CIVH, the Remgro-controlled telecommunications infrastructure holding company that owns both Vumatel and Dark Fibre Africa, is talking to local and international investors to raise R6-billion in new funding.

Vodacom Group has held talks to buy a significant minority stake in CIVH, though it’s understood a deal with South Africa’s largest mobile operator, although still potentially on the cards, is not imminent. TechCentral understands from a source who claims to have knowledge of the situation that the parties held exclusive talks about a deal, but that this exclusivity period has since lapsed.

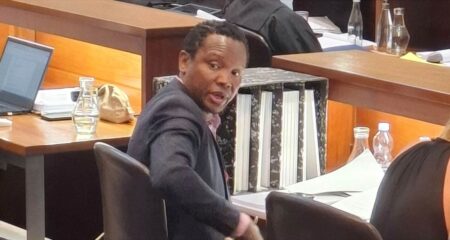

CIVH chairman Pieter Uys — who previously led Vodacom Group as CEO before joining Remgro in 2012, where he serves as head of strategic investments — told TechCentral that CIVH’s management team and its advisors have been working on a R6-billion capital raise process since November last year. (Remgro is CIVH’s largest shareholder, with an effective 54.7% stake.)

“The process was paused in April this year because of Covid and restarted somewhere in the second half of the year,” Uys said, adding that both local and international potential investors have been in discussions with CIVH and its advisors.

Three independent sources told TechCentral this week that Vodacom has held detailed talks with CIVH about a possible investment and that the telecoms group remains keen to invest, particularly given Vumatel’s strong presence in the home fibre broadband market and Dark Fibre Africa’s significant fibre footprint. However, the exact stage of those discussions is not entirely clear at this point.

Vuma in demand

One source said Vodacom was eyeing a 40% stake in CIVH, while another said it was no more than 30%. Though it’s understood the talks are still taking place, there is no guarantee the parties will reach agreement, one source said. A sticking point could be valuation.

Vodacom is believed to have wanted to buy a stake in Vumatel previously, before it was acquired by CIVH. TechCentral reported in May 2018 on speculation that was rife in the telecoms industry at the time that Vodacom was poised then to buy a 49% stake in the company. Ultimately, however, CIVH snapped up the shares and the Remgro-controlled company took full control of Vumatel.

