Snap, maker of the disappearing photo app that relies upon the fickle favour of millennials, jumped in its trading debut after pricing its initial public offering above the marketed range.

Shares opened at US$24 and traded as high as $25,42 apiece on Thursday, giving the company a market valuation of about $29bn (R380bn), based on the total number of shares outstanding after the offering in the deal prospectus.

Snap sold 200m shares in its IPO at $17 each, above the $14 to $16 marketed range. Its market valuation at the IPO price, of about $20bn, implies a multiple of about 21,4 times eMarketer’s estimate for Snap’s 2017 advertising sales. Snap went public at a valuation at least twice as expensive as Facebook, and four times more costly than Twitter.

“Snap presents investors with the opportunity to invest in the company behind an innovative, large-scale and distinctively young-skewing platform,” said Brian Wieser, an analyst at Pivotal Research Group. “Unfortunately, it is significantly overvalued given the likely scale of its long-term opportunity and the risks associated with executing against that opportunity.” He gives Snap a sell rating.

Snap raised $3,4bn in its IPO, in the biggest social media IPO since Twitter more than three years ago. It’s also the first tech company to list in the US this year.

After ringing the stock exchange’s opening bell on Thursday, CEO Evan Spiegel and co-founder Bobby Murphy headed to Goldman Sachs Group’s offices in lower Manhattan to await the first trade, according to a person familiar with the situation. Shares opened almost two hours later.

Goldman Sachs and Morgan Stanley led Snap’s offering, and Goldman Sachs is also the stabilisation agent, tasked with ensuring the first day of trading goes smoothly.

“There is a huge amount of people who really just want to get in on the hot new thing, who see this as the first opportunity of its type in a number of years,” David Kirkpatrick, CEO of Techonomy Media, said in an interview. Still, “they’ve got some serious work to do to actually make a real business that makes profits”.

The company also needs to convince investors to put their complete trust in its management: it listed non-voting shares, the first company to do so in the US, according to its deal filing. That means stockholders will have no sway over things like director nominations and executive compensation, and they won’t be able to bring matters before the annual meeting. Co-founders and majority holders Spiegel and Murphy will be responsible for the decisions that lead to Snap’s success — or on the hook for its mistakes.

Snap, which posted a net loss last year of $515m, even as revenue climbed almost seven-fold, has some things to prove. It needs to continue to increase revenue per user, address slower user growth — which fell below 50% in the fourth quarter for the first time since at least 2014 — and inch closer to profitability.

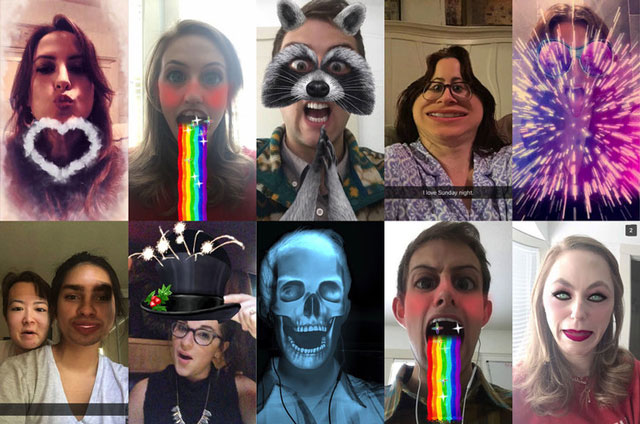

Its advertising model is still evolving, with many brands using the platform to experiment with one-off campaigns before committing to longer term spending. While the advertising business has been built up from nothing in about two years, advertisers have said that the ad-buying process is still overly complicated. They’re also concerned about only being able to access a narrow demographic through Snap — its core user group of teens and 20-somethings.

Its advertising model is still evolving, with many brands using the platform to experiment with one-off campaigns before committing to longer term spending. While the advertising business has been built up from nothing in about two years, advertisers have said that the ad-buying process is still overly complicated. They’re also concerned about only being able to access a narrow demographic through Snap — its core user group of teens and 20-somethings.

Facebook, with about 1,2bn active daily users on its flagship platform and 1,2bn on its messaging tool WhatsApp, trades at a multiple of about 10,5x revenue estimates for this year. Facebook’s Instagram introduced a video-reel feature — similar to Snapchat’s stories — that already has 150m daily users. That’s in line with Snap’s daily active count of about 158m.

Facebook priced shares in its IPO at the top end of the proposed range in May 2012, then following a first-day trading technology glitch the stock climbed less than 1% and languished for more than a year. Once the company’s strategy of betting on mobile software started to pay off and revenue and profit exceeded estimates, it surged, and Facebook now has a market valuation of about $397bn.

Twitter, with more than 300m monthly active users, comes in at 4,8x projected revenue. The social media site had an impressive debut, then proceeded to stumble as user growth slowed.

Snap faces what those companies faced, with one proven product to date under its belt.

The company offered the shares in its IPO for $14 to $16 each. Orders for the offering were concentrated at about $17 to $18 a share, people familiar with the process said on Tuesday. Demand outpaced the number of shares being offered by a multiple of 10, people familiar with the situation said.

Including unexercised stock options and other convertibles for a total of 1,39bn fully diluted shares, Snap would have a fully diluted value of about $23,6bn, according to a person with knowledge of the matter, who asked not to be identified because the information is private.

Given the interest, Snap could have priced the shares at $19 each, the person said, but executives wanted to ensure that shares would make a decent gain in their debut. — (c) 2017 Bloomberg LP

- Reported with assistance from Drew Singer