Snap, the maker of messaging app Snapchat, plans to reveal financial statements and other disclosures for its initial public offering by late this week, according to a person familiar with the matter.

It will be the public’s first chance to see the performance of the fast-growing company, which is aiming to raise as much as US$4bn in its IPO. Snap has already filed its information privately with the US Securities and Exchange Commission.

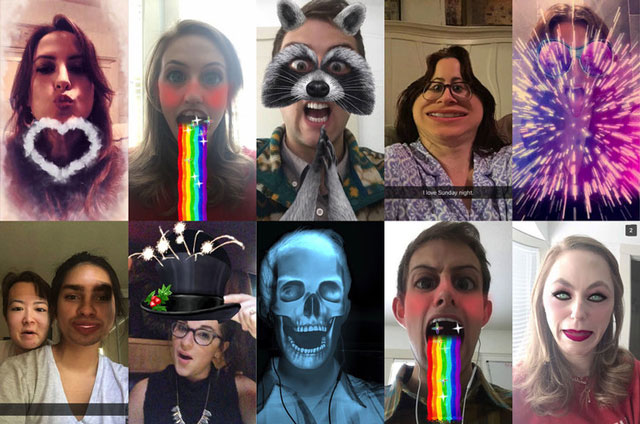

In a recent private meeting with underwriter analysts, Snap emphasised how dedicated its users were to its app, which lets them send annotated videos and selfies, people familiar with the matter have said.

The company plans to emphasise its average revenue per user and is aiming to grow in more mature markets, according to the people.

After filing publicly, Snap must wait 21 days before starting a road show to tout the listing to investors. On the current schedule, the company’s shares could start trading in March.

Noah Edwardsen, a Snap spokesman, declined to comment.

The technology news site Recode earlier reported the timing of the public filing. — (c) 2017 Bloomberg LP