When Google published revenue from its cloud business for the first time last month, a feeling of bitter vindication swept through IBM.

When Google published revenue from its cloud business for the first time last month, a feeling of bitter vindication swept through IBM.

Google, which is ranked the third biggest cloud provider in the world by industry analysts, reported US$9-billion in cloud revenue for 2019. IBM lists $21-billion in cloud sales, yet usually it’s relegated to fifth place. Research firm Gartner even excludes it from its top-six rankings. After Google’s report, employees at IBM thought they’d finally get the credit they deserved.

But the industry didn’t notice. Google still holds the bronze medal behind Amazon Web Services and Microsoft’s Azure. Analysts say IBM will remain near the tail-end of their rankings because the company defines the cloud more broadly than industry leaders.

“What IBM calls cloud is different to what Amazon and Google call cloud,” said Ed Anderson, an analyst at Gartner. All companies have their own unique definition of cloud, and analysts like Anderson try to weed out the numbers that go beyond traditional descriptions.

“You can see this posturing with IBM,” Anderson said. “They are really nervous about reporting a number that is too small and nervous about reporting a number that is too big that no one will believe.”

Analysts prioritise what’s known as “pure public cloud”, the infrastructure that allows companies to rent servers, control their computing power on demand and only pay for what they use. Amazon.com’s AWS pioneered this new way of computing in 2006, and along with Microsoft, the two hold more than 50% of the global market in public cloud. IBM only has a small public cloud but it sweeps other businesses into its calculation of cloud revenue, including software, hosting services and consulting to help companies migrate data to the cloud — a market IBM dominates.

Not as ‘sexy’

While these services are crucial, they are not as “sexy” as the core public cloud offerings that have defined the market and deserve to be the main industry measurement, according to analysts from prominent firms such as International Data Corp, Synergy and Gartner.

For a company like IBM, which has undergone multiple transformations in its 108-year history, it’s important to communicate “that they are not just about yesterday’s technology”, said Frank Gens, chief analyst at IDC. “That’s why they are all feisty about wanting to establish their cloud credentials.”

