About a week ago, a rather important event happened in the Internet-of-things (IoT) space. You may have missed it, perhaps because the dry technicalities of IoT is not all that appealing. Intel has quietly discontinued its three SBC boards, the Joule, Edison and Galileo.

SBCs, or single-board computers, are underappreciated marvels. The most popular example is the Raspberry Pi, a credit card-sized computer with enough features to be a standalone system. Give it power, storage (as little as a microSD card), a screen and input device and you have a full-fledged computer.

Developers use SBCs for a variety of projects, ranging from home-built 3D printers to automation at industrial sites. My printer works wirelessly, through the Pi I taped to the back of it. The appeal lies not only in the diminutive size and elegantly small energy footprint. Most SBCs are Linux friendly, so building custom applications or improving on existing open-source systems is convenient and easy.

It does not even need to be technical: I run a media centre on a Raspberry Pi 2, using software I downloaded and installed with just a few clicks. SBCs are also largely behind the Kodi media boxes flooding the market, often running Android as the operating system.

SBCs are perfect for the IoT space: they are cheap, easy to develop for and reliable. So, why would Intel kill off its SBC boards? Is it giving up on IoT? Not quite, but it could be read as an admittance that its IoT strategy has not been working too well.

This is notable, since the chip maker has been investing in several futuristic platforms, including spatial awareness for autonomous drones, eye tracking and augmented reality. It is staking much of its future on being the hardware-software nexus for many of tomorrow’s devices not bound to desktops and laptops, Intel’s stalwart revenue streams.

