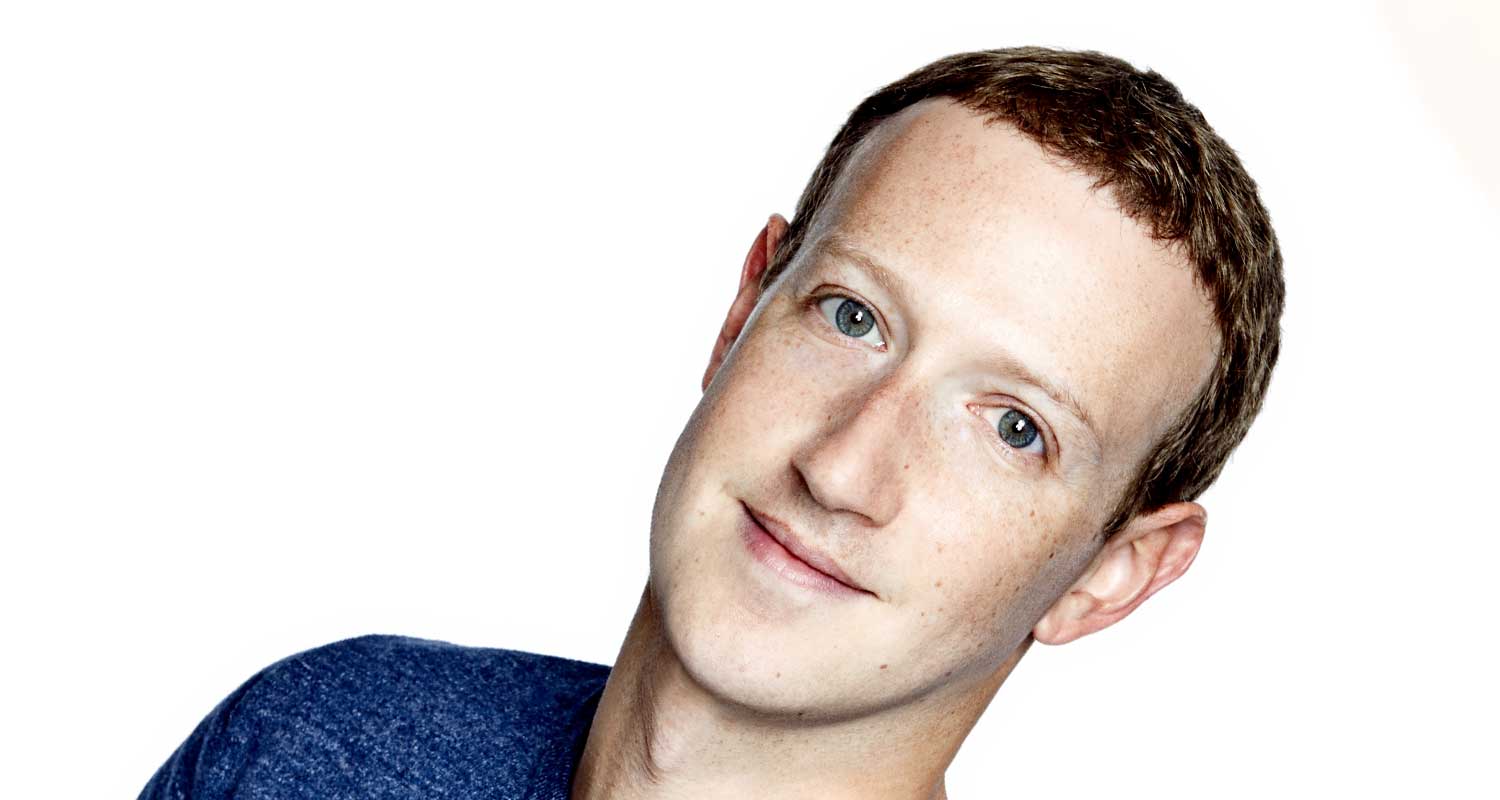

Meta Platforms investors must ask themselves one thing about Mark Zuckerberg: do they trust him?

