The ANC and business leaders are heading for a showdown over how to revive an economy ravaged by the coronavirus and a two-month lockdown to curb its spread.

The ANC and business leaders are heading for a showdown over how to revive an economy ravaged by the coronavirus and a two-month lockdown to curb its spread.

An ANC document dated 22 May proposes encouraging the use of pension funds and the central bank to finance infrastructure spending to drive economic growth. The government should also create a state bank and pharmaceutical company, according to the document, which was drafted by Enoch Godongwana, the party’s head of economic transformation.

Lobby group Business Unity South Africa panned the document on Tuesday, saying it revived “old ideology and dogma” that envisions giving the state a bigger role in the economy, allowing it to tamper with the central bank’s mandate and independence, and enabling it to lend support to non-strategic state companies.

“We need to agree on the structural reforms critical to enable investment, growth and inclusion,” Busa CEO Cas Coovadia said in a statement. “We remain convinced the private sector is best placed to stimulate such economic growth.”

Business groups have played a key role in helping the government tackle the fallout from the virus, raising money to support small enterprises and buy protective equipment and ventilators, and alienating them would bode ill for efforts to reignite economic growth and create jobs.

Jobs bloodbath

Business for South Africa, an umbrella body of business groups, has warned as many as four million jobs may be at risk in an economy where only 16.4 million people worked before the pandemic hit. GDP could contract 7% this year, according to the central bank, the most in at least six decades.

Attracting investment will be imperative to the reconstruction effort, and the task will be extremely difficult in the post-virus period, Busa said. It called on the government, business and labour unions to prioritise the national interest and work together in pursuit of a growth rate in excess of 5%.

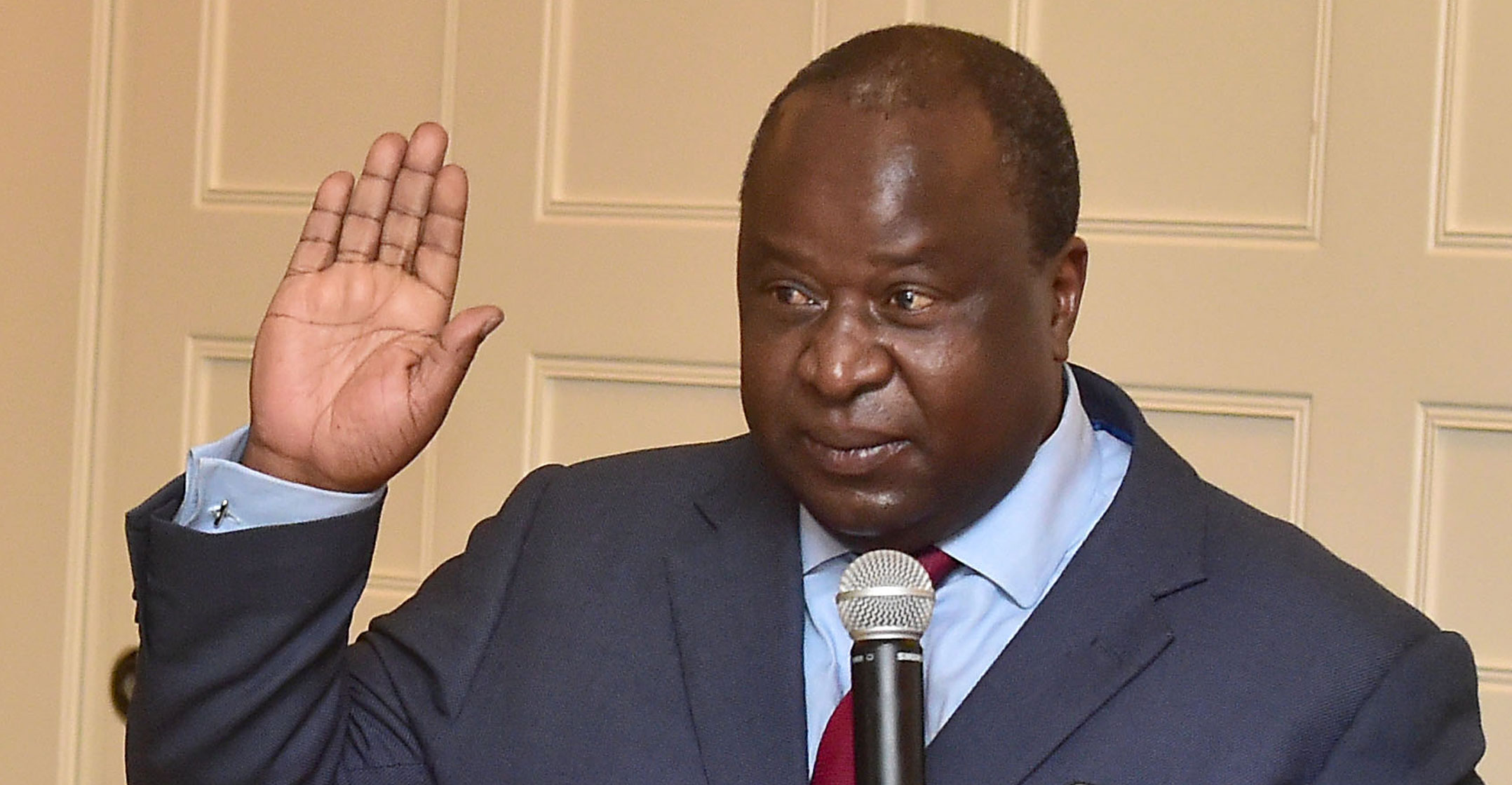

Meanwhile, faced with a budget deficit that’s likely to reach wartime levels, finance minister Tito Mboweni is rebuffing suggestions that the central bank help plug the hole.

South Africa’s budget shortfall is forecast to exceed 10% of GDP in the fiscal year to March 2021 as restrictions to curb the spread of the coronavirus weigh on economic activity and sap tax revenue. The largest gap on record was 11.6% of GDP in 1914, followed by 10.4% in 1940.

Mboweni, a former central bank governor, said on Twitter that he is against printing money and wants the South African Reserve Bank to remain independent. His comments came after Godongwana suggested that the bank help finance development and infrastructure through the creation of a R500-billion fund, while deputy finance minister David Masondo has said he would support direct central bank purchases of government debt.

With GDP set to contract the most in at least four decades, pressure on the Reserve Bank to play a bigger role in bolstering the economy is increasing. However, it has ruled out paying for government spending through loans.

“It would blur the lines between an independent central bank and publicly elected office bearers,” deputy governor Kuben Naidoo said in a conference call on Tuesday. “If we were to finance government directly, there would be no pressure on government to manage their costs in any way.” — Reported by Mike Cohen and Prinesha Naidoo, (c) 2020 Bloomberg LP