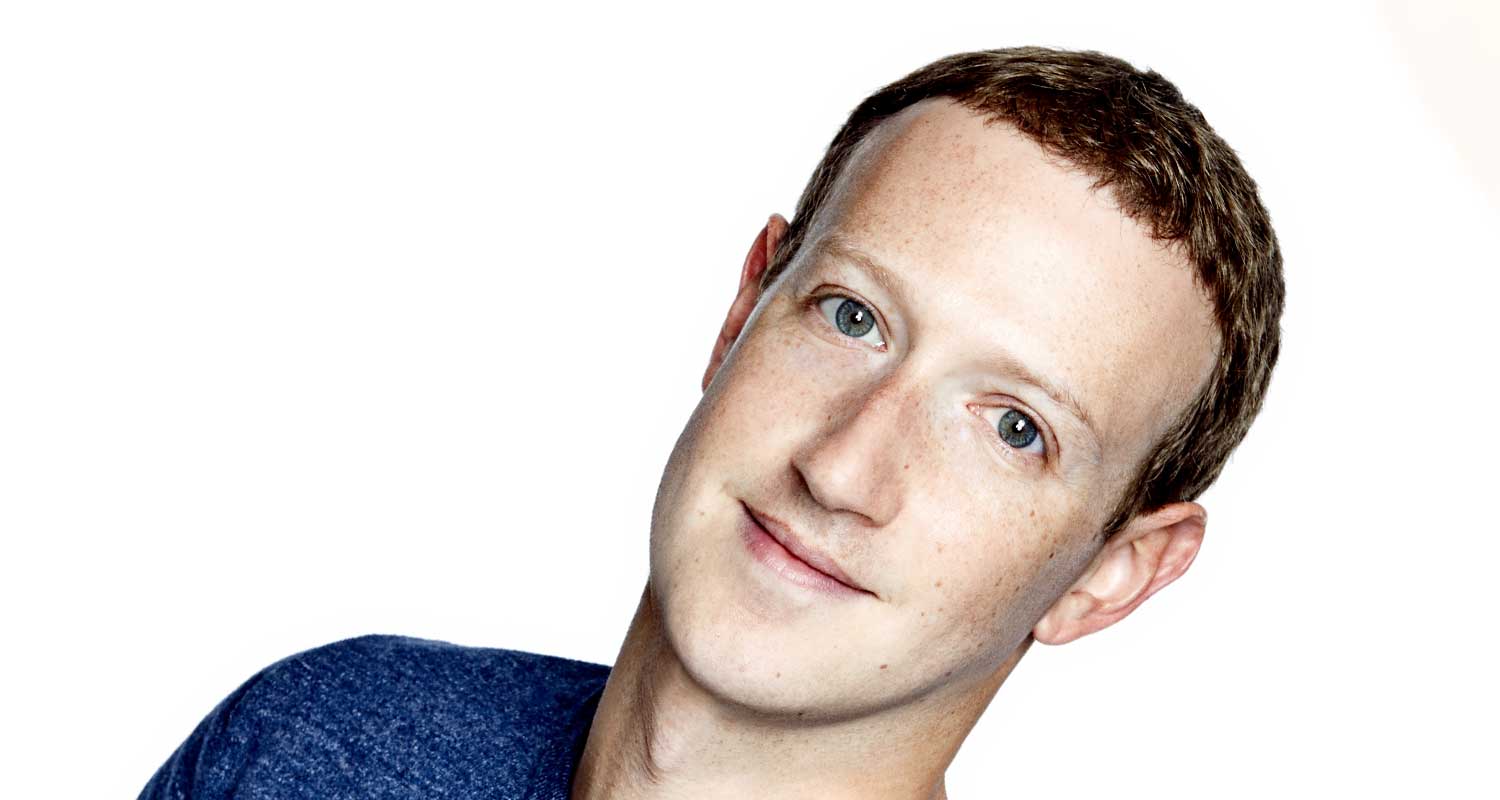

Meta Platforms may have got caught in a downward spiral over the past year, but Mark Zuckerberg seems to be putting it back onto a more fruitful direction, at least for now.

Meta’s decline in ad revenue for the third straight quarter wasn’t as big as expected; there was a US$40-billion buyback for shareholders; and daily active users — Meta’s “North Star” for years — blew past the psychological two billion barrier, according to fourth quarter earnings it announced on Wednesday night.

More importantly, CEO Mark Zuckerberg replaced much of his usual talk about the still-to-be-realised metaverse with pledges about a new era of “efficiency” for Meta, on the heels of slashing thousands of jobs, and a refocus on artificial intelligence, echoing where other tech rivals like Google are placing more of their bets.

Zuckerberg’s obsession with the metaverse and his expensive strategic pivot has put pressure on the company’s stock price, which declined 60% over the last year, and it still looks years away from being a viable business. That’s why it was likely a relief for investors to hear him paying significant attention on Meta’s earnings call to his bread-and-butter business: social media. Along with the buyback this may have helped push Meta’s shares up 20% in after-hours trading on Wednesday night.

