Telkom has signalled it’s ready for a serious fight with its bigger rivals, this week taking the wraps off aggressively priced, 4G/LTE data-led mobile packages for both prepaid and contract customers that look set to have its bigger rivals scrambling for a response.

The new packages, called “FreeMe”, are meant to help Telkom’s mobile arm, which has finally reached breakeven after years of investment, increase its market share, which currently stands at just 2,6%, according to independent research.

Signalling a significant market shift away from the voice paradigm of the past, Telkom’s new mobile packages are led by data and include an unlimited mobile data and voice option (for calls to all South African networks; fair-use limit of 3 000 minutes) for R999/month. SMSes – up to 50 a day – are thrown in for free on all packages.

All FreeMe packages, even the entry-level R99/month option that includes 1GB of data and free texts, offer free on-network calls to Telkom fixed lines and mobile numbers (with a 3 000-minute a month fair-use restriction to stop abuse).

Other packages include all the above benefits plus data for R149/month (2GB), R299 (5GB), R399 (10GB), R599 (20GB) and R999 (unlimited). The 20GB and unlimited options also include free calls to all South African networks (not only on-net calls), with a fair-use policy of 1 500 minutes and 3 000 minutes a month respectively.

In a break with bigger rivals Vodacom and MTN, Telkom is also cosying up to so-called over-the-top providers: messaging and voice-over-Internet protocol (VoIP) calls in WhatsApp, BlackBerry Messenger and Viber on the new plans are zero-rated, meaning they won’t come off a user’s data allocation. In effect, then, calls made over the Internet using these apps are completely free of charge to both prepaid and contract users. Telkom intends adding Skype and FaceTime zero-rating only later as integration of the Microsoft- and Apple-owned platforms is more complex.

Attila Vitai, who heads Telkom’s consumer and small business division, said the company wants to be the consumer champion and embracing the likes of WhatsApp and Viber was an essential step in doing this. It’s a change in tack by Telkom, whose regulatory team had previously voiced concern, along with Vodacom and MTN, about the impact of over-the-top providers on the operators’ ability to invest in their networks. The big players have called for the providers to face the same stringent regulations that they do.

Rejigging of radio frequency spectrum is key to Telkom achieving success with the new packages. It is “re-farming”, or reallocating, most of the spectrum it has access to at 1,8GHz from 2G to 4G/LTE. It’s retaining just enough spectrum in the band to continue to serve the few hundred thousand customers who have only 2G devices. Telkom also has access to a big chunk of LTE spectrum at 2,3GHz, but it intends using this for fixed-wireless solutions exclusively in future.

“We are tapping into global trends where people increasingly use a data service to communicate, even for voice,” said Vitai.

He said it’s the first time a South African operator has championed both the cause of prepaid and contract users at the same time.

“We are very conscious that there is disquiet that prepaid customers pay a lot more per megabyte and per minute. Now, if you sign up for a contract, you pay a fixed monthly fee, and if you buy prepaid, the bundle size is the same, but has a 30-day validity,” Vitai said.

There is also no long-term contract tie-in, provided a consumer goes for a Sim-only option or buys their phone upfront. If they elect to take a phone subsidy, they will then be locked in over an agreed period of time while they pay it back, he said.

As an additional sweetener, both prepaid and contract users get free, unlimited data access at 6 000 Wi-Fi hotspots around the country.

Independent analysis published this week by Research ICT Africa shows that Vodacom controls 37,7% of the South African mobile telecommunications market, followed closely by MTN at 36%. Cell C is third at 23%, with Telkom languishing at 2,6%.

But although Vodacom has had a successful year, and MTN has invested heavily in its network to catch up with its bigger rival, it’s Telkom that is best positioned for growth, Research ICT Africa said.

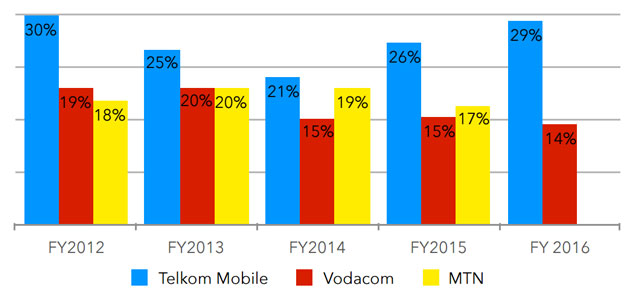

“Telkom Mobile has been especially successful with a strong contract segment: its post-paid share is higher than Vodacom’s and MTN’s. Launched in 2011, within five years it has seen an average total subscriber growth rate of 54,6%/year to 2,7m and has succeeded in reducing its Ebitda loss by 94% between its 2015 and 2016 financial years to just R43m, bringing the operator close to breaking even in the fourth quarter of 2015.” (Ebitda, a measure of operating profit, is short for earnings before interest, tax, depreciation and amortisation.)

Research ICT Africa said Telkom Mobile’s product offering has been “especially dynamic”, even before the introduction this week of the “FreeMe” plans.

“It has offered its post-paid consumers Sim-only contracts and month-to-month payments starting in early 2015 when Vodacom, MTN and Cell C did not offer such flexibility.

“It also offers some of the lowest call rates and the lowest data rates in the country (measured by a 1GB basket and cost per megabyte),” it said.

In the 2016 financial year, Telkom Mobile contributed 12% to Telkom group revenue, “solidifying the group’s place as an integrated telecoms service provider”.

Although Telkom Mobile has by far the smallest share of the market, it has had an outsized impact, Research ICT Africa said.

“Subscriber behaviour suggests that it has had the largest impact in the contract segment where Telkom Mobile is gaining most of its subscribers: it has grown from 579 125 contract subscribers in the 2015 financial year to 794 272 contract subscribers in 2016.”

However, this is still only a fraction of the 4,9m contract subscribers belonging to Vodacom and the 5,2m to MTN.

Per subscriber, Telkom Mobile’s investment is roughly on par with Vodacom’s. However, in absolute terms, its investment is only R660m (2016 financial year) whereas Vodacom and MTN are investing in the billions. “This shows that its scale remains minuscule in the mobile market.”

- A shortened version of this article was originally published in the Sunday Times

- See also: Telkom detonates bomb on mobile rivals and Telkom just turned SA telecoms on its head