As much as US$68-trillion (R1-quadrillion) will change hands between generations over the next 25 years, and much of this wealth will land up in the hands of millennials.

As much as US$68-trillion (R1-quadrillion) will change hands between generations over the next 25 years, and much of this wealth will land up in the hands of millennials.

Millennials don’t shop as their parents did, they don’t consume media as their parents did, and they certainly don’t invest as their parents did. These new-era investors wants to manage their money themselves – they’re DIY investors – and they want to invest in alternative assets, like crypto, far more than previous generations.

A recent survey suggests that two out of three millennials say they believe crypto is becoming a more attractive asset class. According to Charles Schwab research, more than half of all developed market young investors have actively invested in a cryptocurrency, and another 20% believe it is a solid long-term investment choice.

Millennials and cryptocurrency – a perfect match

Millennials own more crypto than any other generation. Another recent study, from Piplsay, found that 49% of millennials polled own cryptocurrency compared to 38% of Gen-Xers and 13% of Gen Z. Millennials are also more likely to adopt the investment as a form of payment, with 53% saying they are “very likely” to purchase products or services with crypto, versus 40% of Gen X polled and just 7% of Gen Z.

This generation is well known as savvy and embracers of all things digital. Even when it comes to investments, most of them prefer doing things online or over an app rather than filling in lengthy paperwork or having to deal with a consultant at their bank branch.

“Millennials are growing natively with Web 2.0 — that is, mobile — and Web 3.0 (crypto) technology,” says Sean Sanders of Revix, a crypto investment platform based in Cape Town, which is backed by JSE-listed Sabvest. “They intuitively understand digital wallets and treasure chests, which are part of many games younger millennials played, such as Fortnite and Minecraft.”

The youngest millennials are 25, while the oldest in the cohort are 40. Sanders also pointed out that some of the younger members of this generation may not have credit cards or bank accounts yet, so they are instantly leveraging crypto wallets to conduct trades and transactions.

What’s interesting to note is that nearly half of millennial millionaires, defined as those having more than $1-million (R15-million) in net worth, have at least 25% of their wealth in cryptocurrencies, according to the CNBC Millionaire Survey. The results highlight a new generational divide in wealth creation from crypto, with younger investors able to earn vast fortunes from the surge in the prices of bitcoin, ether (Ethereum’s native cryptocurrency) and other digital currencies. The importance of crypto to young millionaires could shift the wealth management industry as private banks, brokers and wealth management firms scramble to cater to a new, crypto-heavy clientele.

Early adopters

“Younger investors jumped on crypto early, when it was not as well known,” explains Sanders. “The younger investors were more intellectually engaged with the idea, even though it was new. Older investors and the boomers were largely saying, ‘Is this legit?’

“The funny thing is that we’re still in the early stages of the crypto growth story, and I see many investors asking the exact same questions as I was asking in 2016, namely ‘Am I too late?’, ‘Have I missed out already?’ and ‘Bitcoin’s already so expensive. Is it too late to invest?’ I suspect that people will still be saying this in five years from now, too.”

Being risk averse is a hallmark of the generation that came of age during the financial crisis of 2009, yet affluent millennials are investing in growth-focused assets more than ever before. Specifically, they embrace global investment opportunities that are generally outside of traditional go-to investments.

Betting big on technology

Affluent millennials eagerly embrace disruption, according to an a Edelman report. The report surveyed more than a thousand millennials, who had the equivalent of R2-million in investable assets or an annual income of at least R1.4-million. “Affluent millennials are bullish on new technologies and industry disruptors for achieving their investment goals,” the report said.

Millennials are also putting their money where their mouths are. The most popular millennial stock investments are all tech companies: Apple, Facebook, Amazon.com, Tesla and Netflix, according to Howard Gold of MarketWatch.

Sanders says: “Smart, modern investors with a growth mindset are including single cryptocurrencies like bitcoin and ether as well as our crypto bundles, which are diversified, ready-made baskets of cryptocurrencies, similar to index funds, as a key element in their overall investment portfolio.

“It is clear that wealthier millennials are embracing both risk and technology to their advantage, to grow their wealth even further.”

