South Africa’s Infrastructure Fund, which is spearheading government efforts to secure R1-trillion of private investment, said it has identified a project pipeline and implementation could begin by year-end.

South Africa’s Infrastructure Fund, which is spearheading government efforts to secure R1-trillion of private investment, said it has identified a project pipeline and implementation could begin by year-end.

Established in August, the fund is targeting investing R100-billion in infrastructure over the next decade — spending it anticipates will galvanise 10 times as much money from pension funds, banks and other institutions. National treasury allocated the fund R18-billion over the next three fiscal years in the February budget, with a first portion set to be tapped in May, according to Mohale Rakgate, the fund’s chief investment officer.

“Government is really putting its money where its mouth is,” Rakgate said in an interview on Wednesday. “There is a sense that it can’t be business as usual.”

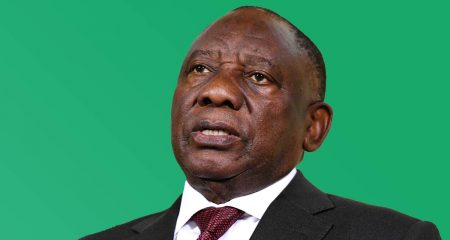

Increased infrastructure investment underpins plans unveiled by President Cyril Ramaphosa in October to reignite an economy that contracted the most in a century last year because of the coronavirus pandemic. Investment as a percentage of South Africa’s GDP has been in decline since 2016 and hit a record low of 13% last year, according to International Monetary Fund data.

The Infrastructure Fund will direct financing towards projects that have a positive social impact, including the construction of new transport links and student accommodation, and improving access to water and the Internet. It may also help cash-strapped state companies and municipalities fund infrastructure plans that they can’t afford to finance on their own.

‘Enabling platform’

“The Infrastructure Fund is not a fund in the traditional sense, but more of an enabling platform that packages projects and programmes,” ensures they are viable and then draws in private investors, said Pam Majola, the fund’s operations specialist.

The fund, which falls under the auspices of the Development Bank of Southern Africa, will take equity stakes in some projects, and provide loans, debt guarantees or capital grants to others.

“Each project will have its own details and specifics, and we will structure it accordingly,” Rakgate said. He sees the fund’s main challenge as identifying bankable projects and doesn’t anticipate any difficulty in raising funds from private investors.

The fund intends approaching national treasury for exemptions to government rules that have previously resulted in infrastructure investment bottlenecks. Such exemptions were granted to speed up the procurement of renewable energy from private producers as the country confronted chronic electricity shortages.

The fund intends approaching national treasury for exemptions to government rules that have previously resulted in infrastructure investment bottlenecks. Such exemptions were granted to speed up the procurement of renewable energy from private producers as the country confronted chronic electricity shortages.

There is a need to “expedite the implementation”, Rakgate said. “We are finding each other in that regard.” — Reported by Monique Vanek, (c) 2021 Bloomberg LP