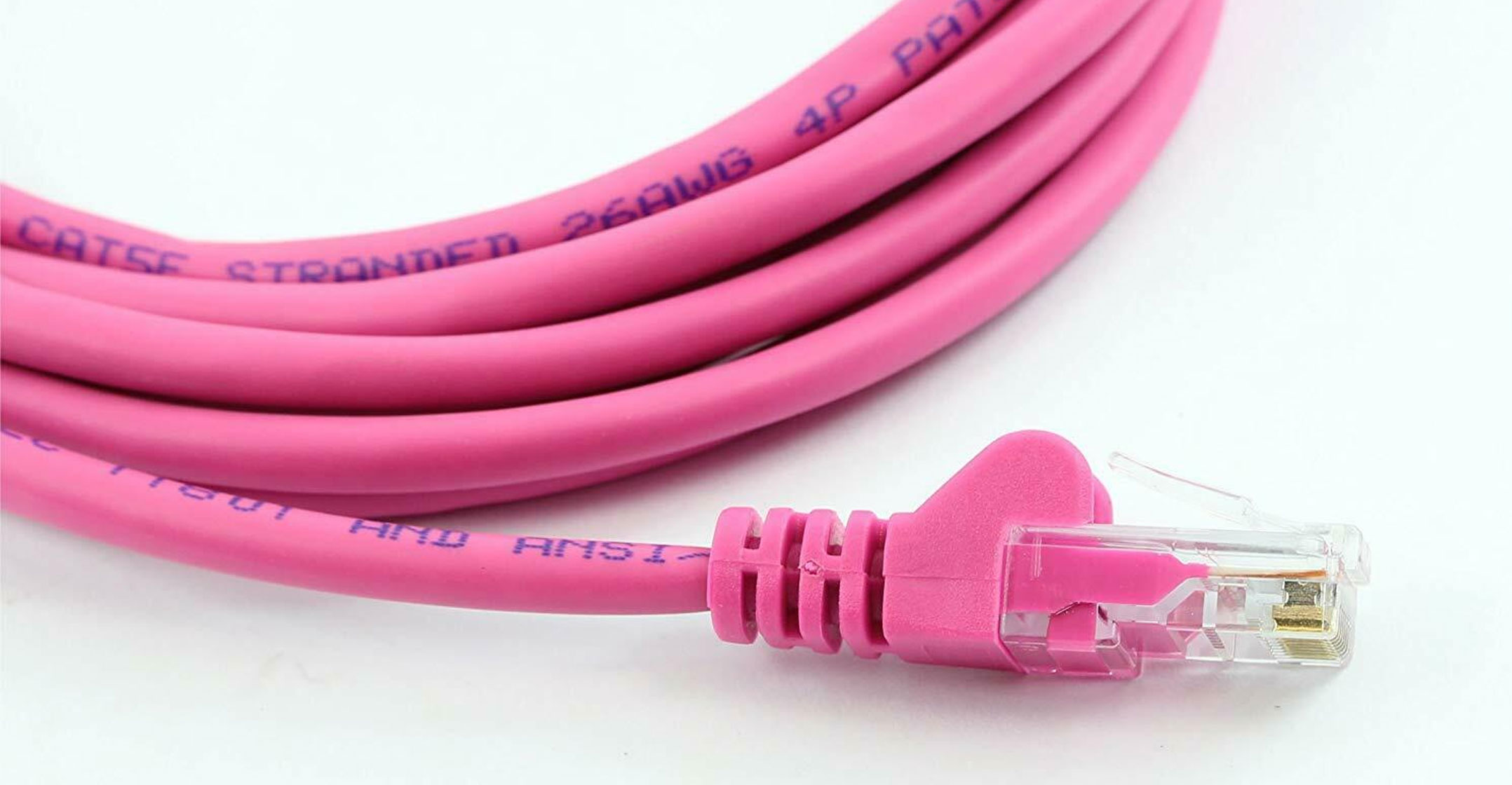

If Vodacom were to make a bid for CIVH, the deal could face stiff opposition at the Competition Commission, especially if it was to take control (which doesn’t appear to be Vodacom’s intention, sources said). It would give Vodacom access not only to South Africa’s largest home fibre broadband network but also DFA’s network of more than 10 000km of fibre-optic cable infrastructure across South Africa, which is utilised not only by Vodacom, but by many of its competitors, including MTN.

If a deal to sell a portion of CIVH goes ahead, no matter who the investor is, it will likely be one of the biggest such deals in South Africa’s ICT industry.

If a deal to sell a portion of CIVH goes ahead, no matter who the investor is, it will likely be one of the biggest such deals in South Africa’s ICT industry.

In a September financial filing, Remgro attached a R19.3-billion valuation to CIVH. The implied valuation gave the telecoms infrastructure holding company an intrinsic value higher than Telkom’s market capitalisation, which was R17-billion at the time of the publication of this article.

Though it reported headline losses in the six months to end-June, mainly on the back of one-off costs, CIVH contributed R608-million in operating profit (earnings before interest and tax) to Remgro, up 150.2% from R243-million in the comparable six-month period in 2019. CIVH’s revenue contribution was R3.7-billion, up a solid 57.7% from the June 2019 six-month period.

CIVH acquired control of Vumatel in May 2019, when it bought the remaining 65.1% of the shares it didn’t already own. Remgro issued a guarantee to Rand Merchant Bank for a loan facility, which was granted to CIVH to fund the Vumatel acquisition. Remgro’s exposure related to this as of 30 June 2020 amounted to R3.3-billion.

Vumatel’s revenue contribution increased by 80% to R1.5-billion compared to the prior year, driven by strong growth in fibre-to-the-home subscribers. However, its results were also negatively impacted by higher depreciation and finance costs driven by the expanding network.

Caught napping

Vumatel, which was founded in 2015 by businessmen Niel Schoeman and Johan Pretorius, has quickly emerged as a significant player in South Africa’s home broadband market.

Telkom, which had dominated the market with slower copper cable connections, was caught napping by the upstart, and was forced to modernise its network and roll out its own home fibre infrastructure, something it had been reluctant to do until then as it was still sweating its legacy copper infrastructure through DSL technology.

Remgro said its 54.7% stake in CIVH had an intrinsic value of R10.6-billion (and a book value of R4.5-billion) at the end of the reporting period in June. This was up from an intrinsic value of R8.4-billion a year ago.

Other than the Remgro controlling shareholding, CIVH has a diverse group of investors, including New GX Capital Holdings, Chlanich, Community Investment Holdings and Consolidated Capital Investments. – © 2020 NewsCentral Media