Expectations were high for the first quarter after the wild success of the fourth quarter last year, which spurred the biggest value gain in the history of the US stock market. Those hopes were dashed by the results on Wednesday, with shares sliding by as much as 19% in after-hours trading.

Investors seemed unhappy primarily about three things:

- First, Meta’s forecast for its current quarter revenue, which fell in the midrange of what analysts had estimated, suggests digital ad prospects are not as strong as some had expected;

- Second, Meta increased its full-year capital expenditure expectations to as much as US$40-billion, up from a previous high of $37-billion; and

- Third, a sentence you’ve seen written a thousand times by now, spending on the “metaverse” project is still astronomical and won’t be cooling off for at least another year.

Speaking to investors, Zuckerberg pleaded for trust and loyalty, citing previous challenges in Meta’s 20-year history, such as the transition from desktop to mobile and the introduction of important new features like Instagram Stories and Reels.

In those cases, investors baulked at costs, questioning whether Meta would eventually be able to slot advertising into those innovations in a way that would prove sufficiently lucrative. Zuckerberg’s point was that the company succeeded on all of those fronts and can do it again with artificial intelligence, though it may take years. “Historically,” he said, “investing to build these new scaled experiences in our apps has been a very good long-term investment for us and for investors who have stuck with us.”

The scale of this current undertaking, however, is far greater in cost, ambition and risk than anything that has come before it. In fact, it’s not even remotely close. Building and running AI models requires extraordinarily expensive amounts of computing power when just about every tech giant — and many non-tech companies, too — is scrambling to buy hardware that is in short supply.

Even if Meta can obtain the necessary resources — and it’s making great progress on that front — there are still questions about how well this technology will actually work. Will businesses be willing to let an AI bot, with all of its potential hallucinations, go out and interact with their customers? Will the quality of AI-generated ads satisfy advertisers’ standards? And will AI targeting be accurate enough to place those ads in front of the right people at the right price?

On the consumer side, what desire is there among normal users to interact with AI tools? The company’s wide roll-out of Meta AI this past week, its most significant foray into consumer AI yet, put the chatbots front and centre in some of the world’s most popular apps: WhatsApp, Instagram, Messenger and Facebook. These apps now attract 3.24 billion people every day. But some are asking: what do I do with this, exactly?

The metaverse problem

Making things more difficult for Zuckerberg is that while his track record is good, there is a lingering problem with the “metaverse”, a bet that has shown only minimal signs of paying off, just as AI might not. Last year, the company’s Reality Labs unit lost $16.1-billion. In this year’s first quarter, it lost an additional $3.9-billion. Zuckerberg tried to convince investors that spending wasn’t all being put towards his passion project. “We need to find better ways to articulate the value” of Reality Labs, he said.

Zuckerberg did throw out some morsels that suggested things were on the right track. On AI, he said around 30% of recommended content on Facebook is now driven by AI, as is more than half of what people see on Instagram. This is good for increasing engagement and, therefore, good for ads.

Read: Meta opens headset OS to third-party device makers

And with Reality Labs, he said the company had been highly encouraged by the early sales of its Ray-Ban smart glasses, which recently gained the ability, thanks to AI, to describe what users see in front of them. The glasses were sold out in many places, Zuckerberg said — though he didn’t provide any context on how many sales that actually meant. Still, he said a significant market for fashionable AI-powered glasses had arrived sooner than he thought. Investors should be excited about the possibilities it brings.

Read: Meta goes all-in on AI

And maybe that’s how these earnings should be viewed — through AI sunglasses, ideally rose-coloured, shielding some of the harsher details. If Zuckerberg’s right, and all these research strands come together, Meta may well be on its way, as he said, to being the “leading AI company in the world”. It’s up to investors whether they back him — or want to hop off the journey now. — Dave Lee, (c) 2024 Bloomberg LP