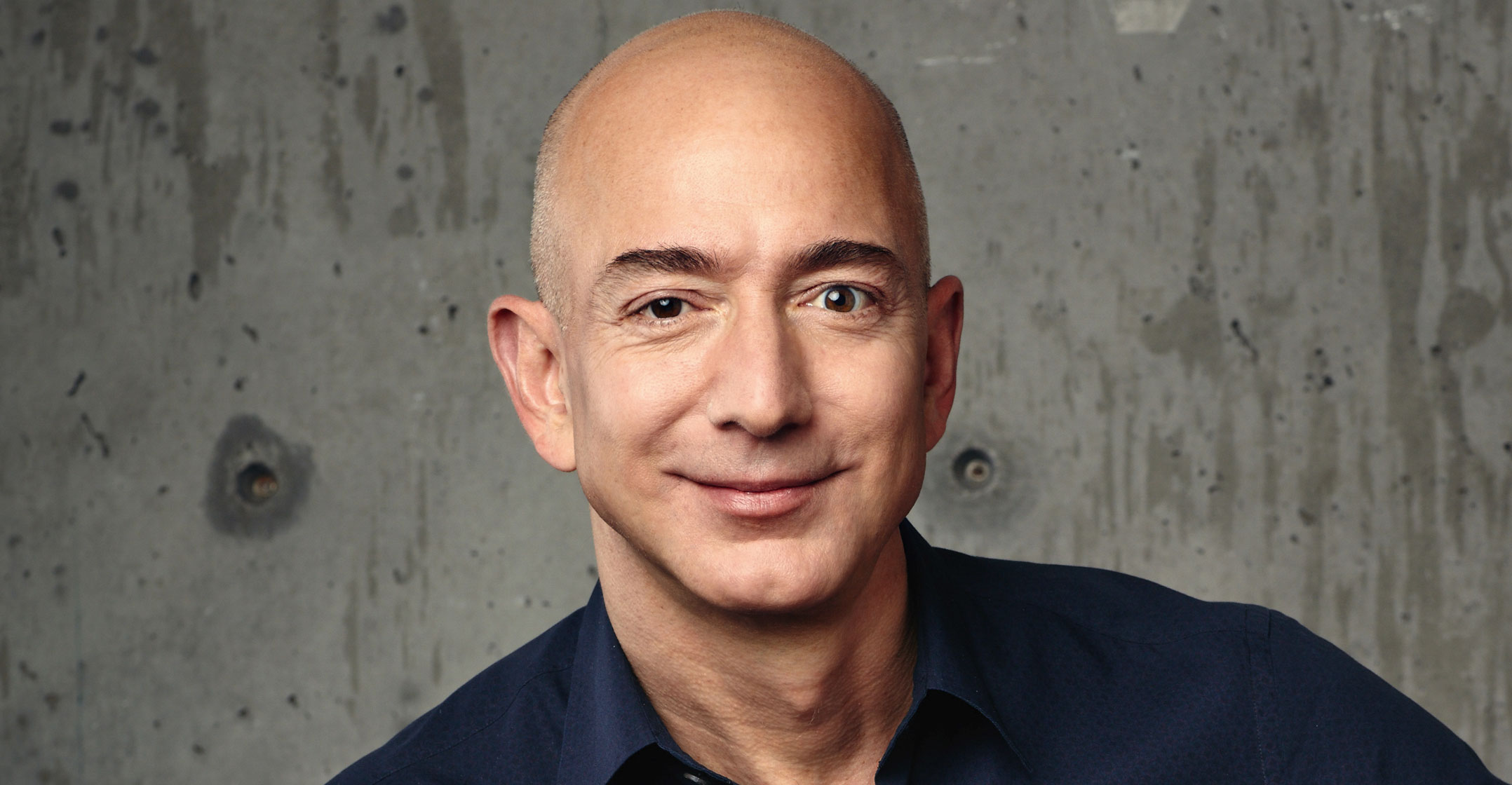

Banks around the world have spent the past few years preparing for competition from small, nimble technology start-ups. It turns out the real threat may be Jeff Bezos.

Financial institutions have parried the threat from fintech firms by incorporating some of their innovations through partnerships and in-house coding teams, according to McKinsey & Co. In its annual banking report, McKinsey said that the industry needs to continue its digital makeover to protect the up to 40% of revenues at risk by 2025 and prepare for competition from so-called platform companies like Bezos’s Amazon.com.

“We thought that fintechs would provide the chief digital threat,” authors of the report said. Instead, it’s become clear that e-commerce companies such as Amazon and Alibaba Group “are reshaping one industry after another, blurring sector boundaries as they seek to be all things to all people”.

Bezos, the founder and CEO of Amazon, built the company into the world’s biggest online retailer. As he extends Amazon’s reach, the Seattle-based company has had discussions with banking regulators about financial innovation, according to lobbying disclosures reviewed by American Banker. And it already has a small business lending arm that has doled out more than US$3bn to more than 20 000 of the merchants on its e-commerce platform.

American technology giants including Google and Facebook have already begun to encroach on finance activities like payments, McKinsey said, and concern is spreading through the boardrooms of traditional lenders. Barclays CEO Jes Staley said at a conference this month banks need to defend their turf and predicted payments will become “where the battleground of finance is fought over the next 15 years”.

In Asia, firms like Alibaba have made the most headway. Digital upstarts in China have grabbed huge chunks of market share from banks, including 25% of unsecured consumer lending and 12% of mutual fund sales.

Under pressure

“You have companies that have hundreds of millions of customers, offer a great customer experience and trade at a currency that rewards revenue, but not necessarily profit growth,” Asheet Mehta, one of the authors of the McKinsey report, said in interview. “They are under pressure to keep increasing revenue, and financial services is a large pool they can go after. We’re starting to see that.”

In McKinsey’s vision for the future, tech companies will reorder global commerce into ecosystems in which giants provide a variety of products and services through a single gateway. Banks will still have opportunities in this new order because they are trusted by customers and hold vast data sets about retail and corporate transactions, according to the consulting firm.

The global banking industry, which had an 8.6% return on equity last year, could offset the loss of profits from price competition by partnering with platform companies and generating more revenue from their data. Banks that go further by creating their own platforms could elevate their ROE to 14%, according to the report. ROE is a measure of profitability.

Bankers in Asia and parts of Europe and Latin America are much more worried than their counterparts in the US, Mehta said. While American bank executives often cite heavy regulation as a barrier to entry against technology firms, the position of regulators could evolve to create a more level playing field, according to the report.

Even without that, as technology giants build out their consumer ecosystems in the US, they could offer things like cross-border transactions and payroll services through established providers, Mehta said.

“There’s no reason they can’t offer deposits,” Mehta said. “They could have bank providers in their mall, like they do with lots of other merchants. If anybody wanted to not have a bank charter, that is one way you would do it.” — Reported by Hugh Son, with assistance from Stephen Morris, (c) 2017 Bloomberg LP