Taiwan’s TSMC has good reason to remain bullish. The world’s most important chip maker expects revenue to climb 20% this year as the industry suffers a shortage of components used in everything from cars to servers. But the incredible cost of meeting this outsize demand is starting to eat away at the bottom line.

Second quarter operating profit missed estimates for the first time in two years, and the outlook for this period is softer than many expected. Some of the blame falls on Taiwan’s strengthening currency, a trend caused in part by rising exports from the likes of TSMC. According to chief financial officer Wendell Huang, an unfavourable exchange rate knocked 0.5 percentage points from gross margin last quarter.

Yet adding that deficit back into its income statement, we can see that although the numbers would have been better, TSMC would likely still have posted operating income below estimates.

Demand is set to remain robust because TSMC sees the chip shortage persisting into next year, while clients are also building greater stockpiles than in the past in order to offset the risk of supply constraints and global political tensions.

The dichotomy between booming revenue and softening profitability will persist into the company’s peak quarter when it starts building chips for Apple’s annual iPhone release, as well as components for servers used to deliver streaming video and support continued work-from-home demand. The company said revenue would climb at least 20% in the September quarter from a year earlier, but forecast operating margin of 38.5% to 40.5%, less than estimates for 40.8%. In other words, while sales will remain strong, margins won’t.

Boosting capacity

That’s something shareholders are going to need to get accustomed to. Despite being a minor contributor to overall sales, the company is boosting capacity for automotive chips. Its output of micro controllers, the components that car makers complain are short, will rise 60% in 2021 from last year. To further meet demand for mature products, the company is expanding capacity at its factory in Nanjing, China.

Auto chips and decade-old technologies aren’t TSMC’s competitive advantage. It’s largely left this segment to distant rivals like United Microelectronics and GlobalFoundries, which have both announced expansion plans to boost output of these older categories. But since there’s excess demand, TSMC clearly sees the need to seize the opportunity. And because it’s legacy technology, the costs to ramp up won’t be too high.

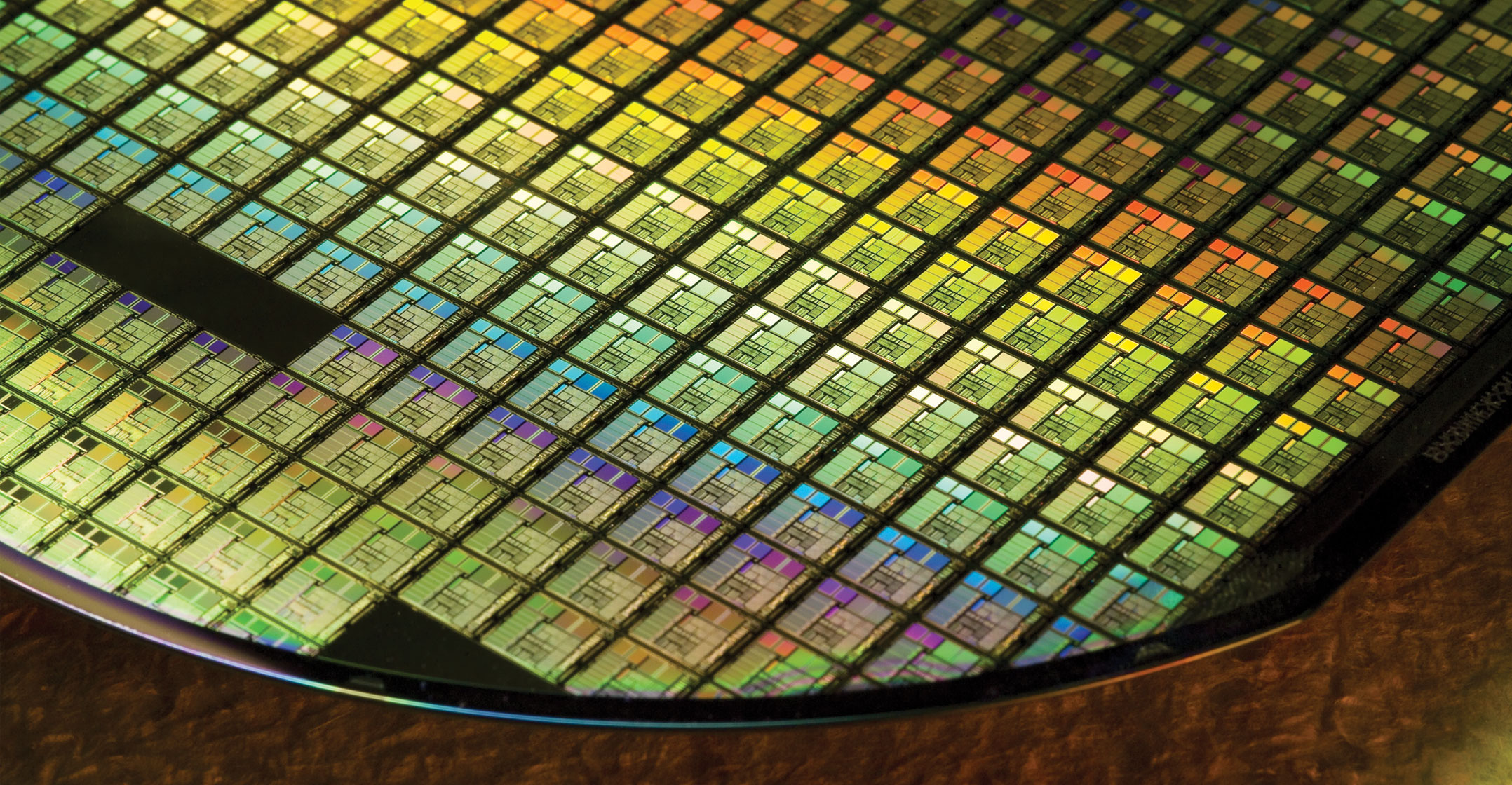

Where things really matter is at the leading edge. Apple and graphics chip designer Nvidia, smartphone chipmaker Qualcomm and processor supplier AMD all rely on TSMC to cram more transistors onto a sliver of silicon so that they can offer more powerful components. This continued advancement is so difficult that the company’s closest rivals, namely Samsung Electronics and Intel, have fallen behind.

As a result, if you want the best semiconductor manufacturing, TSMC has become your only choice. That’s great for the Taiwanese company, but also a burden. The process of developing and driving up production is actually a drag on earnings, because the upfront costs outweigh the initial revenue boost. Only after output hits mass scale can the firm start enjoying fatter margins.

TSMC is confident that it will be able to benefit from this massive investment — topping US$100-billion over three years — and a history of solid execution works in its favour. But investors may need a little patience before reaping the rewards. — (c) 2021 Bloomberg LP