Samsung Electronics has introduced its first mobile processor powered by AMD graphics as the company tries to better compete with Apple.

Browsing: AMD

Microsoft has lured away a veteran semiconductor designer from Apple as it looks to expand its own semiconductor efforts.

When Nvidia announced plans to buy ARM, the deal was more than just the chip industry’s largest-ever acquisition. Now its audacious plan is in peril.

Amazon Web Services has introduced two new custom computing chips aimed at helping its customers beat the cost of using chips from Intel and Nvidia.

Huawei is in advanced talks to sell its x86 server business after the US blacklisting of the company made it difficult to secure processors from Intel.

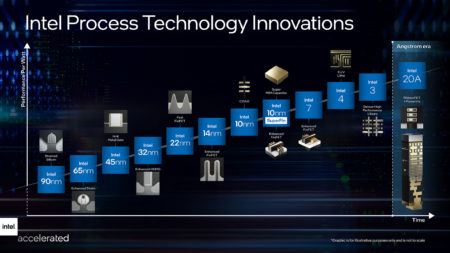

Intel shares plummeted on Friday to the lowest level since January after it detailed a spending plan that it said would pressure profitability over the next few years.

Intel’s future is looking a bit grim. And the reality is the chip maker’s problems are only going to get more challenging. By Tae Kim.

Intel said its factories will start making Qualcomm chips as it laid out a road map on Monday to expand its new foundry business to catch rivals such as Taiwan’s TSMC and Samsung Electronics by 2025.

Chip maker Intel said it still faces supply chain constraints and gave an annual sales forecast that implied a weak end of the year.

PC sales are booming, and despite the industry’s cyclical past, investors and the major PC makers believe strong computer demand will last for a long time to come. Not so fast!