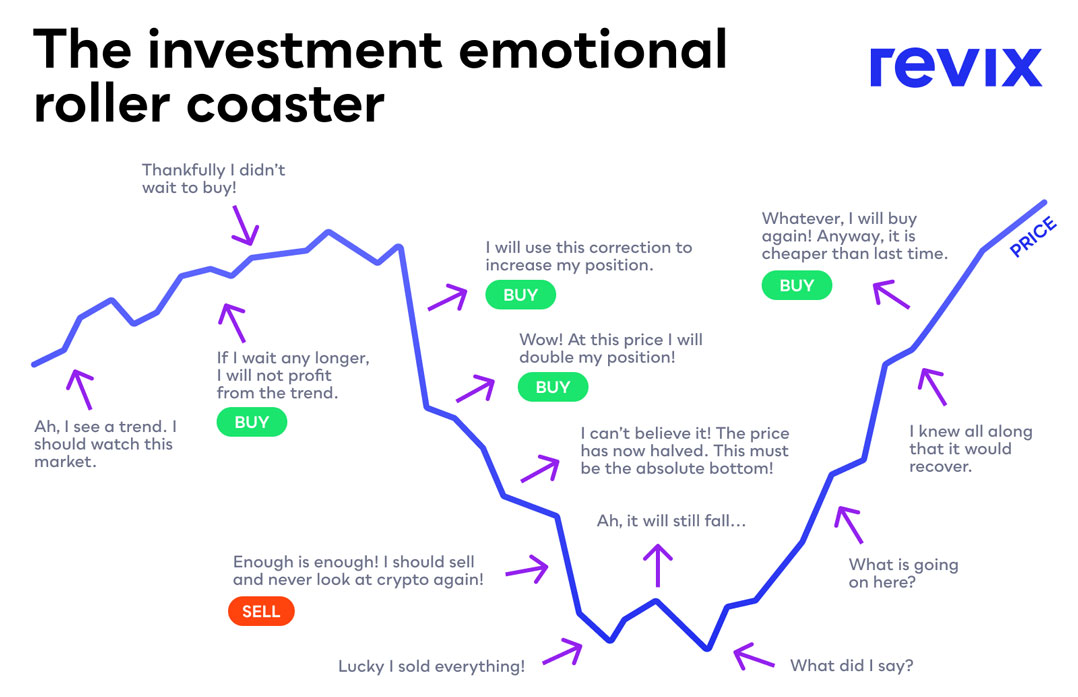

How can emotions propelled by mass hysteria hamper your success as an investor? The crypto market’s reaction to the recent ups and downs of cryptocurrencies like ethereum, bitcoin and dogecoin is a case in point of the dangers of emotional investing.

How can emotions propelled by mass hysteria hamper your success as an investor? The crypto market’s reaction to the recent ups and downs of cryptocurrencies like ethereum, bitcoin and dogecoin is a case in point of the dangers of emotional investing.

Here’s a checklist to help you outmanoeuvre your biases, one at a time.

To quote Warren Buffet, “If you can’t control your emotions, you can’t control your money.”

A failure to keep emotions in check is the main reason so many individual investors lose money in markets. Even buying a simple index-tracking exchange-traded fund (ETF) is no protection against the pressure of your own behavioural biases. We tend to take big risks when prices are high and the relative rewards on offer are at their lowest, while large on-paper losses still cause too many people to exit markets right before they rebound.

In other words, those sneaky biases can – if left unchecked – push you to do just the opposite of what is best for your financial future. They could even put you off investing altogether. But here’s the good news: While you can’t suppress these emotions, you can learn to recognise them – and put in place a process to stop them from getting in the way of your long-term goals.

What does this mean?

What does this mean?

A checklist can be a big help when it comes to avoiding purely emotion-driven decisions. Even if you know you shouldn’t just jump on the latest hype stock (dogecoin, we’re looking at you!) or enter a trade after some major global news drops (like Elon Musk’s recent backpedalling on bitcoin), going through the same set steps every time can help ensure you don’t make any impulse decisions. A checklist won’t fly a plane, but it might help avoid an accident.

