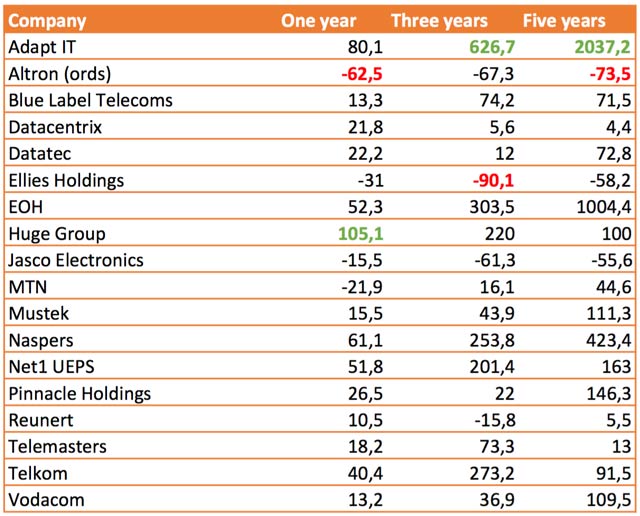

An investment in Adapt IT over the past three years or, even better, over five years would have paid off handsomely. The IT counter has proved to be by far the best performer among technology and telecommunications stocks on the JSE over the longer term.

In the past three years, Adapt IT shares have appreciated by 626,6%, and over five years they have risen by a spectacular 2 037,2%. The Durban-based IT services business has performed consistently well, delivering strong earnings growth over that time.

But TechCentral research shows handsome returns were to be had in other technology shares.

Noteable performers over five years include Vodacom (109,5% up over five years), Mustek (111,3%) Pinnacle Holdings (146,3%), Net1 UEPS Technologies (163%), Naspers (423,4%) and EOH (up by a massive 1 004,4% over five years).

The strongest performers in the past 12 months are Naspers (up by 61,1%), Adapt IT (80,1%) and Huge Group (105,1%).

But a few shares have bucked the generally positive trend. Altron is a notable laggard, falling by 62,5% over the past 12 months and by 73,5% over five years. Over 12 months and five years, Altron is the worst performer among the shares.

Ellies Holdings has also taken a hammering, falling by 31% in the past year and by 58,2% over five years. Those who bought Ellies three years ago would have seen 90,1% of their money wiped out, making it the worst performer over this period.

Jasco has also has a torrid time, falling by 55,6% over five years.

It should be noted that the comparisons do not take into account dividends paid and purely reflect share price performance over 12 months, 36 months and 60 months. — © 2015 NewsCentral Media