On 15 June, First National Bank will become the first major banking brand in South Africa to launch a mobile virtual network operator and take on South Africa’s incumbent mobile operators.

Years in the making, FNB is hoping to sign up hundreds of thousands of its clients to the new service, which will offer both prepaid and post-paid products. The service is available only to FNB customers.

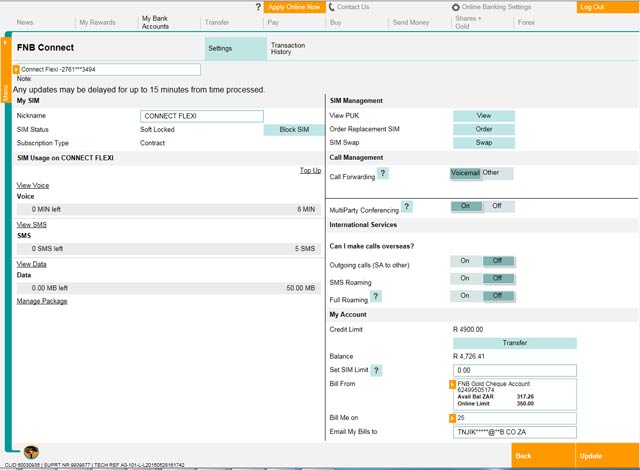

The bank, which has been running a pilot since last November with thousands of its employees, will integrate its mobile offering — to be branded FNB Connect — tightly with its online and cellphone banking platforms and with its eBucks rewards programme.

TechCentral has been testing the network under a non-disclosure agreement and embargo since earlier this week. The NDA was lifted on Thursday after another website published leaked information before the official launch, which was set for next Tuesday.

[View FNB Connect’s full pricing]

In a detailed interview with TechCentral earlier this week, FNB Connect CEO Ravesh Ramlakan explained why the bank has decided to enter South Africa’s competitive mobile market with an offering of its own.

Ramlakan said FNB has been selling a wide range of telecoms products for some time. Indeed, the company has its own telecoms licences from communications regulator Icasa.

“We already sell prepaid airtime top-ups, cellphone contracts, devices, voice over IP, 3G data rewards, etc. After we analysed it, we realised the most obvious thing to do next is to offer our own Sim where we can control the customer experience,” he said.

“We have over 2m people topping up airtime with us and have sold over 250 000 devices to date. This stuff is not new to us.”

It’s taken a long time to bring the product to market, though, because, he said, the bank wanted to ensure there was deep integration with its online banking systems and to ensure the product was ready to bring to market.

It has developed its own billing and support platforms. This required complex back-end development, Ramlakan said. The system is fully integrated with FNB’s mainframe-based core banking platform, Hogan.

Ramlakan denied suggestions that the reasons for the delays in launching the offering were because of concerns about the quality of partner Cell C’s network.

Cell C has previously admitted it has had problems, especially in Gauteng, but said recently that these issues have now been resolved.

“We’ve been testing it from November with a few thousand staff around the country and the response has been quite positive,” Ramlakan said.

He emphasised, however, that FNB is not tied to one partner network. “Our platform is network agnostic and we could easily put another operator in there in future.”

Though both Vodacom and MTN have resisted working with third parties to launch MVNOs, Ramlakan believes the launch of FNB Connect could prompt a change in approach.

“The incumbent operators are always resistant, but once you take one and launch, the other guys become more amicable to it,” he said.

FNB has access to Cell C’s full network, including its 2G and 3G infrastructure. It will also have access to its 4G/LTE network when this is launched later this year.

When customers apply for an FNB Connect Sim, the bank is able to do customer scoring on the fly, Ramlakan said. Customers also do not need to Rica their Sims as FNB already has that information through the Fica regulatory process.

Key to FNB’s offering could prove to be its tight integration with eBucks, FNB’s very successful loyalty rewards programme. FNB Connect users will get between 15% and 40% of their mobile spend back in the form of eBucks, depending on the rewards level they are on.

Ramlakan said FNB Connect is not meant as a profit centre for the bank, but rather as a means of rewarding customer loyalty and attracting new customers.

In a pointed departure from the approach to contracts taken by South Africa’s two big mobile operators, FNB will separate the cost of the Sim and airtime from the cost of the device.

Customers will pay separately for each. They can use either their own device, or buy one from the bank, which they can then pay back over a period of time.

Prices are in line with what’s available from other operators, with the prepaid per-minute charge set at 95c/minute (on per-second billing). Prepaid data is a pricey R2/MB, but FNB, like other operators, wants to encourage users to buy data bundles.

Prepaid users get 50MB of free data per month, but to be eligible they must register their FNB Sims for inContact or cellphone banking or have a cumulative monthly airtime spend of at least R35.

The bank is also offering month-to-month contract plans called Flexi, where users can choose their own bundles of voice, data and SMS to build a package suitable to them.

The Flexi plans will also allow customers to use the FNB Banking App to make free calls to other app users and pay 39c/minute for calls to someone on another network. These calls are placed over the Internet, so a good quality connection is needed and data charges will apply.

Ad hoc voice bundles started at R35 for minutes and go up to R700 for a thousand minutes. It’s R140 for 200 minutes and R245 for 350 minutes.

Ad hoc data bundles start at R15 for 50MB and go up to R245 for 2GB. 100MB (R28), 300MB (R75), 500MB (R95) and 1GB (R145) are also available.

FNB is also offering a 24-month Connect Data contract, with prices started at R35/month for 500MB and going up to R245/month for 5GB (plus an additional 5GB for use between midnight and 5am).

Customers manage their Sims and their telecoms spend through the FNB website, where a new tab will give them access to a range of telecoms features. The head of a household, for example, will be able to manage all the Sims in a home and what limits apply to each.

If someone misplaces a Sim, they can block it with the click of a button. If they then find it again, they can log on and reactivate it. Sim swaps can also be done online, with the new Sim delivered free of charge.

Those wanting to port their number from another network can do this automatically without the need for any paperwork, Ramlakan said. Porting can take up to 24 hours, but is usually done in about four or five hours.

The system also provides real-time billing through the website on all Sim types, including prepaid.

Prepaid users can elect to top up automatically by a set amount to avoid calls being cut off because they’ve run out of airtime. This can be set up for data as well.

Ramlakan said FNB is targeting those with an income of between R100 000 and R500 000 per year.

“For launch, we want to focus on the middle-income market and test our volumes for sales distribution. More products will come after launch,” he said. – © 2015 NewsCentral Media