It’s no surprise that 2022 was a memorable year for cryptocurrency markets. Everything that could go wrong did – the year the “black swan” became a common occurrence. Between macroeconomic factors, unstable stablecoins and mismanaged exchanges, there was a lot to take away from this year.

It’s no surprise that 2022 was a memorable year for cryptocurrency markets. Everything that could go wrong did – the year the “black swan” became a common occurrence. Between macroeconomic factors, unstable stablecoins and mismanaged exchanges, there was a lot to take away from this year.

So, let’s review the major events of 2022 and assess the asset class’s outlook for 2023.

The 2022 review

Macroeconomic: inflation, interest rates and war

The year 2022 can be summed up as the year the money printer stopped working and the consequences became clear. A year marked by decade-high inflation rates, soaring energy prices and some of the most significant interest rate increases in history.

How did markets react to this?

Rising interest rates, high inflation and soaring energy prices all do one thing: they take money out of the hands of everyday people.

- Rising interest rates: Increase mortgage and credit card payments

- High inflation: Raises the cost of everyday goods and services

- Soaring energy prices: Feed into higher fuel, electricity and food costs

In other words, a perfect storm for decreasing disposable and investable income…

When you’re in these economic tightening environments, where your disposable income is being reduced on a daily basis, it’s difficult to invest anything, and if you do, investors will seek to preserve rather than grow their wealth. This is why investors will normally shift away from high-risk investments and towards “safe haven” investments.

We can see this effect play out in the stock market.

As of December’s close, the safe-haven asset, gold, outperformed the S&P 500, the riskier (tech-heavy) Nasdaq, and further down the risk scale, bitcoin over the 2022 calendar year.

While cryptocurrencies are the riskier of the above-mentioned assets and indexes, there is more to the cryptocurrency story, and it can explain the performance seen in 2022.

Cryptocurrencies: unstable stablecoins and mismanaged exchanges

The unstable stablecoin

Terra Luna and its algorithmic stablecoin, UST, were once a new and exciting project on their way to becoming one of the largest stablecoins by market cap and the backbone of DeFi. However, a targeted attack on the UST peg caused the stablecoin to decouple from its US$1 value, spiralling both UST and Luna to near zero. An ecosystem worth around $50-billion vanished in a matter of days, causing investors to lose billions of dollars and the overall crypto market to suffer.

Mismanaged exchanges

Out of the Terra Luna collapse came a plethora of bankruptcies. Many mismanaged institutions and funds were either directly or indirectly exposed to the Terra Luna collapse.

Following the collapse, many yield-offering companies, including Celsius Network, Voyager Digital and Three Arrows Capital, had to file for bankruptcy.

FTX

By the end of the winter, crypto markets had begun to level off, with investor confidence returning. FTX, the ostensibly strong crypto exchange led by founder Sam Bankman-Fried, continued to invest in crypto companies, bailed out many Terra Luna distressed start-ups, and was regarded as the source of stability in the crypto market.

But just like that, another black swan hit.

In November, revelations about FTX and sister company Alameda Research’s solvency issues, the comingling of customer funds and strange transactions surfaced. As a precaution, crypto investors began withdrawing funds from FTX, resulting in a classic bank-style run and the demise of the crypto exchange titan. The previously known “pillar of stability” in crypto was insolvent in late November, and FTX filed for bankruptcy protection.

What can we take away from this?

Crypto is still young. Like any new technological advancement, there is going to be volatility. A parallel financial ecosystem is being built, live, in front of our eyes. Of course, there are going to be growing pains, mistakes and failures — but that’s the price of true progress.

While this year has been difficult for crypto, all the failures have been caused by two factors: a lack of regulation and, as a result, greed.

Many people have called for proper crypto regulation in response to the failures and bankruptcies seen in 2022. Without adequate government oversight and regulation, fraud and theft, as well as irresponsible lending and leveraged trading, would not have been possible.

Despite this, crypto is still here, multiple blockchains are still operational, and billions of dollars are being processed every day — the technology is winning.

2023: the year ahead

As we move into 2023, investors should be aware that the current macro environment, confidence in crypto and unclear regulatory frameworks will continue to put pressure on crypto.

While these are issues, 2023 offers a year to solve them.

Regulation

Due to the sheer number of bankruptcies and mishandling of assets, regulators will undoubtedly come knocking in 2023. While some people might not like this idea, regulation is the exact thing needed for true crypto adoption to take place.

