It’s instructive to look at 2021 returns in the tech sector by geography, market cap and profitability.

The major learnings we get from doing this are the staggering underperformance of Chinese tech when compared to US tech, the generally solid returns enjoyed across all large-cap US tech stocks, and the sizeable underperformance of unprofitable companies when compared to profitable businesses.

It’s also useful to examine those subsectors that struggled last year (such as online retail and media) to determine if their challenges are structural or more transitory.

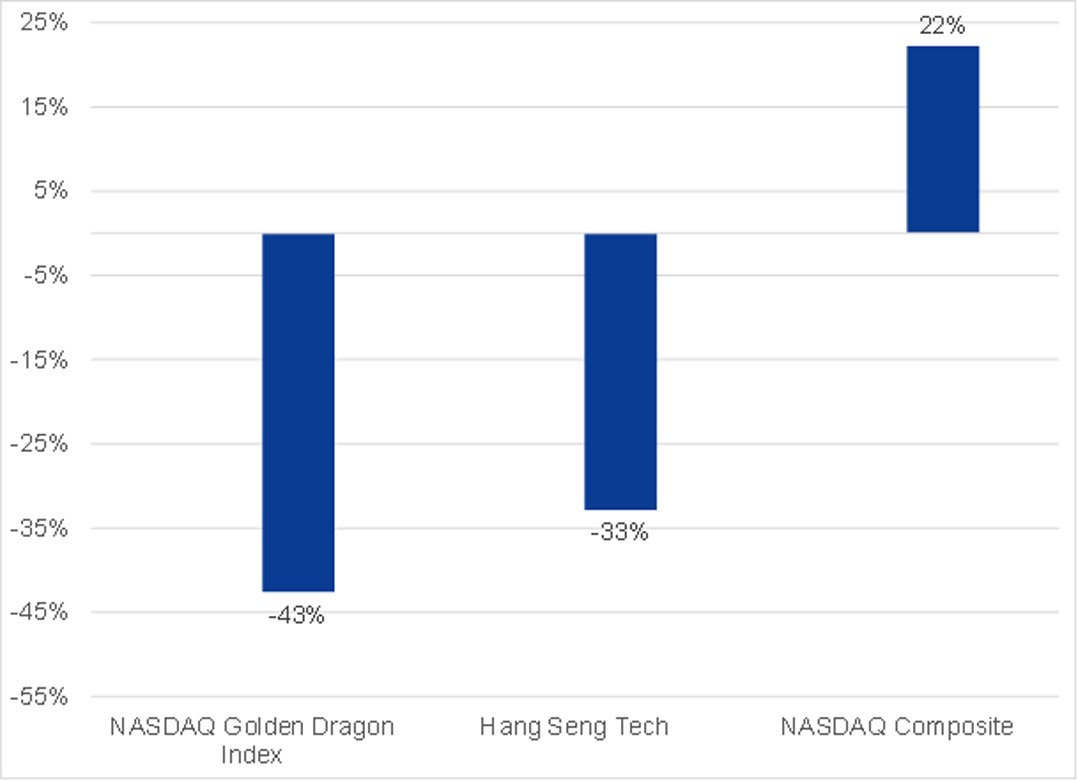

When examining 2021 returns in the tech sector by country or region, the most striking difference can be seen between the world’s two largest tech hubs: the US and China.

As is now well documented, the past year has been tumultuous for Chinese tech shares as increased government regulation, slowing earnings growth and rising capital expenditure cast a shadow over the sector during 2021.

Even with this backdrop in mind, the extent of the Chinese tech stocks’ underperformance when compared to the US is astounding. Chinese tech underperformed the Nasdaq Composite Index by 50% when using the Hang Seng Tech Index as a proxy for Chinese tech and by 60% when using the Nasdaq Golden Dragon China Index.

The “BAT” stocks (Baidu, Alibaba and Tencent) were down by 31%, 49% and 19% respectively last year. In contrast, FAANGM (Facebook, Apple, Amazon, Netflix, Google (Alphabet) and Microsoft) were up 21%, 36%, 6%, 13%, 69% and 55% year over year, respectively.

A key question as we start 2022 is where the relative opportunity lies between these two geographies. The increased uncertainty brought about by Chinese government regulations and perhaps a higher cost of capital must be balanced against valuations that were slashed in 2021. Similarly, while US large-cap tech stocks continue to grow earnings at decent rates with seemingly impenetrable moats, these advantages must be weighed against valuation multiples that now comfortably exceed those of their Chinese counterparts.

