memory chip business and OLED sales. The chip prices will continue to rally and may rise more than 30% in the first quarter alone on sustained supply shortage.”

Shares of Samsung rose by 2% to 1 813 000 won as of 9.01am in Seoul. The stock surged 43% in 2016, after three straight annual declines. Samsung, which settles most component sales in US dollars, also got a lift from a weaker Korean won. The US dollar appreciated to 1 157,4 won on average in the fourth quarter compared with 1 121,4 won in the previous three months, according to the Bank of Korea data.

Samsung is counting on its flagship Galaxy S line this year to repair its image and fire up a beleaguered mobile division. The next iteration of the phone is said to feature a bezel-less display and voice-enabled digital assistant. But the company’s also warned of slowing key markets and growing uncertainty around trade protectionism and currency fluctuations.

Sales were 53 trillion won in the quarter, the company said, compared with the 52,1 trillion won analysts expected. It won’t provide net income or break out divisional performance until it releases final results later this month.

Samsung’s semiconductor division was probably its best performer in the fourth quarter on the back of stronger prices, lifting its shares to new highs in past weeks despite the company’s challenges. Operating income from the chip business probably came to 4,5 trillion won in the quarter, according to the average of six analysts surveyed by Bloomberg, which would mark a record high for the business.

DDR3 4GB dynamic random access memory chips averaged $2,48 in the fourth quarter, compared with $1,75 in the previous three months, according to data from InSpectrum Tech.

Samsung’s main US semiconductor competitor also painted an optimistic outlook last month. Micron Technology, the largest US maker of memory chips, predicted stronger-than-expected sales on demand for phone and computer parts.

“Memory chips are short on supply now and inventory is well below average because of strong demand from lower-end smartphone makers,” Claire Kim, a Seoul-based analyst at Daishin Securities, said before the release.

Operating income from the phone division was probably 2,3 trillion won in the quarter, after posting a record low 100bn won profit in the preceding three months, according to the analyst survey. The Galaxy maker has teamed up with independent third-party experts to determine the root cause of the fires and should announce the results soon.

“Since the cause of the fires has not been proved yet, we cannot yet guarantee the next Galaxy S8 will be a great success,” Hanwha Investment & Securities said in a 15 December report.

The company’s display division probably posted a profit of 1,1 trillion won. Earnings at the consumer electronics unit, which encompasses TVs and appliances, probably fell to 800bn won because of rising panel prices, according to the analysts.

Apple is said to be planning to adopt OLED technology in at least one new iPhone later this year. — (c) 2017 Bloomberg LP