Nowhere is this more important than when it comes to selling an investment in response to a recent gut-churning drop. So, what do you do when it is time to make that crucial sell-or-stick decision? This simple checklist may not have all the answers, but it will hopefully get you asking yourself the right questions.

Question 1: Did I invest for the wrong reasons in the first place?

You may have fallen prey to one of many behavioural biases when initially purchasing the asset. The availability bias, for example, refers to our tendency to overemphasise recent and easily available information – including on investment performance. Investors love a good story, and plenty of evidence suggests that their decisions are also heavily reliant on how such information is presented (the framing bias).

When lots of other people are jumping on a bandwagon in search of a quick buck, the herding bias can also cause us to cave in and follow suit. And even after you buy, confirmation bias all too easily encourages investors to favour information that confirms their choices and dismiss that which disagrees with them.

Popular cryptocurrencies or stocks are not always a bad investment – and popularity could even be a key part of your investment process if you are a momentum trader, for example. But with all these biases potentially at play, it is important to be honest with yourself: If you do not know as much about an investment as perhaps you should, then you might be better off out of it.

The price will not necessarily go down, but whatever outcome transpires will have little to do with your investment process. Without a rigorous buying (and selling) strategy, your biases will lead you to make bad decisions in the long run, and you’ll end up facing losses.

Question 2: Would I buy at this price?

There are two more biases you need to be aware of when you own an asset. The first is the endowment effect, which involves you becoming too emotionally attached to your investments. The second is the anchoring bias, which can cause you to overstate the importance of the price at which you bought in.

One way to tame these tigers is to ask yourself the following question: “If I’d never bought X, would I buy it now at the current price?” If the answer’s no, then you may be holding onto your investment for the wrong reasons and should strongly consider selling.

Question 3: Why do I really want to sell?

Have your fundamental beliefs significantly shifted? Or has a market movement or media report just got you stressed? Whatever it is, be sure to identify the real reason you’re looking to sell.

The same biases involved in buying also apply when it comes to selling – and the first step towards making better decisions is to be aware of which biases might be influencing you. Do that consistently and you’ll be a long way towards overcoming the overconfidence bias, which is particularly dangerous when markets have been rewarding you nicely for a while.

Question 4: Am I in line with my investment horizon?

Myopic loss aversion might lead you to overemphasise the importance of short-term price action. If you have a passive, diversified portfolio of crypto assets (like the Revix Top 10 Bundle, which we’ll come back to in a minute) then short-term volatility really shouldn’t affect your decisions. Taking a large loss may be tough from an emotional standpoint, but most investments adequately compensate you for this risk: Prices have always gone up in the long term. Make sure that any decision to sell makes sense in the context of your overall investment timeline.

Question 5: Is selling now consistent with my initial exit plan?

If you’re reading this and don’t have exit strategies in place for individual investments, then be sure to draw one up for your next purchase. This might just be the most important thing you’ll ever do when it comes to improving your investment process. Knowing when and why you will exit ahead of time significantly reduces the impact of your behavioural biases when times are tough. If a price hits your stop-loss or profit target level, or something materially alters your investment thesis, then respect your plan and exit the position immediately.

Question 6: Why should I care?

It is worth pointing out that this list is not exhaustive: At the end of the day, everyone’s individual circumstances mean they will be battling with slightly different emotions. It is up to you to figure out the details of your counter-bias selling strategy – but you should now be more aware of the subconscious forces threatening your long-term investment success.

Following this sort of checklist might not be as glamorous as riding the wave of the next flashy cryptocurrency or electric vehicle stock, but if it puts you in a slightly better position to overcome your biases, then you’ll sleep better at night. And more importantly, so will your portfolio.

So, how do you get started with investing?

So, how do you get started with investing?

Picking one cryptocurrency to back — like bitcoin — can be risky because you may have chosen the wrong horse to back regardless of your best analysis.

