As the Covid-19 pandemic enters a “new and dangerous phase”, the price of safe haven gold is approaching its highest since 2012 — but one big investment bank thinks the economic response will soon see the yellow metal swell to its highest price ever.

As the Covid-19 pandemic enters a “new and dangerous phase”, the price of safe haven gold is approaching its highest since 2012 — but one big investment bank thinks the economic response will soon see the yellow metal swell to its highest price ever.

What does this mean?

With central bank interest rates leading to poor returns from income-paying investments like your bank savings account and government bonds, gold’s price is now up 15% this year — sitting just below levels last seen eight years ago.

With Brazil, the US and South Africa at the forefront of a record daily increase in coronavirus cases, and more details emerging of China’s confrontational new security law in Hong Kong, investors may be feeling less optimistic about a V-shaped global economic recovery.

With Brazil, the US and South Africa at the forefront of a record daily increase in coronavirus cases, and more details emerging of China’s confrontational new security law in Hong Kong, investors may be feeling less optimistic about a V-shaped global economic recovery.

Derivative traders, who bet on the future movement of gold prices, are at their most positive position in a month. And they’re not the only ones. Investment bank Goldman Sachs is predicting gold will hit a record high of US$2 000/ounce within 12 months: in other words, gold is set to rise another 15% from its present position.

For those sadly lacking a gold bullion vault, Revix, the fintech backed by JSE-listed Sabvest, offers a simple and cost effective way to invest in gold.

Through Paxos Gold — a regulated and insured cryptoasset — you can invest in gold with as little as R500 and not have to worry about the custody and insurance burdens of physical ownership.

Revix offers a modern and effortless way to own physical gold that allows you to sell your gold investment whenever you choose — whether that’s in a couple hours or many years’ time. One PAX Gold token is backed by one fine troy ounce of the highest quality gold stored in high-security, fully insured vaults.

What’s driving the rush to gold?

Gold is a safety net in times of economic uncertainty and it acts as a hedge against inflation thanks to its limited supply and long trading history. So, unlike central banks who are printing money at unprecedented levels, gold’s supply remains steady.

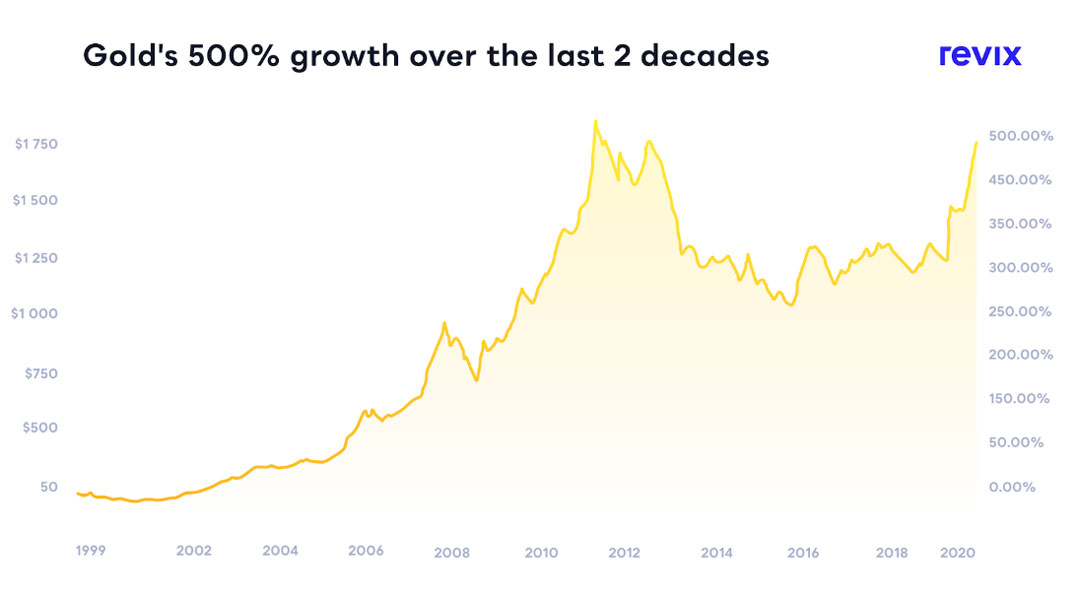

This means gold acts as a rand hedge and is widely recommended as part of a diversified portfolio. It’s one of a handful of investments with a positive return in 2020 — gold prices are around $1 780/ounce and have gained 15% so far in 2020 and 34% over the past 12 months.

Sean Sanders, CFA Charterholder and CEO of investment platform Revix, said: “The unprecedented printing of money by governments is why it’s critically important today more than ever to hold inflationary hedges like gold in your investment portfolio.

“Investments like gold can protect your hard-earned savings at times like these, meaning they will hold their value, or increase in value, rather than lose value like currency does when inflation occurs.

“We’ve seen record customer sign-ups over the last few weeks as many of our new clients realise that with no monthly account fees we can offer them substantially lower costs than elsewhere else. Additionally, South Africans are seeing their hard-earned rand savings going up in smoke and want investments that strengthen when the rand weakens.”

Invest in gold risk-free with Revix

Revix is also offering customers a remarkable gold investment offer for the last week of June. Sign up to Revix using the code GOLD and they will fully guarantee your gold investment for one week.

At the end of your risk-free period, if your investment has increased in value, the profits are all yours. If your investment declines below the amount you deposited, Revix will top up your account back to its starting value. You are then welcome to withdraw your investment at any time after the promotion is complete.

Invest in gold risk free with Revix

About Revix

Revix brings simplicity, trust and great customer service to the investing space. Revix’s easy-to-use online platform enables anyone to own the world’s top assets in just a few clicks. Revix guides new clients through the sign-up process, to their first deposit and first investment. Once set up, most customers manage their own portfolio, but can access real-time support from the Revix staff at any time. For more information, please visit www.revix.com.

- This promoted content was paid for by the party concerned