Crypto market

The 2022 crypto market has been through it all: scandals, fraud, bankruptcies and greed – and everything in between. Through it all, we’ve seen the power of decentralised finance (DeFi) and how it mitigates counterparty risk. We’ve seen cryptocurrencies like ethereum move towards a greener, less energy-intensive future and how crypto payments are solving the problems of high banking fees and long settlement times.

The power of crypto investments in 2023

Although crypto had a difficult 2022, from an investment and long-term standpoint, there is no asset class that has performed as well as crypto at any time in its history.

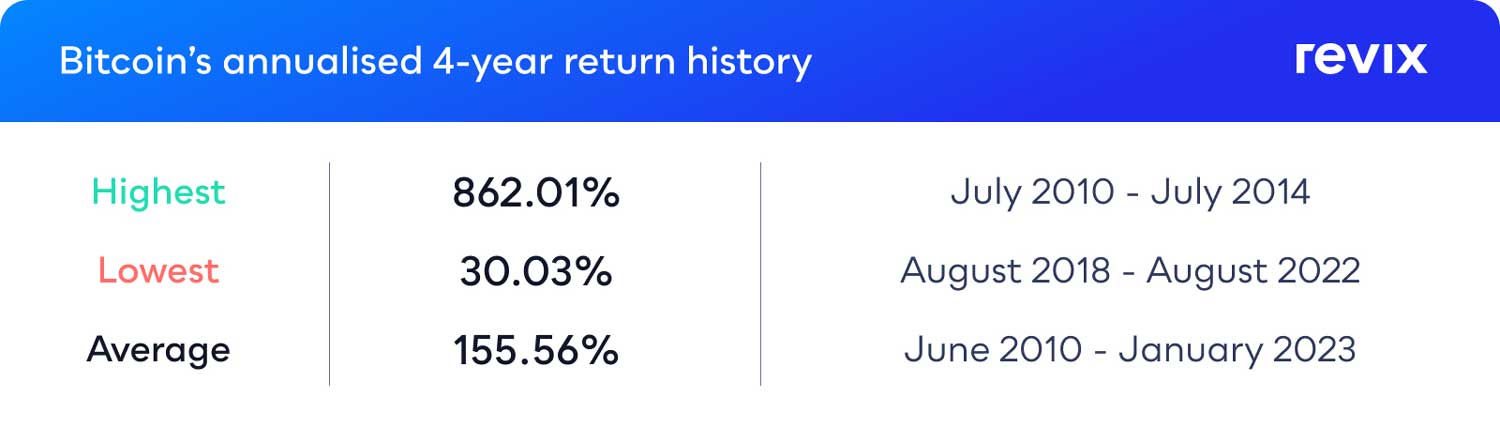

Over the course of its existence, bitcoin has returned an average of 155.6%/year. What demonstrates bitcoin’s true power as an investment class is that it has never had a four-year period of negative returns. Better yet, even in its worst four-year period, bitcoin has managed to deliver more than 30% every year for that four-year period, with its highest being an astounding 862% in one year.

From this standpoint alone, bitcoin proves itself as one of the most powerful portfolio enhancers of our generation.

Conclusion

The 2022 crypto market has felt like a balloon that has been held underwater by bad news and bad actors — but we all know what happens when you release a balloon from under the water: it immediately rises to the top. So, what happens after those bad actors are gone? What happens when bad news becomes good news? And what happens when this asset class finally gets its time in the sun again?

We could find out in 2023.

About Revix

Revix brings simplicity, trust and great customer service when investing in cryptocurrencies. Its easy-to-use online platform allows anyone to securely own the world’s top cryptocurrencies in just a few clicks. Revix guides new clients through the sign-up process to their first deposit and first investment. Once set up, most customers manage their own portfolio but can access support from the Revix team at any time.

Remember, cryptocurrencies are high-risk investments. You should not invest more than you can afford to lose, and before investing please take into consideration your level of experience and investment objectives – and seek independent financial advice if necessary.

This article is intended for informational purposes only. The views expressed are opinions, not facts, and should not be construed as investment advice or recommendations. This article is not an offer, nor the solicitation of an offer, to buy or sell any cryptocurrency.

To learn more, visit www.revix.com.

- This promoted content was paid for by the party concerned