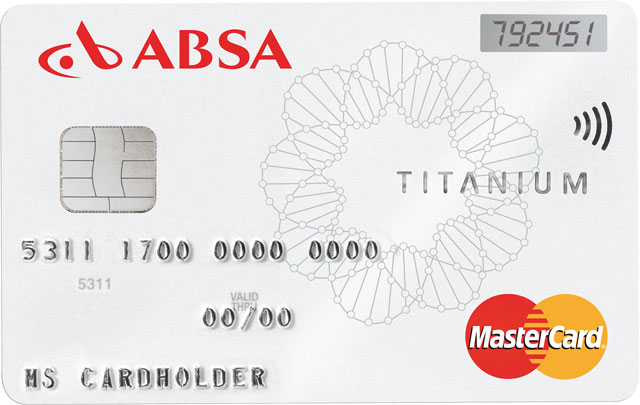

Banking group Absa has launched a product aimed at tech-savvy young professionals. Called Potentiate, it includes a new bank card with a digital display for showing one-time Pin numbers.

The product promises various loyalty benefits and those taking it up can opt to purchase an Apple iPad through the bank, too.

The new card includes “tap-and-go” technology from MasterCard called PayPass. It uses near-field communication (NFC) technology, allowing customers to make low-value payments at retailers that support NFC. The one-time Pins that the card displays are intended for online transactions and for merchants that require it for authentication.

Available to consumers over the age of 18 who earn more than R3 000/month and have a three-year degree, diploma or certificate issued at level six or above of the National Qualifications Framework.

With Potentiate, Absa is going after aspirant, tech-savvy South Africans — a market First National Bank, which offers consumers a range of laptops, tablet computers and handsets at subsidised rates, has done well to target.

Customers opting to take an iPad from Absa will save 15% on the purchase price, whether the device is purchased upfront or paid off over time. The bank is offering only the 16GB Wi-Fi and 3G version of the third-generation iPad.

Absa clients can pay for the tablet in instalments, up to a maximum of 24 months at R232/month. Shorter payment periods can be arranged at higher fixed monthly rates.

The iPad deals include 1GB/month of free data through Vodacom for the first two months, and the bank will deliver the devices at no additional charge. Absa says the offer will later be extended to all of its customers and that this is only the first of its planned device offerings.

“With Potentiate, Absa is positioning itself as a long-term partner with the young professional client,” says retail markets head Arrie Rautenbach.

The product also offers consumers unlimited use of certain functionality without incurring additional charges. “Any free unused transactions will be rolled over for use in the next month and, unlike other competing offers in the market where customers pay a premium for out-of-bundle transactions, Potentiate has no hidden charges,” he says.

“If a customer exceeds the allocated number of transactions on the Potentiate account, no penalties will apply and they will only be charged the normal pay-as-you-transact fee for that particular transaction.” — (c) 2012 NewsCentral Media