Zuckerberg said the company’s AI-discovery engine had helped plays of Reels, its short-form video rival to TikTok, double in just the last six months. “We’re making progress here, and our monetisation efficiency on Facebook has doubled in the past six mothns,” he added. “In terms of the revenue headwind, we’re still on track to be roughly neutral by the end of this year or maybe early next year, and after that we should be able to profitably grow Reels while keeping up with the demand that we see.”

Supreme command

Zuckerberg, who has supreme command of Meta through his majority voting shares, has said he likes being in a position of having to fight against naysayers, and has spoken with conviction and sincerity when describing his vision for the metaverse. That’s admirable, but it has also risked neglecting his fiduciary duty to fellow shareholders. The metaverse should never have become the company’s primary focus. Meta’s attempts to sell virtual reality headsets to employers for work meetings is poorly thought out since, in the rare cases that enterprises are buying such gear, it is for training new recruits — not meetings, for which interacting in VR is still physically uncomfortable for most people.

Zuckerberg should have invested in the metaverse as a long-term research project — which he has admitted is many years in the making anyway — and instead worked on more effectively cleaning up toxicity and misinformation across his apps and on bolstering Meta’s core product, Facebook’s ad business and content feeds. On the latter, Zuckerberg is making progress. He spent the last year investing more heavily in artificial intelligence to help fill the data void created by Apple’s privacy-related changes to iPhones and iPads, which cost Meta an estimated $14.5-billion in lost ad revenue in 2022. By enhancing the machine-learning algorithms used by Facebook’s ad tools, the site is drawing deeper correlations about users to better understand them for targeting, without collecting more data on them.

As Zuckerberg highlighted on Wednesday night, Meta is also trying to use AI to make more effective recommendations on Reels. Last October, the company said during an internal talk that people were spending 20% more time on Reels because of improvements to the company’s algorithms, according to a report in the Wall Street Journal, which was already a step in the right direction. TikTok has grown at great speed in part because its algorithm is so good at predicting what people want to see.

By contrast, Meta’s flagship metaverse offering for consumers is falling short of the company’s own expectations. The social platform attracted fewer than 200 000 monthly active users last October, well below the 500 000 target the company had set for the end of 2022, according to documents reported on by the Journal.

By contrast, Meta’s flagship metaverse offering for consumers is falling short of the company’s own expectations. The social platform attracted fewer than 200 000 monthly active users last October, well below the 500 000 target the company had set for the end of 2022, according to documents reported on by the Journal.

Social media is the most ulcer-inducing business in tech, as Twitter’s new owner Elon Musk has learnt, filled with complex policy decisions and constant agitating from advocacy groups. Zuckerberg has no doubt found it painful to see his mission to connect people around the world become misused and frequently criticised, hence why virtual reality may have become an escape from what he has described as “being punched in the stomach every day”.

Now he appears more willing to concentrate on his core business once again, and even listen to those who are telling him so. That he is the last remaining founder-CEO of the biggest tech firms makes his willingness to take heed of criticism all the more remarkable. Brad Gerstner, who runs Altimeter Capital, told the CEO in an open letter last October that the company needed to “get fit and focused” and pare back its metaverse spending, which will make up 20% of Meta’s costs in 2023.

That sentiment was echoed by Meta’s own chief technology officer, Andrew “Boz” Bosworth in a blog post this week: “We have a core feature offering that is very strong,” Bosworth wrote. But then “a small feature idea comes up that serves a subset of the market … so we indulge. Repeat that thought process a hundred times and you have a cluttered [user interface], a large team, a slow product and no obvious path forward… To survive as a company you must be willing to focus and prioritise.”

Read: Meta shares skyrocket as sales top expectations

Bosworth didn’t cite the metaverse in his post, but he may be understandably frustrated that the company is trying to chase down multiple strategies without first strengthening its core money-printing operation¹.

Meta’s chief marketing officer, Alex Schultz, famously revealed that for years, Zuckerberg looked to Facebook’s daily active users as a measure of the firm’s success, or what he called its “North Star”. Now as that number has hit two billion daily visitors in the fourth quarter, Zuckerberg needs to focus on other important metrics like ad revenue, which has been declining at rates never seen in the company’s history.

Read: Meta-backed 2Africa cable comes ashore near Cape Town

With ad spending expected to stay soft over the next year², Zuckerberg must decide for the long term if it really makes sense to be a metaverse company, or if it should be a short-form video social network instead. The economic climate means either path will be painful, but when ad spending picks up once again, a refocus on the core business will give Meta the momentum it needs to keep going for the long term.

¹ Sheryl Sandberg, who helped build Meta’s ad machine to what it is today, reportedly didn’t attend company meetings in virtual reality ahead of her shock departure last year.

² A survey of ad buyers by Cowan recently showed that companies expect to increase their ad spending by just 3.3% in 2023, compared to 7.5% last year.