The second point that’s instructive to outline is the generally solid performance of large-cap US tech shares in 2021. Given their high weight in indices, these shares were once again a major driver of US equity indices in 2021. The five largest shares in the S&P 500, for example, accounted for 31% of the S&P 500’s total return in 2021 (8.8 percentage points of the index’s 28.7% return). All five of these shares (Alphabet, Apple, Microsoft, Nvidia and Tesla) are tech related. As noted above, the FAANGM shares enjoyed a generally strong year, albeit with admittedly large variance in returns within the group. Nevertheless, it is noteworthy that all these shares had positive returns in 2021. This contrasts with many smaller tech shares that ended the year with total returns that were negative and, in some cases, severely so.

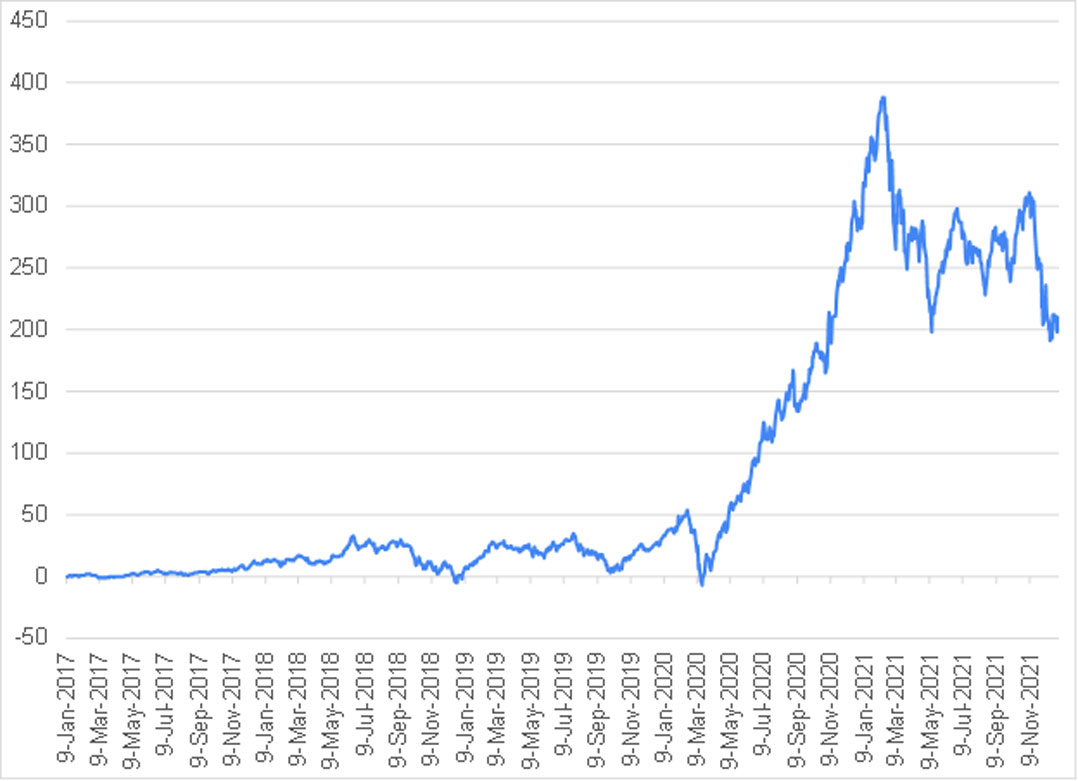

The final comparison worth making is between the performance of profitable and unprofitable companies in 2021. Look at the Goldman Sachs Non-Profitable Technology Index (see figure 2) as a proxy for loss-making tech companies. It is important to note that companies can be loss-making according to standard GAAP accounting rules but nonetheless still be creating economic value. Nevertheless, this index serves as a useful, although imperfect, proxy for the more speculative part of the sector. After quadrupling in 2020, this index of unprofitable tech companies has declined by 48% from its highs in 2021. All in all, the index declined 19% in 2021. The larger, more profitable businesses in the sector have meaningfully outperformed in 2021.

