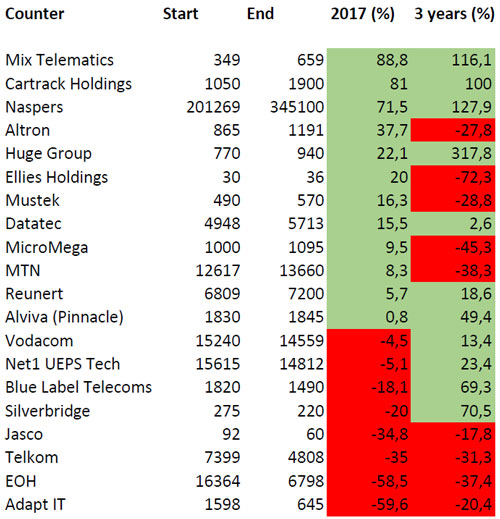

Mix Telematics was the best performing technology share on the JSE in 2017, TechCentral’s annual analysis of share price performances shows. The company, which provides fleet management and vehicle tracking services, saw its share price jump by more than 88% between 1 January and 31 December.

Its rival, Cartrack Holdings, also had a barnstorming 2017, which its share price climbing by 81%. Over three years, Mix Telematics and Cartrack have risen by 116,1% and 100% respectively, far outperforming the overall market.

The other big winner in 2017 was global Internet and media giant Naspers, which, despite its size, added an impressive 71,5% in the year — at one point touching a new record high above R4 000/share — driven mainly by its 33% stake in China’s Tencent Holdings.

Altron, up 37,7% on the continued turnaround now led by new CEO Mteto Nyati, and telecommunications specialist Huge Group, up 22,1%, rounded out the top five performers of the year. Over three years, Naspers and Huge Group have added 127,9% and 317,8% respectively, while over the same period, Altron has fallen by 27,8%.

Making up the rest of the top 10 were Ellies Holdings (up 20%, but down 72,3% over three years), Mustek (16,3%), Datatec (15,5%), MicroMega (9,5%) and MTN (8,3%).

MTN was the best performer among the big telecoms operators, handily beating Vodacom’s negative 4,5% return. Telkom’s share price had a shocking year, falling by 35%.

The worst performer in 2017 was IT services group Adapt IT, which was punished after investors took fright at slower organic earnings growth. EOH also had a torrid time in 2017, falling by 58,5%, but recovering off its worst levels of the year below R30/share.

Over a three-year period, companies that have delivered strong performances include Mix Telematics, Cartrack, Naspers (up 127,9%), Huge Group, Blue Label Telecoms (up 69,3%) and Silverbridge (up 70,5%). — © 2017 NewsCentral Media