Is polkadot ready to be awakened and follow the rest of the “ethereum killers”?

Is polkadot ready to be awakened and follow the rest of the “ethereum killers”?

In recent weeks, we’ve seen many of the cryptocurrencies hailed as “ethereum killers” achieving impressive returns, largely because of ethereum’s recent network upgrade that did little to ease high transaction fees and network congestion.

Ethereum has been a victim of its own success as higher network usage came with increased fees and slower transaction speeds.

Will polkadot catch up to these “ethereum killers”, or is it just quietly building an empire in the shadows?

What is polkadot?

Right now, blockchains fall into one of two major categories. They’re either purpose-built and designed for a very specific function, like bitcoin, which was specifically designed as an alternative payment system and store of value.

Or they can be more open and general in their function and can be applied to a wide range of uses, like ethereum or cardano, which can be used for building decentralised applications (dApps) — blockchain-based versions of regular apps, like the ones you get on your phone.

On the other hand, polkadot is a blockchain that provides an environment that other blockchains, known as “parachains”, can run on. It essentially provides the infrastructure that other blockchains can use to interact with one another securely.

Polkadot has been designed with one purpose in mind: to unite an entire network of blockchains, from bitcoin to ethereum to all those other cryptocurrencies you’ve never heard of.

As things stand, developers must choose which blockchain on which to build their applications. Each chain is unique and has its own strengths and weaknesses that developers have to weigh up when deciding where to develop. For example, ethereum has a large network that is robust and easy to use, but it’s relatively slow and expensive, while competitors like solana were built for the prioritisation of scalability.

The problem: Blockchains can’t talk to each other

To understand what polkadot is and why it’s so promising, we need to start by outlining one of the largest problems in the blockchain and crypto space: blockchain interoperability. Blockchains can’t really communicate with one another, which limits crypto’s whole “rebuild the financial world from the ground up” narrative.

If you choose to develop on cardano, you won’t be able to interact with the ethereum blockchain, and you therefore lose the large ecosystem ethereum has to offer.

This is where polkadot steps in, allowing different blockchains to operate seamlessly together at scale. Polkadot allows developers to customise the specific features they want, giving them flexibility to opt into those parts of the polkadot network that suit their project and stay away from the parts that don’t. Furthermore, it enables their project to operate across multiple blockchains, therefore not closing them off to just the blockchain they have built their project on.

Simply put, polkadot acts as a framework for all blockchains that opt in, a bit like how HTML allows websites, browsers and servers to interact with each other. The idea is to take care of messy and costly cryptocurrency mining processes (including validation of transactions and security protocols) and enable developers to focus on creating blockchain-based apps.

Ready for a run-up?

Many were hoping that last month’s hotly anticipated upgrade would solve ethereum’s high transaction fees issue, but all the evidence has pointed to the contrary. With ethereum’s high fees and network congestion still not fixed, the month of August saw many competitors (the “ethereum killers”) gain momentum.

Ethereum is clearly feeling the pressure. Over the last five months, we’ve seen ethereum lose over 20% of its dominance in the smart contract crypto category. This means that, for the first time ever, developers are not only looking for alternatives to ethereum to create their apps, but they are actively using them at an accelerating rate.

