A local technology start-up wants to take the hassle and confusion out of filing tax returns using the SA Revenue Service’s eFiling platform.

Marc Sevitz and Evan Robinson, both 28, started TaxTim last year. The two pitched the idea to Google’s Umbono programme in 2011 and were one of the first three teams that qualified for funding.

Sevitz is a chartered account by training and has worked for KPMG; Robinson was a self-employed Web developer and has a master’s degree in biotechnology and biochemistry from the University of Cape Town.

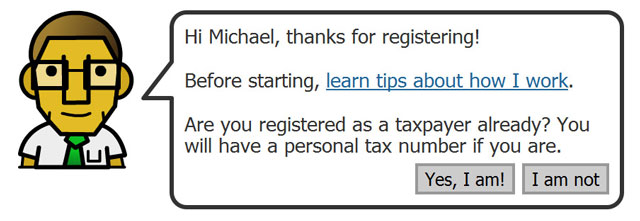

Introduced by mutual friends, Sevitz ended up doing Robinson’s tax returns. “I was outraged that I couldn’t do them myself,” says Robinson. “I thought anyone of average intelligence shouldn’t have to go to an expert to do their tax. I wanted to take Marc’s understanding and allow people to do their own returns using a virtual assistant.”

At first, the service was going to be called Tax Helper, then My Taxman, and then Bob. The pair ditched the last of these after being reminded of Microsoft’s failed project of the same name. “Eventually I did a search for intelligent-sounding English names,” Robinson says. “Tim came up and the .com, Twitter and Facebook names were all free so we went with TaxTim.”

The Umbono programme provided half of TaxTim’s initial funding, with the other 50% coming from five international investors affiliated to the programme and who become shareholders in the companies they fund.

The company closed its second round of financing last month, with one of the first-round investors participating in the second round, too, and two more signing on. The newcomers are Permjot Valia, a Canadian national who started Salesforce.com, and a local investor Justin Stanford of 4Di Capital.

TaxTim makes its money by charging a flat rate of R199 for each tax return. If customers tweet about the service or post a Facebook update about it, this is reduced to R169.

Though the site went live only two days before the close of the last tax season, 116 people signed up. It now has almost 1 000 users.

Robinson says the company’s involvement with Umbono was invaluable. “They provide fast Internet, office space, mentors and some funding, and access to Google and external experts to bounce ideas off. We had access to great search engine optimisation [experts] and analytics minds. Now we’re alumni and we attend some of the Umbono events and help newcomers.”

The pair has international aspirations for the service and Robinson says they are eager to spread their wings to other developing nations. “In places like Germany, the process of filing a tax return is automated, but there are many other regions where people still need to submit returns manually,” he says. “We’re looking at African countries first, but also at places such as India and Brazil. The back-end I’ve written is easily customisable — it’s a drag-and-drop flowchart of questions and answers,” Robinson explains.

The SA Revenue Service (Sars) has gone to great effort to get more people to pay tax in recent years and because of this it’s making it easier to complete tax returns. But that also makes Sars a potential competitor to TaxTim. “At the moment it’s easy to file a return, but not easy to understand what to put into it,” Robinson says.

Currently, the average age of users of the service is 33, and Robinson says most users are already making use of eFiling but are simply looking for a helping hand with it. TaxTim offers step-by-step instructions and screenshots so that users can complete eFiling correctly. The company hopes eventually to automate its offering with Sars, but at present users still have to input the data in Sars website.

“We’re trying to get it automated with Sars, but we help the user do it step by step. There are screenshots and examples and users can copy data across from TaxTim to eFiling as our output looks exactly like the Sars forms.”

TaxTim is hosted using Amazon’s EC2 expandable cloud so it can “handle high levels of traffic and scale as needed”.

The biggest challenge TaxTim faces, according to Robinson, is “changing entrenched behaviour”. He says people have resigned themselves to handing their tax over to others for a sometimes-substantial fee. “TaxTim allows people to do it themselves and costs less than the monthly penalty from Sars,” he says.

The company expects a large spike in users in the next few months as the tax season closes on 23 November.

TaxTim users can pay for the service using credit cards on PayPal, by using Ukash vouchers from Pick n Pay or Checkers, or by electronic funds transfer. It will also soon be possible to make payments using Peach Payments, another Umbono project, which supports services such as eBucks and M-Pesa.

Robinson hopes to finish work on a mobile phone version of the service, too. He says the company is looking at a presence on Mxit due to the popularity of the platform in SA. “Mxit is a chat medium, so we can serve the same questions using its interface as we do using ours.”

The company offers a package solution to companies called Employee-Assist that provides them with a reduced rate per employee and offers access to a mobile site for the tracking of vehicle mileage. “We’ve heard from human resources that come tax time they get asked all sorts of questions about tax. We want to help them make it easier for employees to file.”

The mileage-tracking mobile site is the result of a personal project Robinson undertook years ago to track his own mileage and will be made available to individual TaxTim users in coming months, too. — (c) 2012 NewsCentral Media