More than 50% of First National Bank customers now tap to pay at the point of sale (POS), marking an extraordinary rise in contactless payments technology since the Covid pandemic struck in 2020.

More than 50% of First National Bank customers now tap to pay at the point of sale (POS), marking an extraordinary rise in contactless payments technology since the Covid pandemic struck in 2020.

FNB said on Wednesday that the use of chip-and-Pin payments, where a customer inserts their bank card into a POS terminal, is declining rapidly.

“On credit cards and Fusion accounts, card swipes account for less than 1%, while contactless is more than 60% of all transactions,” the bank said.

“Consumers have shown a strong preference for contactless payments using their contactless-enabled cards or smart devices,” said FNB Card head of spend and customer value management Ashley Saffy in a statement.

“One of the key reasons is that contactless payments are more convenient and faster than swiping or inserting your card. They also provide a higher level of security, as they use near-field communication technology, which is less vulnerable to fraud than traditional contact-driven payment methods. Additionally, the Covid-19 pandemic accelerated the shift towards contactless payments, as they do not require physical contact between the customer and the POS.”

Read: Tap-to-phone transactions could shake up SA payments space

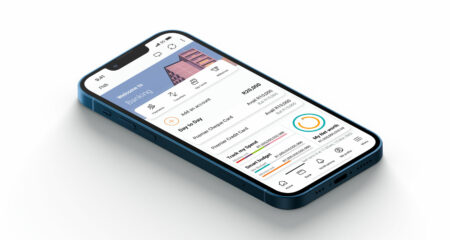

South Africans are not only using their contactless bank cards for payments, but also a wide range of digital card wallets, FNB said. These include FNB Pay, Apple Pay, Google Wallet, Samsung Pay, Fitbit Pay, Garmin Pay and Swatch Pay. – © 2023 NewsCentral Media