SnapScan, the mobile payments application developed by Cape Town-based start-up FireID Payments in collaboration with Standard Bank, has introduced Bluetooth-based payments in its app, obviating the need for users to scan a QR code at the point of sale. At

Browsing: Standard Bank

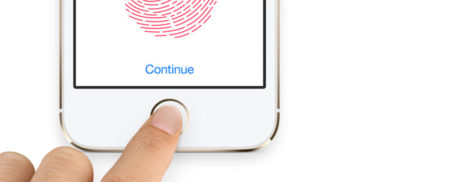

Standard Bank has introduced a biometric mobile banking solution that allows iPhone and iPad users to use their device’s fingerprint scanner to sign into the financial services company’s mobile banking application. The update makes use of the TouchID

Standard Bank has warned of downtime that will affect its customers for most of this coming Sunday. “Standard Bank wishes to advise customers of a planned system upgrade due

A new survey of the technology habits of South Africa’s student community shows that Facebook has become the default social network among students, with 97% of students in tertiary education using the platform. Twitter is second at 67%, followed by

Standard Bank has launched a new innovation centre in Rosebank in Johannesburg in an attempt to, it said, “think and act like a 150-year-old start-up”. Launching the facility on Wednesday

On Friday, Cape Town will launch a pilot programme that will allow residents and visitors to the city to pay for kerbside parking in the central business district with mobile payments app SnapScan. The service will be piloted in conjunction with Street Parking Solutions, the kerbside parking marshals

Standard Bank will undertake IT maintenance this Sunday morning, meaning its online and cellphone banking facilities could be offline. The maintenance could also affect its smartphone banking application. “The planned downtime on Sunday is to do routine maintenance

Standard Bank has said that after the technical glitches that affected its customers on Monday, most of its platforms are available to customers although the bank’s app is still not fully operational. On Monday, the bank apologised to its clients for the glitches, which lasted several hours. Clients said they could

Standard Bank has apologised to its clients for technical glitches that lasted several hours on Monday. “The bank regrets any inconvenience caused,” Standard Bank chief executive in personal and business banking Funeka Montjane said

Earlier this week, Old Mutual in Namibia unveiled a deal with Tranwall of Hong Kong to implement South African-developed “transaction control” technology on the OMcard, a prepaid Visa card that was developed specifically for Old Mutual customers in that country. The technology behind