The United States went 242 years without a trillion-dollar company. Thirty-three days after getting the first, it now has two.

And while Apple lumbered through the final stretch, needing 15 months to traverse the last US$200-billion, Amazon.com covered it in a three-month sprint. The $440-billion in market value it has created in 2018 alone exceeds the value of all but five S&P 500 companies.

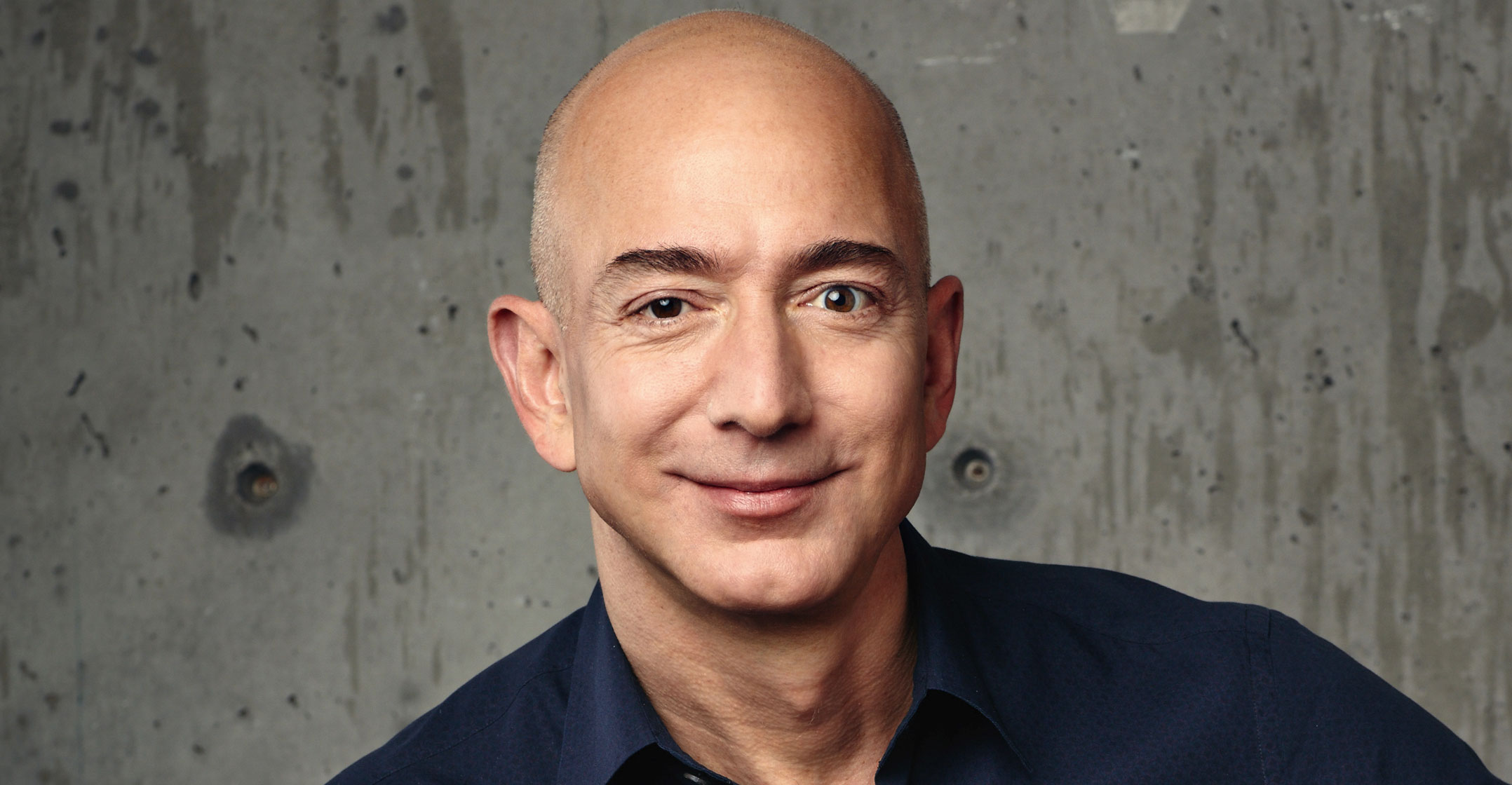

Jeff Bezos’s online superstore rose as much as 1.9% to $2 050.50 in New York, sending its capitalisation above $1-trillion for the first time. Apple passed the 13-digit boundary on 2 August. Two other companies, Microsoft and Google parent Alphabet, are within $170-billion of the goal.