Even the professionals don’t get it right every time. As mentioned earlier, many professional investors would recommend a diversified approach, so you’re not putting all your eggs in one basket. Instead, you’re buying a basket of cryptocurrencies.

Crypto investing can be complicated, time consuming and quite intimidating, so Revix has created an ultra-simple investment platform that allows you to own a diversified Bundle of the top cryptocurrencies for as little as R500.

And what’s great is that you can sell out of your Bundle and withdraw your funds at any time.

Sign up to Revix for free to invest in a Crypto Bundle

Revix’s Bundles are ready-made investments that provide you with direct exposure to the underlying cryptocurrencies within each Bundle. This means that you don’t have to guess which cryptocurrencies to own.

Investing is as easy as signing up and buying a Bundle.

The greatest component of Revix’s Bundles is its “invest and leave it” functionality. Its Crypto-Bundles automatically update your holdings every month so that you always stay up to date with the fast-paced crypto market.

“Our Crypto Bundles let the most successful cryptocurrencies come to you, and this puts your whole investing experience on autopilot — making your money work harder for you,” explains Revix founder and CEO Sean Sanders.

Sign up to Revix for free to invest in a Crypto Bundle

Revix offers three Crypto Bundles on its platform, all of which track the crypto market and are known as passive investments as there isn’t a fund manager picking which cryptocurrencies anyone should own. Instead, Revix’s Bundles provide investors exposure to the largest and most established cryptocurrencies.

The Top 10 Bundle is like the JSE Top 40 or S&P 500 for crypto and provides equally weighted exposure to the top 10 cryptocurrencies making up more than 85% of the crypto market.

The Payment Bundle provides equally weighted exposure to the top five payment-focused cryptocurrencies that are looking to make payments cheaper, faster and more global. These cryptos include the likes of bitcoin, ripple, bitcoin cash, stellar and litecoin.

The Smart Contract Bundle provides equally weighted exposure to the top five smart contract-focused cryptocurrencies like ethereum, EOS and tron that enable developers to build applications on top of their blockchains, similar to how Apple builds apps on top of its iOS operating system.

The Smart Contract Bundle provides equally weighted exposure to the top five smart contract-focused cryptocurrencies like ethereum, EOS and tron that enable developers to build applications on top of their blockchains, similar to how Apple builds apps on top of its iOS operating system.

Revix’s Bundles have outperformed an investment in bitcoin alone over one, three and five years.

“The alternative cryptocurrencies, called altcoins, have outperformed bitcoin, and this is why our Bundles have performed so well — as we equally weight each of the cryptocurrencies within the Bundles, which diversifies your crypto portfolio,” says Sanders.

What fees does Revix charge?

Revix doesn’t charge monthly subscription fees but rather a simple 1% transaction fee for both buys and sells and a 0.17%/month rebalancing fee (which amounts to 2.04% a year only) on the total Bundle value held.

So, whether you want to invest in a slice of the entire crypto market or a specific niche sector in the crypto space, Revix has a low-cost and easy to use investment option to suit your needs.

About Revix

At Revix, we’re driven to empower everyday people to become their own wealth managers. Cryptocurrencies have been our first investable category. We offer bitcoin, a regulated gold tokenised commodity called Paxos Gold, and three ready-made crypto Bundles. These Bundles are like the S&P 500 for crypto and offer passive, diversified exposure to the crypto asset class. Investing is as easy as signing up, choosing an asset, and then watching your portfolio grow.

We have some exciting new products on their way. Soon you’ll be able to invest in emerging themes, sectors and asset classes in an effortless way. Sign up to learn more.

Disclaimer

This article is intended for informational purposes only. The views expressed are not and should not be construed as investment advice or recommendations. This article is not an offer, nor the solicitation of an offer, to buy or sell any of the assets or securities mentioned herein. You should not invest more than you can afford to lose, and before investing, please take into consideration your level of experience, investment objectives and seek independent financial advice if necessary.

- This promoted content was paid for by the party concerned