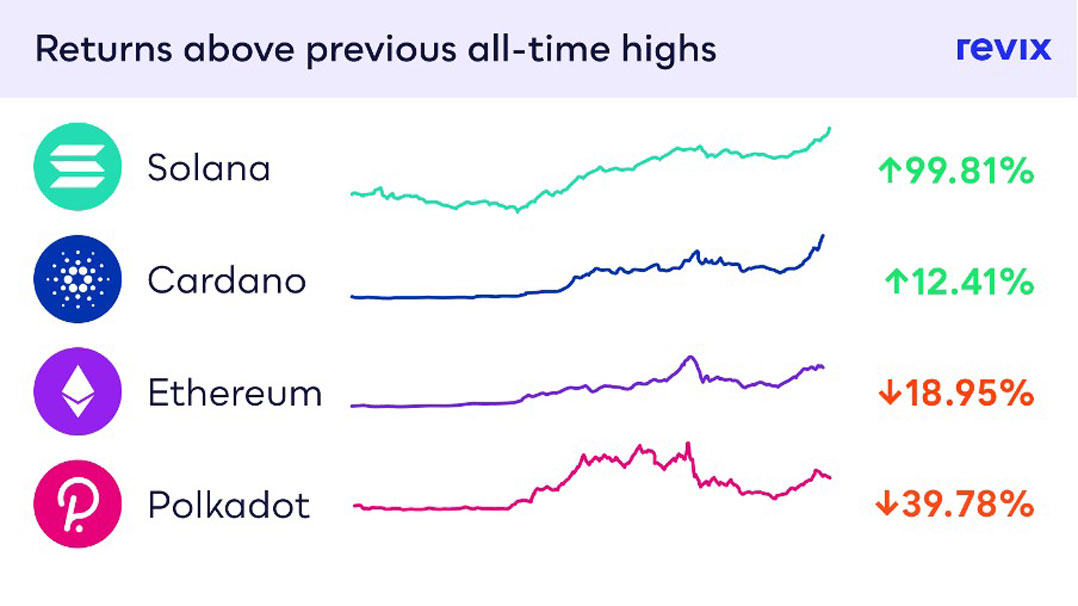

The chart below shows how ethereum and its competitors have performed since their all-time highs in May:

Of the “ethereum killers”, we can see that solana has outperformed, almost doubling since its previous all-time high, while Polkadot is the worst performer as it is still 39% off its record high.

Of the “ethereum killers”, we can see that solana has outperformed, almost doubling since its previous all-time high, while Polkadot is the worst performer as it is still 39% off its record high.

While all the “ethereum killers” have recovered to near all-time highs or greater, polkadot is still lagging.

Will the sleeping giant wake up?

It seems it just did! The recent hype around the polkadot “parachain” auction has sparked the cryptocurrency into life and awoken this multi-chain giant.

How does Polkadot create value?

- Solving for blockchain communication: Blockchains function as separate islands of data with little way of leveraging the information the other networks possess. Polkadot eliminates these concerns through its “multi-chain” network, which enables information transfer between blockchains. This is a valuable function that will be increasingly used in the future of blockchain technologies.

- Solving scalability: Bitcoin only processes between three and five transactions per second, and ethereum between 10 and 15. For context, Visa processes 1 700 transactions per second. This indicates the scalability issue both these cryptocurrencies face. Yet polkadot is a winner when it comes to scalability: It should be able to process up to a million transactions per second!

- An easy way to build custom blockchains: Polkadot allows users to build their own blockchain from scratch using a suite of functionalities while also giving them the freedom to customise anything they need. Custom blockchains can be built within minutes and give users access to polkadot’s security, scalability and interoperability. You are also not confined to write your blockchain logic in a polkadot-specific language as it accepts multiple languages.

Where do I buy polkadot?

Cape Town-based crypto investment platform Revix, which is backed by JSE-listed Sabvest, just added polkadot to its crypto product offering with an enticing fee-free promotion.

Revix will offer zero buying fees on polkadot purchases for one week, from 3 September to 9 September 2021.

Through Revix, you can also gain access to ready-made “crypto bundles”. These bundles allow you to effortlessly own an equally weighted basket of the world’s largest and, by default, most successful cryptocurrencies without having to build and manage a crypto portfolio yourself. They’re like the JSE Top40 or S&P 500 but for crypto.

For more information, visit www.revix.com.

About Revix

Revix brings simplicity, trust and great customer service to investing. Its easy-to-use online platform allows anyone to securely own the world’s top investments in just a few clicks. Revix guides new clients through the sign-up process to their first deposit and investment. Once set up, most customers manage their own portfolio but can access support from the Revix team at any time.

Disclaimer

This article is intended for informational purposes only. The views expressed are not and should not be construed as investment advice or recommendations. This article is not an offer, nor the solicitation of an offer, to buy or sell any of the assets or securities mentioned herein. You should not invest more than you can afford to lose, and before investing, please take into consideration your level of experience, investment objectives and seek independent financial advice if necessary.

- This promoted content was paid for by the party concerned