“I never would have thought at $200 that this would be a $2 000 stock,” said Jason Cooper, a money manager who helps oversee $4-billion including Apple and Amazon shares at 1st Source Investment Advisors in South Bend, Indiana. “At $300, I thought we missed the boat. Boy, was that wrong.”

Through trade wars, unprecedented market volatility, rising interest rates and stock market stress in China, Amazon’s share performance has been as close to straight-up as could be in 2018. It’s had one down month — March — all year, with the average gain in the other seven standing at 9%.

It’s another display of might for technology companies grown on America’s West Coast, a cohort of mega-caps whose relentless appreciation has come to be known as the Faang rally. Along with Facebook, Netflix and Google, the quintet have created $2-trillion in equity value in three years.

From a valuation perspective, Amazon and Apple reflect distinct judgments about what constitutes value in the stock market. Apple may earn more than $58-billion in its 2018 fiscal year, the fruit of maturing franchises in everything from mobile phones to PCs. At about 19 times projected profit, the company is huge and also relatively cheap. Back out the $244-billion in cash and cash equivalents Apple had at the end of its fiscal third quarter and it’s even cheaper.

Amazon’s a different animal, a retail behemoth that maniacally held down profit margins for all of its 24-year existence and is expected to earn a relatively paltry $8.5-billion in 2018. That’s good for a price-earnings ratio of 120 — a sign of the huge faith Wall Street puts in Bezos to execute over time.

‘Could be irrational’

“This is a company that has pioneered e-commerce, and has visionary leadership — they’ve done an amazing job of dominating their niche and successfully expanding,” said James Angel, professor at Georgetown’s McDonough School of Business. “It could be irrational. It could be the market getting carried away. But the market usually knows more than I know.”

For now, the rapid ascent is a validation of the growth-at-all-costs ethos that has defined Bezos’s vision. While the conversation around Apple has shifted from iPhones to sales of apps and music streaming subscriptions, Amazon has relentlessly expanded into new markets, from groceries to data centres. The Seattle-based company’s revenue is growing at a better than 30% clip, more than twice that expected from Apple this year.

Of course, Amazon.com is the younger of the two, having been founded in 1994, a good 18 years after Apple. In addition to slower growth, the maturity of Cupertino, California-based Apple shows in its governance, which is bent on returning profits to shareholders. Apple has doled out more than $275-billion as dividends and buybacks since 2012.

In contrast, Amazon, which has never paid out a cent through either route, generates relatively little in the way of profits and continues to invest heavily in its businesses. Capital expenditures, or spending on physical assets such as warehouses and equipment, jumped to nearly $12-billion in 2017, up from $7.8-billion the year before.

In contrast, Amazon, which has never paid out a cent through either route, generates relatively little in the way of profits and continues to invest heavily in its businesses. Capital expenditures, or spending on physical assets such as warehouses and equipment, jumped to nearly $12-billion in 2017, up from $7.8-billion the year before.

That spending has helped fuel growth in business like Amazon Web Services, which is much more profitable than Amazon’s core retail operations. The company’s cloud computing operations and other high-margin businesses such as advertising will account for about 22% of total revenue in 2018 and could generate as much as $45-billion in operating profit by 2020, Morgan Stanley said in a research note on 29 August.

Perhaps because of that, the retailer gets a slight edge in analyst adoration. While its number of followers is roughly in line with Apple, the proportion of analysts saying buy Amazon is the highest among tech mega-caps. On a scale from one to five where higher is better, Amazon has a consensus recommendation of 4.8. This compares to 4.5 for Facebook, 4.1 for Apple, 4.7 for Google, 4.1 for Netflix and 4.7 for Microsoft.

Other metrics paint a less divergent picture. Both companies are trading in the neighborhood of four times sales, and using a valuation lens that adjusts the price-earnings ratio for the rate of earnings growth, the two are traded at about the same multiple. — Reported by Jeran Wittenstein and Lu Wang, with assistance from Sophie Caronello, (c) 2018 Bloomberg LP