Corporate telephone spend inside the office is mostly well addressed and well managed by advanced PBX systems that include controls like employee call spend limits, employee security access Pins, and call barring.

Corporate telephone spend inside the office is mostly well addressed and well managed by advanced PBX systems that include controls like employee call spend limits, employee security access Pins, and call barring.

Conversely, allowed business telephone spend by employees when outside of the office has been largely unaccounted for and uncontrollable. Until now.

The problem with traditional employee cellphone allowances is that they do not provide the employer with any level of accountability, cost efficiency, or tax efficiency. Similarly, reimbursement policies are expensive, cumbersome, tax inefficient, admin intensive and prone to misuse.

There are traditionally two ways that companies can accommodate employee cellphone spend:

- By giving employees a cash “cellphone allowance”; or

- By allowing employees to submit claims for reimbursement of business calls made.

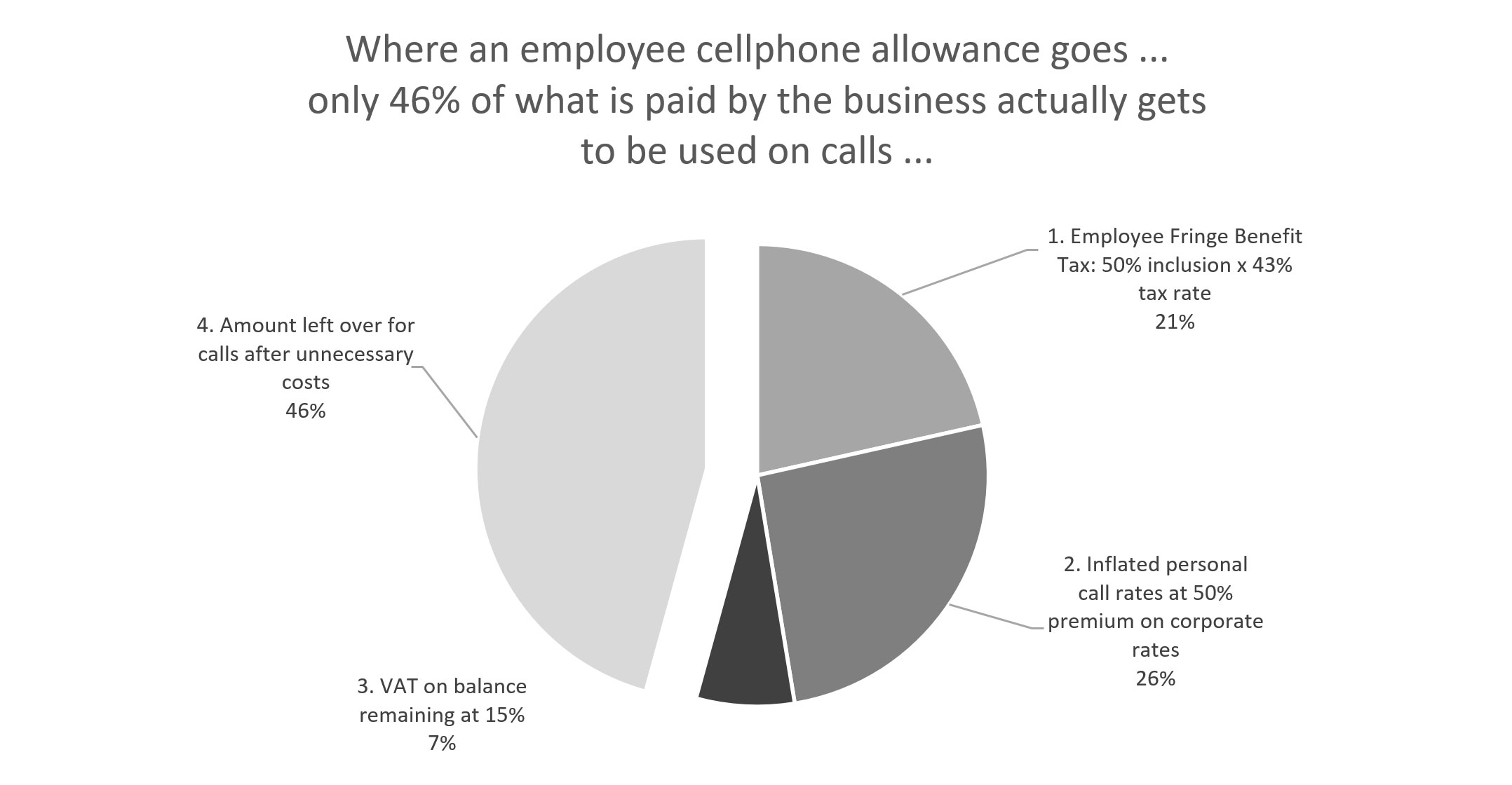

The financial negatives of cellphone allowances are multiple:

- The allowance becomes a taxable benefit in the employee’s hands, taxed as a fringe benefit at usually around a 50% inclusion rate — so the business technically loses the purchasing power of this tax amount before they start;

- The employee then buys call airtime, usually at expensive personal cellphone contract rates, which can be at as much as a 50% premium on business call rates. The business therefore unnecessarily loses this margin, too;

- The employee then also pays VAT (currently at 15%) on the (unnecessarily expensive) airtime they are buying, which is effectively another hit to the business’s bottom line.

In reality, of every rand a business spends on employee cellphone allowances, the first 50% or more is immediately lost to income tax, higher call rates, and VAT.

The problems with entertaining employee call claims are similar to those of cellphone allowances. There is no taxable benefit issue, but:

- The employee’s call airtime is usually at expensive personal cellphone contract rates;

- The employee calls claimed include VAT, which is another hit to the business bottom line as the business cannot claim this back when reimbursing the employee; and

- The latent time and administration overhead cost of the tabulation, presentation, scrutiny and payment of these monthly claims is significant and should not be overlooked.