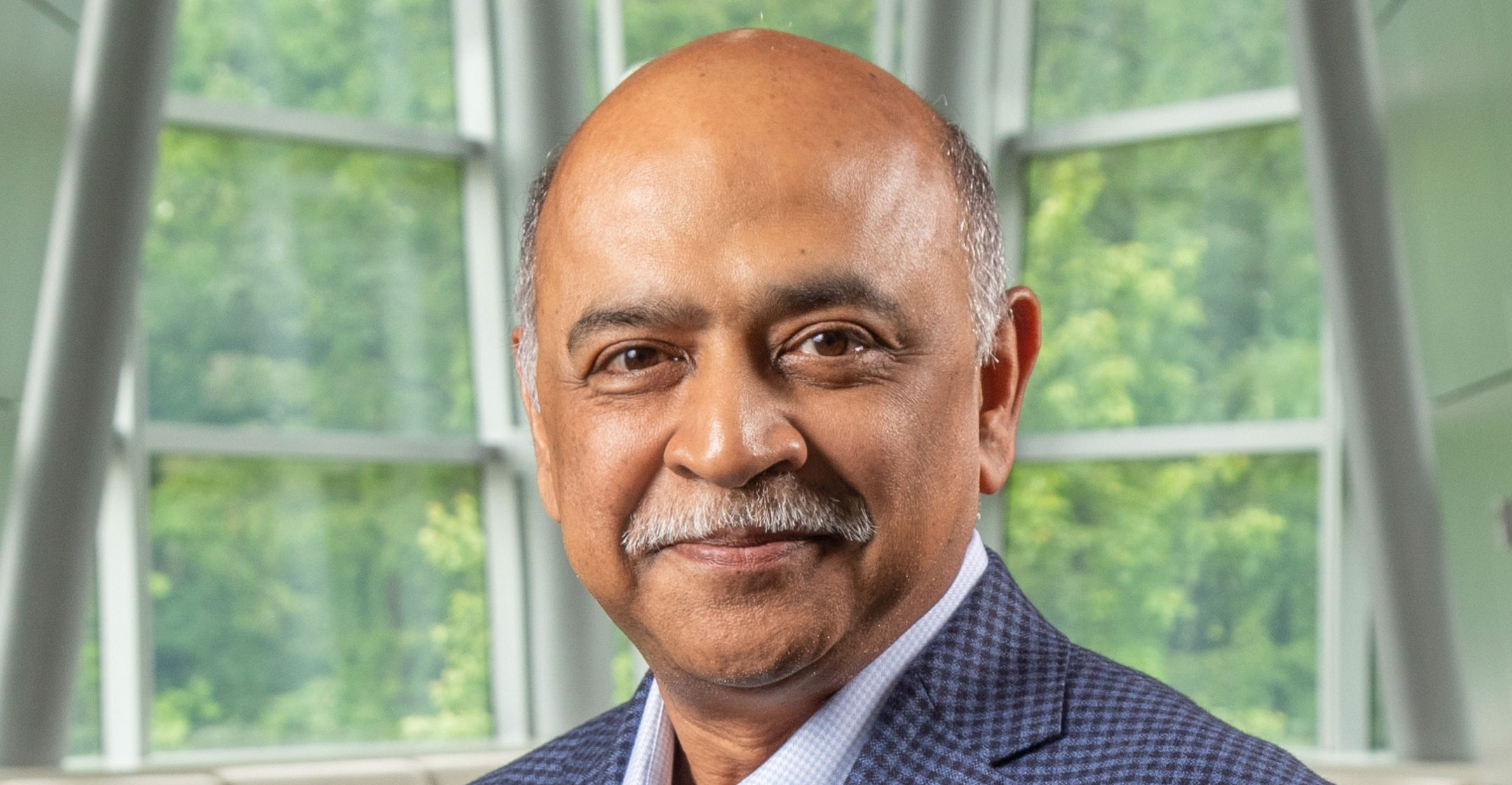

Armonk, New York-based IBM has struggled with declining revenue over much of the past decade as it was slow to adapt to the shift in computing to the cloud and away from the big servers it had traditionally managed on-site for companies. Now it’s staked a turnaround on newer technologies, including artificial intelligence and cloud computing. In 2018, IBM paid $34-billion to acquire open-source software provider Red Hat to help bolster its credentials as a top cloud contender. The company recently said Arvind Krishna, the head of cloud, would be taking over as CEO when Ginni Rometty steps down next month.

Despite all this, IBM is still waiting for recognition. “We’re proud of our progress and we’ve invested for this specific moment in the evolution to cloud,” spokesman Saswato Das said. “We like our hand, and we’ve already done better than most people actually give us credit for.”

When IBM created its cloud division about seven years ago, it decided to use a broad definition when recording sales. The company includes all of its cloud-orientated hardware, software, professional services and any remote infrastructure service it runs for clients into the total number. IBM did this to boost its performance, knowing it was defining cloud in a different way to that of its rivals, according to people familiar with the company who didn’t want to be named discussing private information.

Only about half of IBM’s reported $21-billion in cloud revenue actually comes from core public cloud offerings. AWS’s $35-billion in cloud revenue almost all comes from public cloud. Google’s cloud numbers also include corporate software sales like Gmail and Google Docs.

In the early days of a new industry, experts, market leaders and analysts typically get to set the boundaries on how to best measure the sector. But some experts say that view should update as the market develops to ensure the industry accurately reflects where clients are spending their money.

Charles King, principal analyst at Pund-IT, said initially the cloud was so closely associated with AWS that many analyst firms believed “if cloud didn’t closely model what AWS was doing it wasn’t worthy of being called cloud”. However, the market has become increasingly diverse and simply focusing on core public cloud ignores the billions of dollars flowing into services associated with cloud migration and adoption. — Reported by Olivia Carville, (c) 2020 Bloomberg LP