The growing pressure on margins as telecommunications moves from a voice-driven industry to one where data is predominant is the main reason South Africa’s incumbent mobile operators are keen for so-called “over the top” (OTT) providers like WhatsApp and Skype to be regulated, experts have argued.

Parliament’s portfolio committee on telecoms & postal service has triggered a storm of controversy by announcing it intends holding a meeting – they’re not formal hearings, it insists — later this month to discuss the need (or otherwise) to regulate OTT providers.

The announcement follows much public hand-wringing in recent months by MTN, Telkom and Vodacom executives over the impact of OTT providers on their businesses.

Former MTN South Africa CEO Ahmad Farroukh went as far as to argue that companies such as Facebook and Google are getting a “free ride” and “should pay their way” if they want to profit from their use of the operators’ substantial investments in next-generation broadband infrastructure.

Only Cell C, which is trying to position itself as a consumer champion, has spoken out against regulation. Its CEO, Jose Dos Santos, this week blasted bigger rivals MTN and Vodacom for “declaring war on consumers’ interests”.

Brian Neilson, research director at telecoms consultancy BMI-TechKnowledge, says the increasing pressure on operators’ profit margins lies at the heart of their calls for regulation.

Traditional SMSes are very high margin for mobile operators since they involve negligible costs

“Voice and SMS revenues are already under pressure, partly due to substitution by cheap messaging services like WhatsApp, both directly and indirectly — directly through in-app voice calling and indirectly because I might choose to message someone instead of making a voice call,” Neilson says.

“Coupled to this is the lower margin associated with these applications and the need to invest heavily in the network to carry the exponential growth in data traffic, to which these applications contribute. Traditional SMSes are very high margin for mobile operators since they involve negligible costs and hence any revenues they generate go almost entirely to the bottom line.”

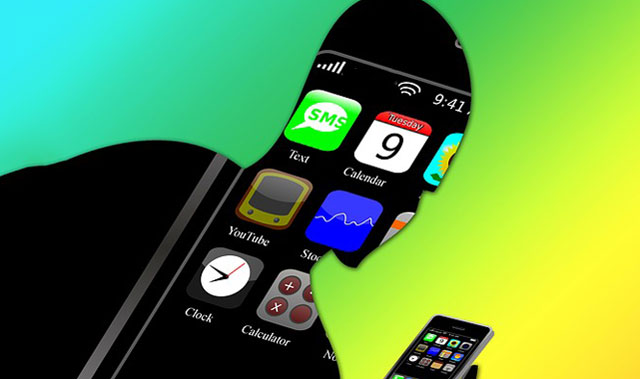

In recent years, mobile operators have watched as applications such as WhatsApp (owned by Facebook), Hangouts (Google), FaceTime (Apple) and Skype (Microsoft) have cut into their hugely profitable SMS business. Their fear is that their voice revenues will be next.

Yet operators in South Africa — and worldwide — have failed in their attempts to be important players in content and applications, Neilson says.

“If one projects these trends into the future, the operators will see their margins squeezed, and, yes, they run the risk of becoming ‘dumb pipes’ that can only command low prices and margins.”

Incumbent operators, which are typically “vertically integrated” — in that they want to provide a full range of services to consumers, from basic connectivity to value-added services on top of their infrastructure — worry that OTT providers will turn them into little more than utilities. In that scenario, they’ll provide only the connections over which third parties generate the real profits.

Elsewhere in the world, there are already examples where operators have started playing hardball with OTT rivals.

Morocco’s three main operators — Maroc Telecom, Méditel and Inwi — earlier this month cut off their customers’ access to Skype, Viber, WhatsApp and FaceTime. Though that decision has enraged their clients, they have been backed by their regulator, which has argued that providers of such services should be licensed.

None of South Africa’s big operators is likely to attempt the same, however. Even if Vodacom and MTN are successful in tolling OTT providers for the use their networks, it would open up arbitrage opportunities for rivals, says Neilson. “Cell C has already embraced this disruptive model in its competitive approach, and Telkom could do likewise.”

Also, aside from consumer protection, regulating any content on the Internet is widely considered to be a bad idea, says Neilson. “There are fears among advocates of effective network neutrality policies and rules that the operators will link hands with the largest content players, effectively forming a cabal and locking out start-ups and smaller, niche players.”

Another important argument against regulation is the inherent impracticability of implementing it, Neilson says.

“The landscape is constantly shifting and it would be almost impossible for regulations to keep up with technology and innovation,” he says. “Even if only a handful of the largest OTT players were targeted and subjected to restrictions with respect to their relationships with the operators, it would be difficult to define markets clearly, and to differentiate between different classes of applications.”

Yash Ramkolowan and Genna Robb, economists at Pretoria-based consultancy DNA Economics, argue that regulating OTT providers would amount to “raising another barrier to competition in the telecoms sector, rather than protecting consumers from harm”.

“The advent of new technologies continues to disrupt competition in a number of traditional markets, many of which have operated in the same manner for decades,” Robb and Ramkolowan say.

“Examples of this include the metered taxi industry, where Uber is quickly becoming both a noun and verb in South African conversation, and the television industry, with Netflix.

“From a telecoms point of view, OTT communications providers such as WhatsApp, WeChat and even Facebook Messenger have revolutionised the way in which we communicate.”

The pair dismiss the argument that OTT providers are “free-riding” on the mobile operators’ infrastructure. The operators’ clients pay to use the data that OTT services consume, they say.

“From a regulatory perspective the debate is more nuanced. It is true that mobile operators face a heavier regulatory burden than the OTT providers, but this in itself is not necessarily a justification for further regulation,” they say.

Over-regulation of these new entrants may only serve to entrench the position of existing operators and throttle the benefits that arise from increased competition

“For example, regulations relating to quality of service are moot in a market where consumers are very easily able to vote with their feet and switch OTT providers. While such regulation may have been necessary when we only had two network operators providing communication services, it is not clear that such regulation should be imposed on rapidly proliferating OTT providers. Over-regulation of these new entrants may only serve to entrench the position of existing operators and throttle the benefits that arise from increased competition, such as lower prices and more market innovation.”

Ramkolowan and Robb argue that a key principle of regulation is that it needs to be proportionate to the risk of harm to consumers. “Ultimately, each aspect of regulation being proposed for OTT services should be weighed carefully in terms of the cost and benefit to consumers. From an economic perspective, this would be far superior to imposing a blanket approach, simply to appease the incumbent mobile operators.”

They accuse the big operators of directing their lobbying efforts at services that compete with their traditional voice and SMS businesses, saying they’re attempting to use regulation to raise barriers to competition.

“While they have no problem with mobile users accessing high-bandwidth applications [like YouTube], they are looking to preclude consumers from using the same bandwidth to access services which compete with their core business offering.

“For users of these services, this does not add-up — if you are already paying for the bandwidth, why should the operator care what it is used for? And isn’t YouTube ‘free-riding’ on their networks just as much as WhatsApp?”

- This piece was first published in the Sunday Times