Luckily for hard-pressed post-Covid South African businesses, there is now a solution: the newly launched, South African-developed Scotty BusinessLine service. It dramatically reduces the costs and also addresses the softer issues of employee cellphone call allowances.

In a nutshell, the Scotty phone app allows you to choose in real time whether to make each call through your Sim card or through your Scotty business phone line, using a choice of two separate dial-out buttons. “SIM” calls go via your Sim as usual, but “Scotty” calls are made from your Scotty phone number and use neither your Sim card’s airtime nor data. Instead, they are billed directly to your Scotty (or company) account.

As an added bonus, Scotty calls use a business phone number and so preserves the employees’ privacy by not showing their personal cellphone number.

A triple saving

Scotty is a compelling financial proposition for companies currently paying out cellphone allowances: The Scotty smartphone app is free, and there are no monthly line rentals or fixed charges for the service. As all Scotty calls are business calls, Scotty airtime is fully VAT deductible as a company expense, and is also not subject to fringe-benefit tax. And as far as call rates go, these are best-in-class low (currently 79c/min including VAT to South African numbers) on pure per-second billing with no call setup, minimum or hidden charges, and Scotty airtime credit never expires. Scotty therefore scores a 3-0 against cellphone allowances for financial efficiency, meaning cost saving.

For larger accounts, the Scotty administrator can set monthly call limits for each user, restrict time-of-day use of the Scotty lines (for both inbound and outbound calls), and even upload the company name and logo to display on the app for internal brand enhancement.

New customers can sign up online at www.scottyapp.mobi and their Scotty service will immediately be active and working. All account and user administration can be done online and is in real time, so hundreds of users can be rolled out and managed effortlessly.

With large parts of South Africa still working from home for the foreseeable future, Scotty BusinessLine offers a fresh new approach to providing remote voice connectivity to employees that does not depend on decent data connectivity or on staff having airtime of their own in hand, and solves all the existing drawbacks of paying traditional cellphone allowances.

About Trabel and Scotty BusinessLine:

Trabel (Pty) Ltd is a South African technology development company founded in 2019 and based primarily in Cape Town. Scotty BusinessLine is a telecommunications product of Trabel, driven by an Android smartphone app. More information can be found at www.scottyapp.mobi.

- This promoted content was paid for by the party concerned