In many ways, 2021 was the opposite of 2020. Subsectors that thrived in 2020, such as payments, e-commerce and videogaming, generally struggled in 2021. The emergence of Covid-19 in 2020, in hindsight, turned out to be the perfect environment for many of these businesses. With individuals forced to stay at home under lockdown restrictions, online shopping and videogaming were natural activities in which to engage in this new environment. As lockdown restrictions have gradually been lifted around the world, we have seen several of these beneficiary sectors slow down.

E-commerce

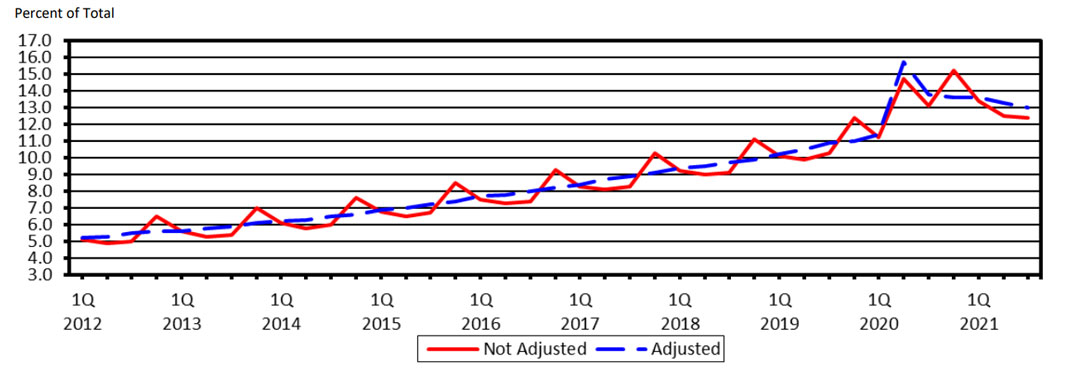

Online retail has steadily increased as a share of total retail sales over the past two decades. As the pandemic hit, US online retail sales penetration jumped strongly from 11.4% in Q1 2020 to 15.7% in Q2 2020. At the time, the prevailing view in the market was that the pandemic had accelerated e-commerce adoption by an order of magnitude and in a permanent manner. Instead, US online retail sales penetration has consistently declined since Q2 2020, reaching 13% in Q3 2021. It now seems more likely that we are headed back towards the long-term trend of roughly a 1-2%/year rise in online sales penetration. This has also been evident in the performance of the e-commerce sector in equity markets. These businesses generally underwhelmed investors in 2021, particularly in the second half of the calendar year where year-on-year comparisons became difficult.

It seems likely that online retail sales will continue to grow as a proportion of total retail sales over time. In certain instances, therefore, the pullback in share prices represent opportunities for investors and the attractive characteristics of the e-commerce sector make it worth studying for investors. It is a sector that generally favours scale (“survival of the fattest”, requires minimal capital — and therefore high returns on capital) and allows for strong earnings growth over long periods of time.

When Covid-19 hit, over-the-top (OTT) streaming was another beneficiary of the pandemic. People stayed home. Those who had not yet subscribed to streaming services had the time and the motivation to try it out. As 2021 started to unfold, it became clear that year-on-year comparisons were going to be difficult for the sector. We saw a sharp slowdown, for example, in Netflix’s subscriber growth in 2021. Initially the share came under pressure, but the company has guided to subscriber growth picking up in the final quarter of the year. Similarly, Walt Disney Co’s subscriber additions for its streaming service, Disney+, disappointed investors in the third calendar quarter of 2021. Clearly, year-on-year comparisons were difficult for OTT streaming in 2021. Similar to online retail, however, we do not believe that this represents a structural change in the growth profile of the sector. Several statistics illustrate this. For example, pay TV is still in about 60% of US households and OTT streaming continues to represent less than a quarter of the addressable market of global pay-TV households. It therefore seems likely that the growth opportunity for OTT streaming remains despite the short-term challenges brought by 2021.

In this article, we examined the returns in the tech sector in 2021. We found three major trends. First, Chinese tech substantially underperformed US tech. Second, large-cap tech counters enjoyed generally solid returns as a group. Finally, unprofitable tech companies really underperformed their larger, more established counterparts. We also looked at some of the subsectors that came under pressure in 2021. We found that in several cases such as online retail and video streaming, although year-on-year comparisons were challenging due to a high 2020 base, we expect these sectors to continue to enjoy structural growth over the long term.

- Seleho Tsatsi is an investment analyst at Anchor Capital