Hardware

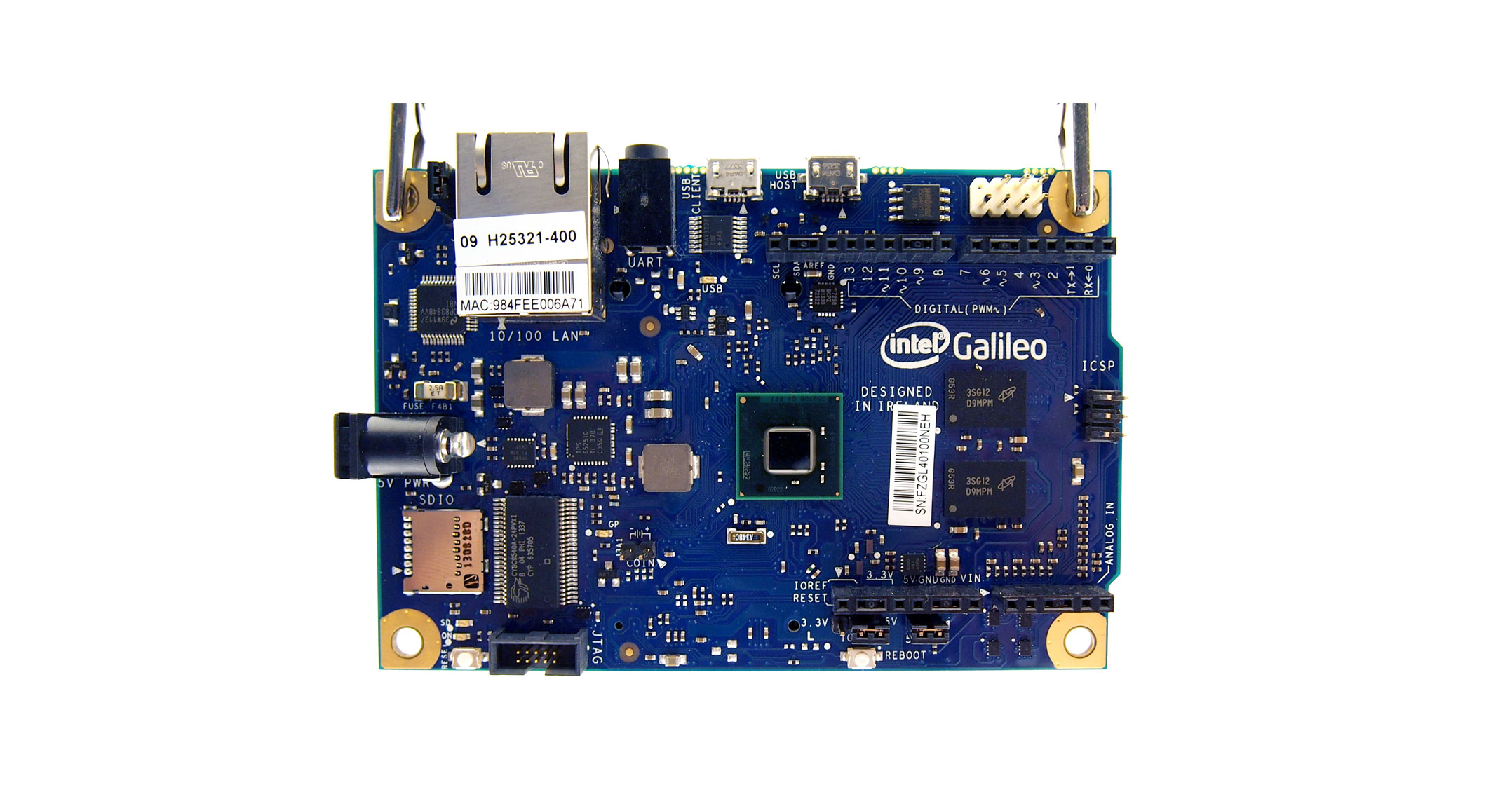

To summarise the hardware, Edison was to be the platform for wearable manufacturers to use, Galileo went after the famous Raspberry Pi’s low-cost computing territory (and was even certified as compatible with Arduino, the other SBC alpha dog), while Joule aimed to be an IoT edge device, namely for smart devices that operate on the outer reaches of networks.

These had been released between 2014 and 2016. They represented the presence of x86 chips in the IoT market, x86 being Intel’s chip architecture. The competition is ARM, the chip maker that has already taken most of the mobile market, much to the chagrin of Intel, which failed to dominate beyond desktop PCs. When ARM and Microsoft mooted a Windows Server version for ARM chips, Intel threatened legal action. It has also responded to ARM by developing several new devices and services, some based on ARM technology. Intel clearly wants a seat at this table.

So, why kill its SBC devices? Intel is not commenting on the move, so that leaves the market to speculate.

According to local IoT specialist IoT.nxt, which I reached out to for comment, a long track record and a commitment to keep components on the market for years are key to viability. Intel never quite came to the party in those areas. Price also dogged it: though some manufacturers of IoT edge and wearables tech found the Intel boards attractive, their prices were not economical in this highly competitive field where every advantage counts.

There are exceptions, such as Amazon using Intel chips to power its Echo devices. But generally speaking — and certainly at the bleeding edge of IoT and smart device development — Intel is struggling to create a presence.

One reason for this, and perhaps the Internet’s favourite theory for the discontinuation, is that Intel didn’t really support the ecosystems for Joule, Galileo and Edison. It produced a lot of documentation, but other support fell short. Consequently, community interest lagged, which is what makes or breaks SBCs. The Pi and Arduino, the two most popular SBC families, can boast colossal communities and close collaboration with the hardware makers. Intel appears to have organised a party it never showed up to.

Some also note that Intel’s SBCs might have contradicted its business model, where it releases new designs and licences those to third parties. To take on the SBC kings, Intel would have to compete far more directly, but this may run counter to its partner relationships.

It may also be a classic case of a large organisation lacking the agility to fight a far more close-quarters bout. Both the Pi and Arduino, as well as many of the other SBCs, come from very humble beginnings, not the vast resources that Intel can throw at it.

Uncompetitive products

The culls could come from a much simpler place: Intel is simply getting rid of uncompetitive products. It also discontinued other products in the announcement, arguably all due to poor returns.

But the most likely reason is a shake-up of its IoT strategy. Late last year, it hired Tom Lantzsch, a veteran from ARM, to oversee its IoT division. There is little doubt his new approach included the discarding of old IoT systems.

It’s a “back to the drawing board” moment of Intel’s IoT, driven by new leadership and no sparing the rod for underperforming products. As the chipset giant seeks to position itself in a world where the new products are not readily using its innovations, Intel needs to crack through to mobile and IoT devices. For the Intel of old, this is an acute problem — not least because Samsung is taking its crown as the world’s largest chip manufacturer. Perhaps there will be an announcement later this year, laying out the new IoT strategy under Lantzsch.

But right now, we’re seeing the bodies hit the floor as it starts cutting the dead wood. Hopefully it will get the rest right as well. That’s important: this is the battle for Intel’s future.

- James Francis is a freelance writer whose work has appeared in several local and international publications