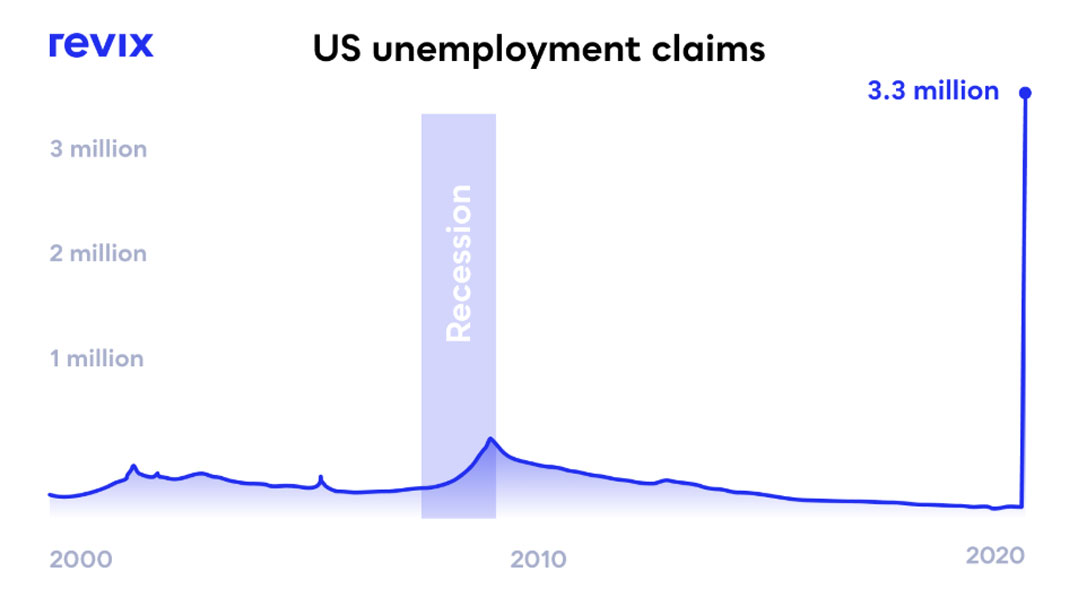

A decade’s worth of US job gains has now been wiped out in under two months. The latest jobs losses are the worst monthly figure on record.

A decade’s worth of US job gains has now been wiped out in under two months. The latest jobs losses are the worst monthly figure on record.

In South Africa, the economic outlook is also worsening, with Investec saying 50% unemployment is possible and that 54% of businesses may no longer exist by the end of the year if the lockdown continues. A GDP contraction of over 14% for 2020 is now a real possibility.

So, what have governments done?

So, what have governments done?

This year, a total of $3.9-trillion (6.6% of global GDP) has been magically created through quantitative easing. What’s crazy is this figure is expected to go as high as $5.3-trillion by year-end.

Why is this a problem?

A rising currency supply is the root cause of price inflation — an increase in the price of goods and services, decreasing the buying power of your hard-earned money. Until 1971, there was some gold backing left in the system, which prevented excessive inflation like this. This meant that the value of money was backed by the value of gold. Since this backing has been removed, the value of gold has risen — because its supply is limited — while some currencies have been devalued as more and more money has been magically created through quantitative easing.

Legendary US hedge fund investor Paul Tudor Jones recently had the following to say:

It (the printing of new money) has happened globally with such speed that even a market veteran like myself was left speechless. We are witnessing the Great Monetary Inflation — an unprecedented expansion of every form of money unlike anything the developed world has ever seen. I still remain a fan of gold. I predict it could also rally to $2 400 and possibly to $6 700 if we went back to the 1980 extremes.

Sean Sanders, CFA Charterholder and CEO of investment platform Revix, said: “The loss of confidence in governments, rock-bottom consumer sentiment and unprecedented money-printing from governments is why it’s crucial, now more than ever, to hold inflationary hedges like gold in your investment portfolio.”

Why invest in gold?

Gold is a safety net in times of economic uncertainty and it acts as a hedge against inflation thanks to its limited supply and long trading history. So, unlike central banks, which are printing money at unprecedented levels, gold’s supply remains steady.

This means gold acts as a rand hedge and is widely recommended as part of a diversified portfolio. It’s one of a handful of investments with a positive return in 2020 — gold prices are around $1 750/ounce and have gained 16.4% since the start of the year and 37.4% over the past 12 months.

Revix, the fintech backed by JSE-listed Sabvest, is offering customers a remarkable gold investment offer.

Sign up to Revix using the code GOLD and the company will fully guarantee your gold investment for one week. Then for every friend you refer to the platform, Revix will give you both an added week risk-free. You can get up to six weeks of risk-free investing by inviting friends to invest in gold, too.

At the end of your risk-free period, if your investment has increased in value, the profits are all yours. If your investment declines below the amount you deposited, Revix will top up your account back to its starting value. You are then welcome to withdraw your investment at any time after the promotion is complete.

About Revix

Revix brings simplicity, trust and great customer service to the investing space. Revix’s easy to use online platform enables anyone to own the world’s top crypto assets in just a few clicks. For more information, please visit www.revix.com.

- This promoted content was paid for by the party concerned