“It is clear that wealthier millennials are embracing both risk and technology to their advantage, to grow their wealth even further.”

Millennials have several options when it comes to investing in more “standard” type of investments, such as stocks. But, according to Sanders, there are only a few ways for investors to get diversified access to cryptocurrencies. This is why he created Revix, a secure and easy-to-use crypto investment platform that gives newbie crypto investors an easy, responsible and transparent means to access growth-focused investment opportunities. The platform is accessible to everyone, with minimum deposits set at just R500. The fintech has raised over R100-million to date and has over 25 000 users.

“Gaining diversified exposure to a bundle of cryptocurrencies is the most responsible approach to investing in this emerging investment class. You don’t have to pick individual winners, and you don’t have to worry about all the complexity that comes with crypto, such as private keys and cold storage.

“Crypto bundles are also unique in that they automatically rebalance once a month so that customer investments stay up to date with the latest crypto market developments. Top performing cryptocurrencies are included in our bundles, while the poor performers are removed.”

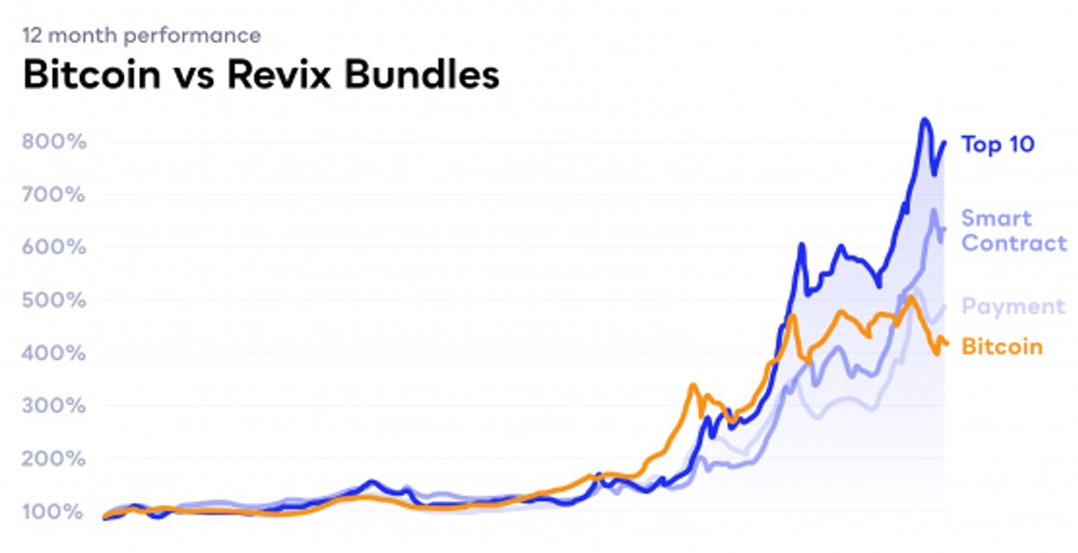

Sanders explains: “The value of diversification is a well-established fundamental of investing, and any way you slice and dice the numbers, a diversified crypto portfolio will give you better risk-adjusted returns and often better absolute returns over time. That has been particularly evident over the last year.

“Diversification works in every asset class in the world. It should come as no surprise that it works in crypto as well,” adds Sanders.

How to diversify using Revix bundles

The Top 10 Bundle is like the JSE Top 40 or S&P 500 for crypto and provides equally weighted exposure to the top 10 cryptocurrencies that make up more than 85% of the crypto market. This bundle has significantly outperformed bitcoin over the last 12 months.

Sanders concludes: “Our main focus at Revix is to make investing easier so that many more people have access and can take advantage of the massive opportunities in today’s markets.”

For more information, visit Revix.

Disclaimer

This article is intended for informational purposes only. The views expressed are not and should not be construed as investment advice or recommendations. This article is not an offer, nor the solicitation of an offer, to buy or sell any of the assets or securities mentioned herein. You should not invest more than you can afford to lose, and before investing, please take into consideration your level of experience and investment objectives and seek independent financial advice if necessary.

- This promoted content was paid for by the party concerned